Dollar Rises on Hawkish Comments from Fed Official, but Risk Assets Stay Resilient

The dollar went up on Friday thanks to hawkish comments from a Fed representative, Waller. The events and reports calendar for this week is not particularly noteworthy, so market participants are likely to focus on central bank representatives' comments regarding the need and degree of final tightening in May. The dollar has rebounded, but investors in risk assets apparently remain confident, limiting upside potential of the American currency.

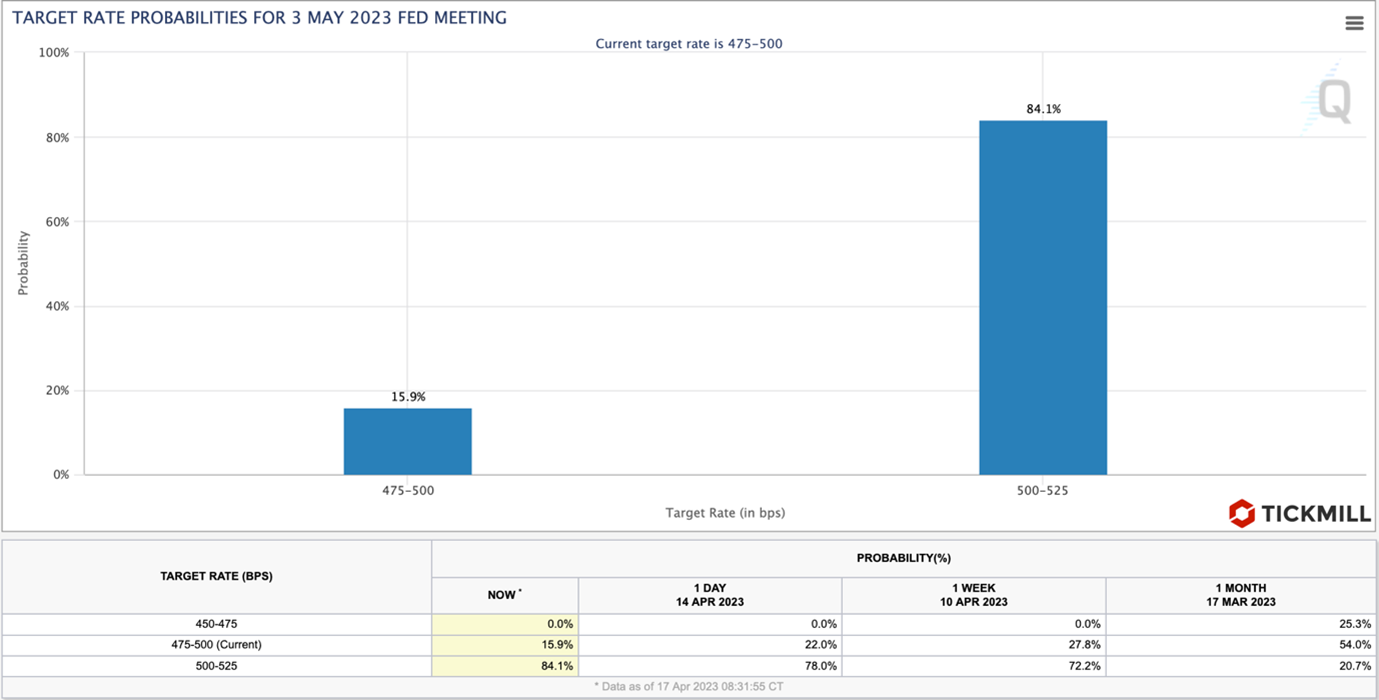

The retail sales report released last Friday indicated a stronger slowdown in consumer activity than expected (a 1% decrease versus a forecast of -0.3%). In contrast to negative signals from the economic front, comments from Fed official Waller suggest that the latest data showed that the central bank has not "made much progress" in suppressing inflation and therefore policy will need to be tightened further. Chances of a rate hike in May have risen according to Fed interest rate futures, up to 88%:

The 10-year bond yield rose 12 basis points from the middle of Friday, indicating that market expectations that the pause in the current Fed tightening cycle will occur after the May meeting have indeed strengthened.

The MOVE rates volatility index is currently an important indicator of the market's concern about the possible consequences of a banking shock in the US. As of today, it has dropped to levels last seen in early March, i.e., before the SVB Financial events. This is a very positive signal for risky asset markets, as the volatility level is one of the risk-aversion factors, and the lower it is, the higher the tendency of investors to seek yield:

Given that the market-implied probability of a rate hike is already almost 90%, and in the absence of shocks that could trigger stock market selling, it is difficult to expect a significant upward correction in the dollar. This means that the current mini-rally in the dollar is unlikely to continue, and one could consider buying EURUSD around 1.09 and GBPUSD around 1.2350:

Regarding the ECB's policy, comments from regulators defending two positions have intensified before the May 4 meeting: to raise the rate by 50 basis points or to announce a pause. Among the recent comments from the ECB, Mario Centeno's statement that the recent decline in consumer price growth rates is an argument for a pause is noteworthy. The market is currently expecting a 32 bp tightening at the upcoming meeting. If expectations shift towards 50 bp, the Euro may receive an additional boost to growth.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.