Dollar Holds Support - Data On Watch

Dollar Shrugs Off Weak ISM Data

The US Dollar is tentatively higher today with the DXY just about in the green following a reversal off yesterday’s lows. Choppy flows over the last 24-hours look driven by the competing moves we’re seeing across markets with the crypto and bond sell off causing murkier FX trading. Yesterday, weaker-than-forecast ISM manufacturing data helped keep dovish Fed expectations entrenched. Despite the data USD was still seen bouncing off the lows as safe-haven demand kicked in amidst a sell off in crypto and bond markets. Until risk flows begin to stabilise, USD might find continued support.

ADP Jobs On Watch

Looking ahead, traders will now be waiting on further US data inputs this week with the ADP jobs number tomorrow followed by weekly jobless claims on Thursday and core PCE & UoM data on Friday. The broad view is that USD should soften through the week if we see further data weakness, keeping dovish Fed expectations entrenched. The ADP print in particular will be closely watched given that the next NFP readings will be delayed until after the FOMC. If jobs are confirmed to have dropped again as forecast ( exp 7k from 42k prior), this should revive USD selling near-term allowing risk assets to recover. However, any upside surprise cold furtehr muddy the waters near-term seeing USD push higher still, though it would likely take a significant upside surprise to weaken December easing chances.

Technical Views

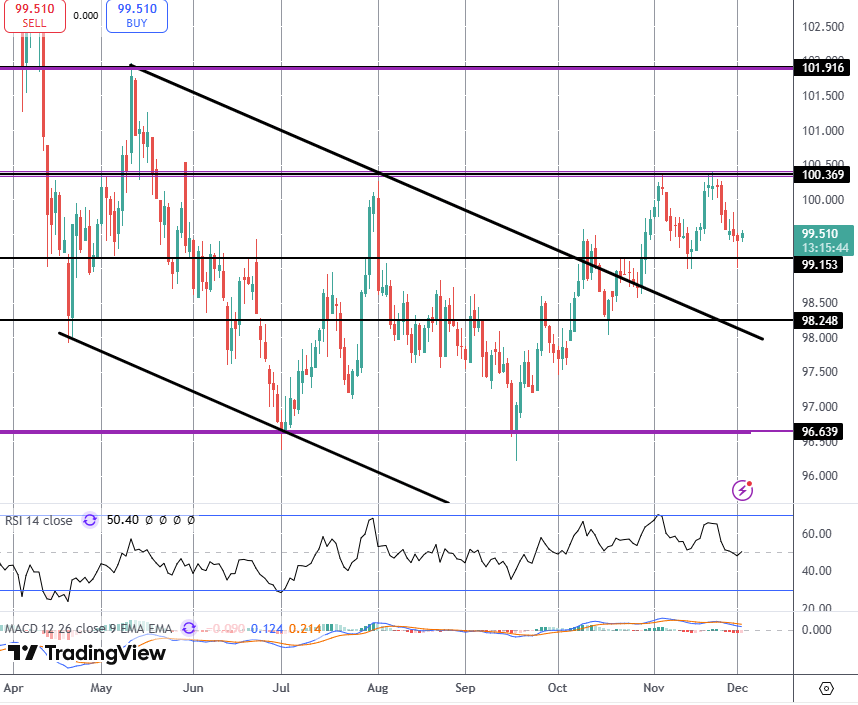

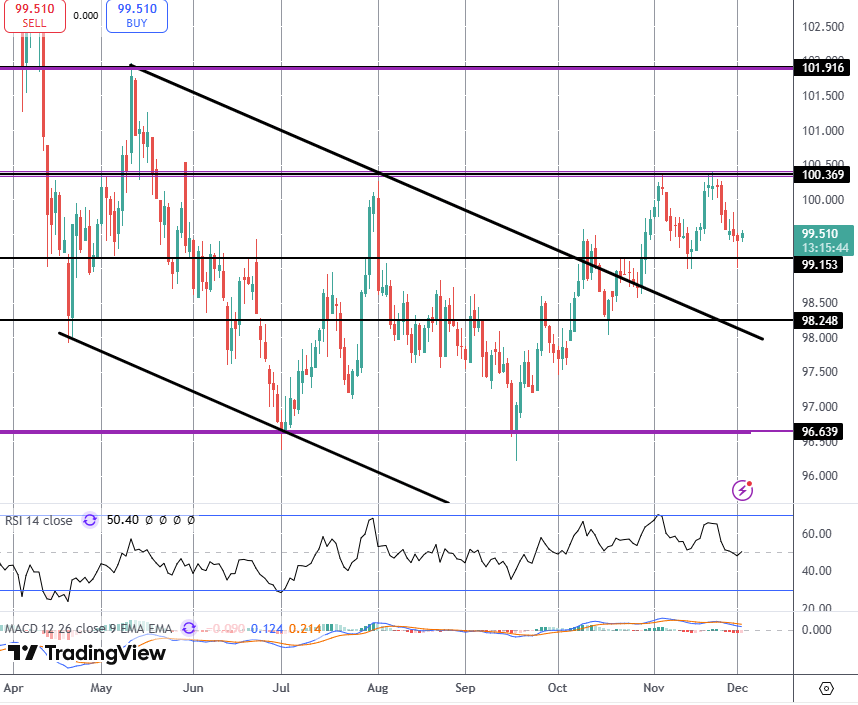

DXY

For now, DXY remains rangebound between 99.15 support and 100.36 resistance. While still above the broken bear channel, focus is on an eventual break higher with 101.96 the next bull target to note. Should we break below 99.15, however, focus will turn to 98.24 next and the retest of the broken bear channel.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.