Dollar Takes the Offensive as Investors Disappointed by EU Inflation Data

EU leaders were able to agree on a sixth package of sanctions last night that would include an embargo on Russian oil, excluding pipeline supplies to landlocked countries. The decision to hit Russia's export revenues will have a high cost in potentially higher inflation and lower EU growth. The ECB's search for a compromise between real output and inflation should remain the key determinant of the short-term movements of the Euro.

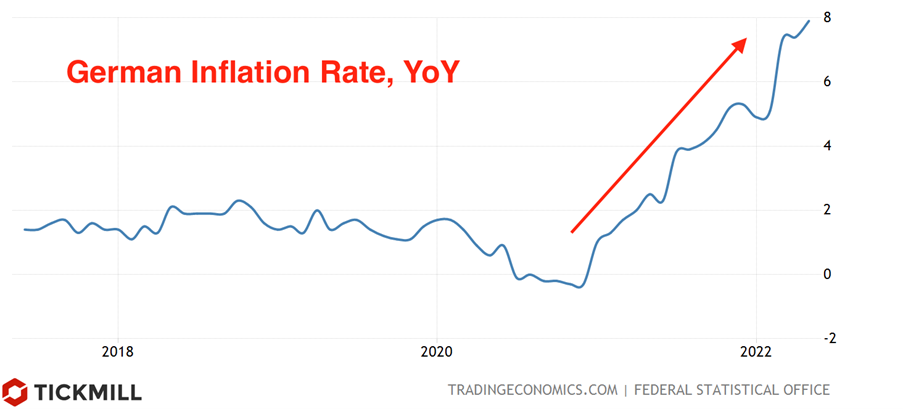

The dollar managed to find support on the last day of May. U.S. bond yields have picked up again in what looks like a belated reaction to a series of pro-inflation data and events in recent days, namely strong U.S. consumption data released last Friday, Fed official Waller's hawkish comments pointing at the Fed’s confidence in tightening ("households’ balance sheets are in great shape"), as well as the oil rally. The reason why the dollar makes slow progress higher is that bond yields outside of the US are rising as well. On Monday, investors cut exposure in European bonds as the German inflation report showed that consumer price growth reached a new high of the current business cycle - 7.9%:

At the same time, monthly inflation accelerated to 0.9%, almost doubling the forecast. EU data published today showed that inflation also exceeded the forecast and amounted to 8.1% against the forecast of 7.7%, actually matching the inflation rate in the US. Investors reacted negatively to the data as the risks that the ECB's policy will lead the economy into stagflation have increased. The euro and pound sterling lost about half a percent against greenback, with the risk of a strong NFP report on Friday, putting an end to rumors about Fed’s “September pause” in hiking rates, likely leading to a deeper decline. The targets for EURUSD are the levels 1.07 and 1.064:

GBPUSD is likely to look for support at 1.25, the previous horizontal level where significant support was consolidated:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.