Dollar struggles to rise amid positive sentiment in US stock market

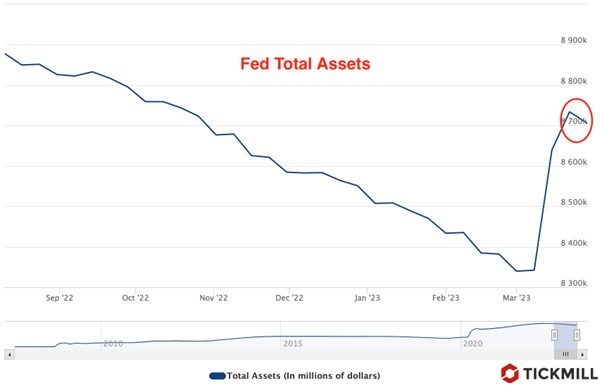

On Tuesday, the dollar is struggling to rise, consolidating around the 102 level. Positive sentiment in the stock market and stress indicators in the US banking system suggest that the potential for further dollar decline is growing. For example, the Fed's balance sheet, which has reflected bank demand for liquidity in recent weeks (due to a new emergency lending channel), is declining again:

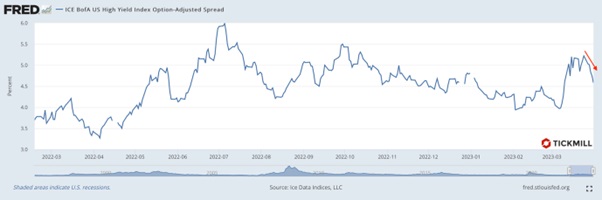

Credit spreads between AAA and high-yield bonds continue to narrow after a brief spike in mid-March, indicating that demand is shifting from defensive instruments to higher-yielding assets:

The technical picture also points to risks of the dollar breaking through the 102 level and moving towards the February low of 100.50:

In March, US manufacturing activity was weaker than expected, with the corresponding index falling to 46.3 points, according to yesterday's report from the ISM. Today, the market is focused on the JOLTS job openings report, with the number of open vacancies expected to fall from 10.8 to 10.4 million. The Fed has previously noted that the JOLTS job openings indicator is among the labour market indicators taken into account. The higher it is, the stronger the labour market deficit in the US, and the more negative consequences there are for inflation. Among the Fed's goals is to achieve unemployment and labour growth rates that will ensure moderate consumer inflation. When there is a shortage of workers (labour supply), an unwanted overheating of the economy can occur.

On Thursday, data on activity in the services sector will be released, followed by the US labour market report (NFP) on Friday. The main risk is strong indicators that will push the Fed back to its previous aggressive position (before the events at SVB Financial). Markets have largely revised the potential for Fed tightening this year (up to a 25 bp hike and then a subsequent pause) as a result, indicating that risks are tilted towards a downward market correction if the economy continues to demonstrate resilience. However, the technical picture of the dollar shown above suggests the opposite: markets are counting on a surprise in the form of weak indicators.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.