Dovish FOMC Report Leaves USD Bulls Struggling

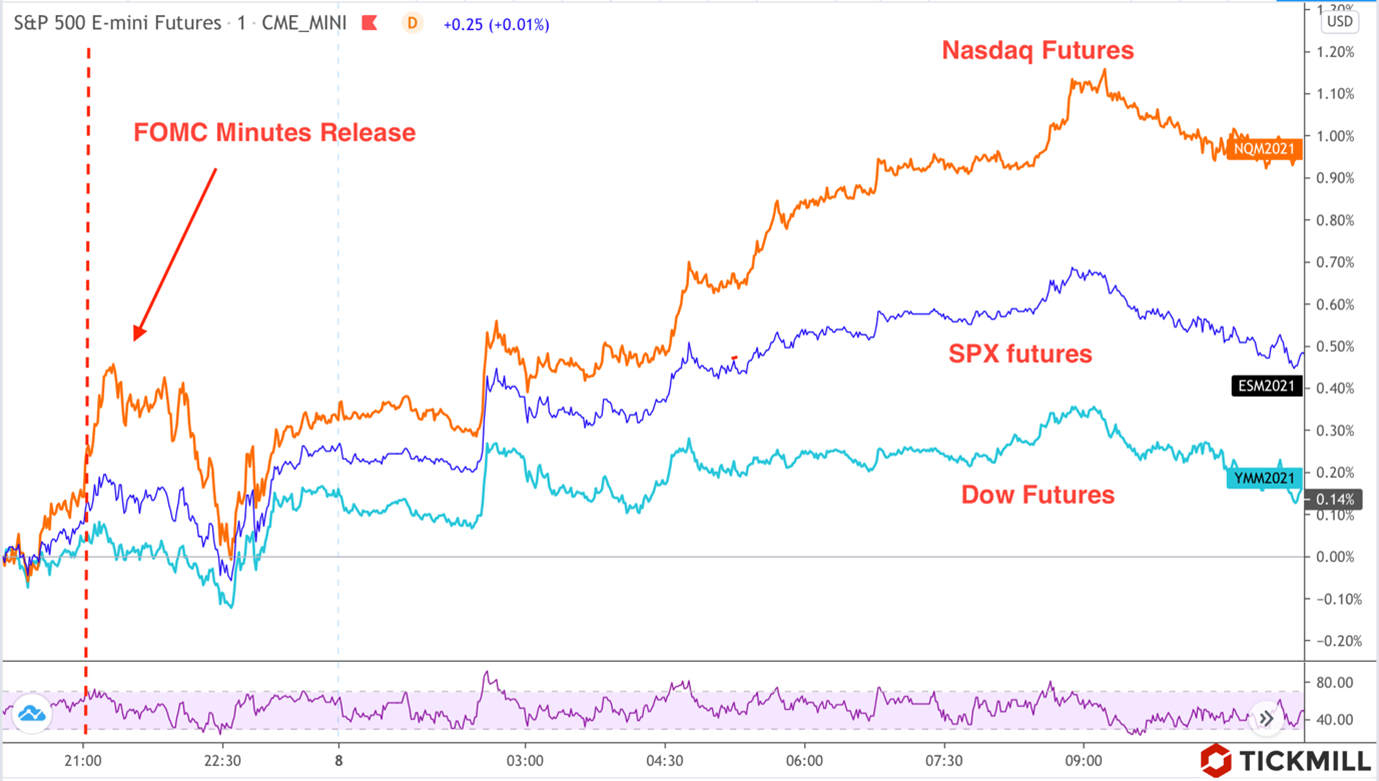

US equity index futures posted another record on Thursday fueled by the release of dovish FOMC meeting report, which dampened concerns of early withdrawal of cheap liquidity, thereby fueling the demand for risk:

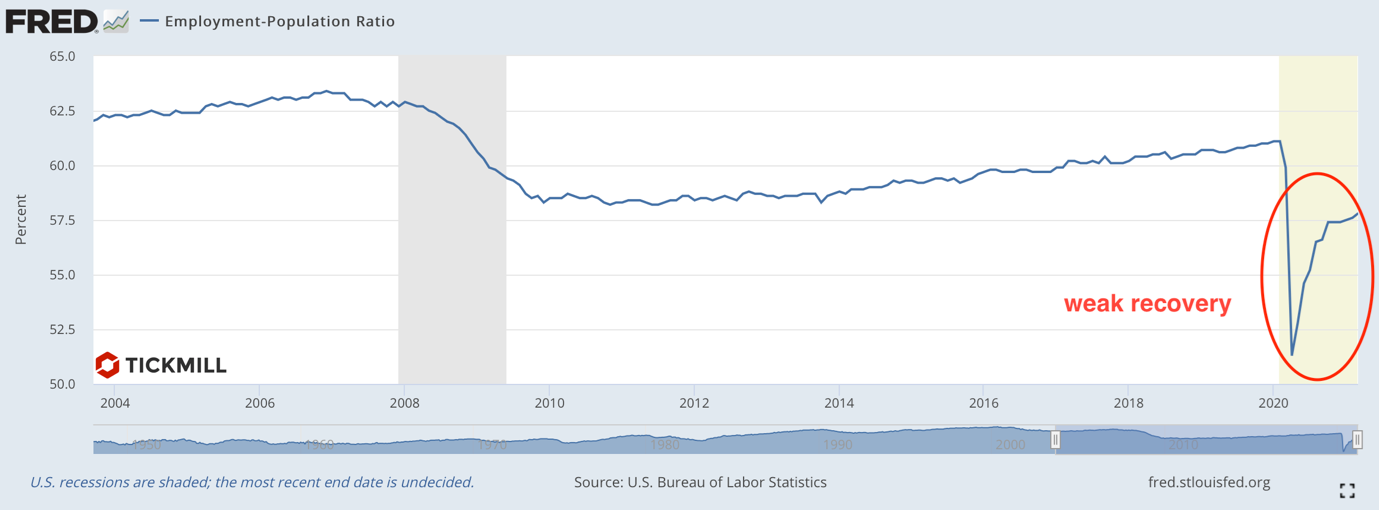

Before the release of the report there were little questionsabout the path of the federal funds rate (the first increase is planned no earlierthan 2024), however there was a good deal of uncertainty about duration and monthlyvolume of asset purchases (QE). However, officials have made it clear in thereport that they want to see more improvements on the inflation side, as wellas material progress in employment growth, specifically recovery ofemployment-to-population ratio:

The Fed progresses fairly fast on the first goal thanks to government stimulus, rebound in consumption and slow adjustment of supply, however it is still far from employment goal and in the most optimistic scenario will reach them in the first half of 2022. An important point from the report was that the path of monetary policy should change based on observable outcomes rather than forecasts.

Control of the federal funds rate (more precisely, the range of the rate) and QE in both cases implies purchases from the Treasury market, the difference is only in the maturity composition of the purchased securities. In the first case, only bonds with short maturities of up to one year are bought (more precisely, borrowed through repo); in the case of QE, the composition is selected in such a way as to influence market rates of the desired maturity, for example, 3, 5 or 10-year ones.

Across the Pond, in the absence of economic news, the ECB data on asset purchases under the Pandemic Asset Purchase Program (PEPP) will likely drive sentiment on the debt and foreign exchange markets. As economic situation worsened in the EU after introduction of the latest lockdowns, the ECB announced that it will significantly increase purchases of assets, which negatively affected the European currency. However, later it became clear that the ECB understands the word "significant" in its own way. From February to March, the purchase of assets increased from 60 to 73 billion euros, which, of course, didn’t live up to market expectations.

Today, the ECB will report how many assets were bought over the past week, and the European currency may strengthen further if the ECB once again confirms that it does not intend to deviate much from the initial asset purchase targets. It will also signal that the ECB is not so worried about the rise in market interest rates and that it sees this phenomenon as a sign of recovery.

The ECB is to release its past meeting report today, which should provide more information on the trajectory of asset purchases as part of its key monetary policy agenda.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.