Dollar Whipsawed Post-FOMC

FOMC Reaction

The US Dollar has seen plenty of whipsaw over the last 12 hours as traders digest the details of the September FOMC meeting yesterday. The Fed cut rates by .25% as expected, including one dissenting vote in favour of a larger .5% cut, and signalled further rate cuts to come. However, USD bears were left a little underwhelmed by the updated dot plot forecasts. The Fed projects just two cuts this year, one less than the market was looking for, and just three cuts for the full cycle, again lower than the roughly 4.5 cuts the market was pricing. The initial bearish USD reaction in response to the rate cut was seen quickly reversing with DXY trading higher into and through the press conference.

Powell’s Comments

Powell’s post-meeting remarks were then seen further dampening the bearish USD reaction. While acknowledging the weakness in the labour market, Powell focused on continued tariff-driven-inflation risks and stressed that any further easing would be determined on a meeting-by-meeting basis, with no pre-set path, referring to the cut as a ‘risk management cut’. Additionally, the inflation outlook was kept unchanged while the growth outlook was raised slightly, adding further uncertainty.

Near-Term View

For now, DXY is likely to continue to range while traders await fresh cues on the back of the meeting. The board view now is that any US data weakness will feed into higher near-term rate cut expectations, leading USD lower, while any upside surprises will have the inverse effect.

Technical Views

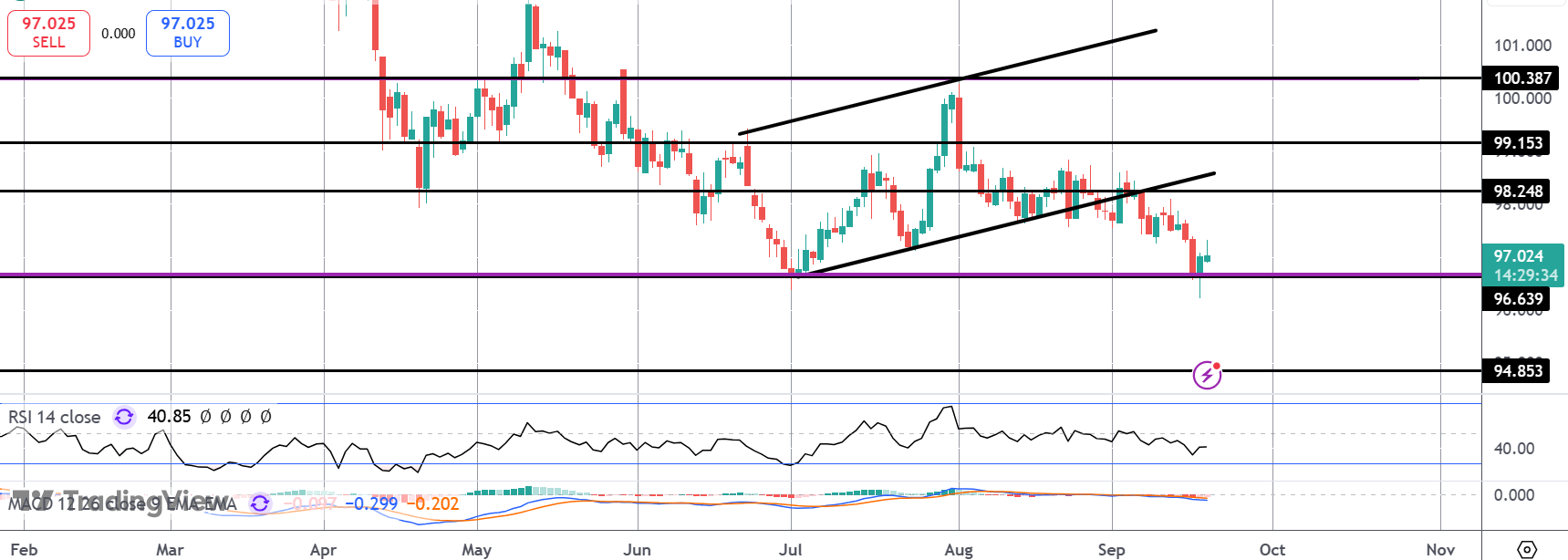

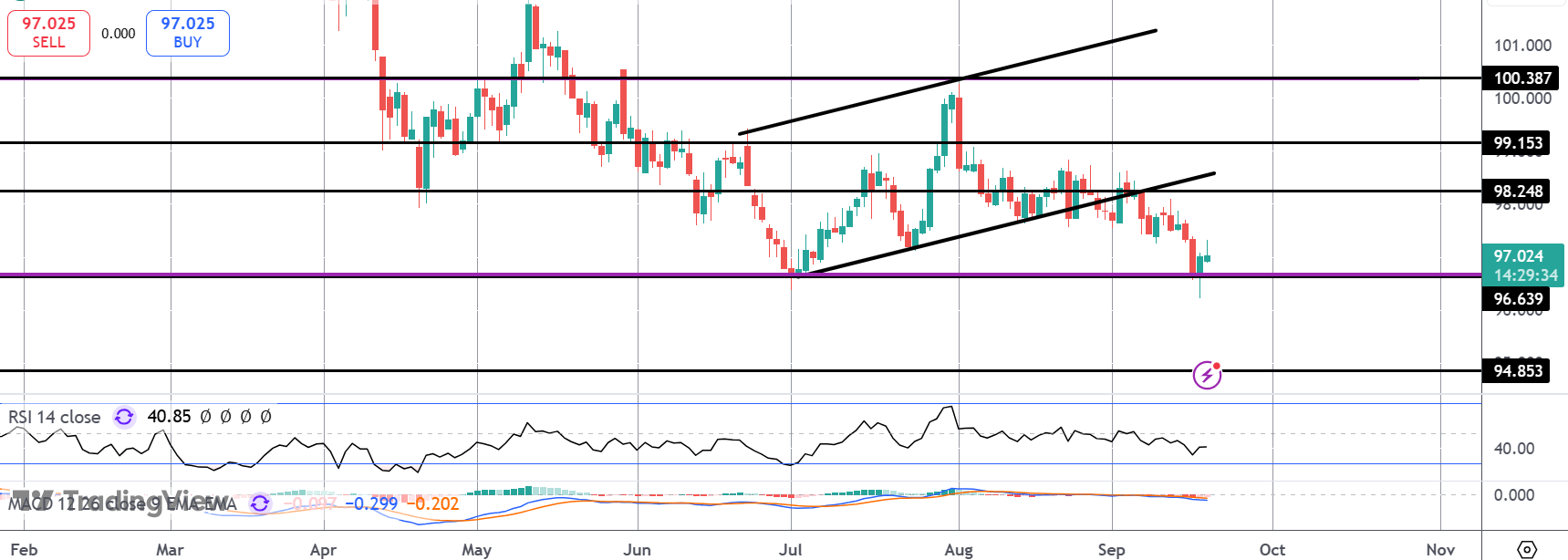

DXY

For now, the index remains atop the 96.63 level after briefly piercing it and breaking to new YTD lows yesterday. Bulls need to see a move above 98.24 to alleviate near-term bearish risks, however, with 94.85 the next bear target if we do break lower.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.