Easing Fed Rate Hike Expectations Dampen USD Demand but Situation may Soon Reverse

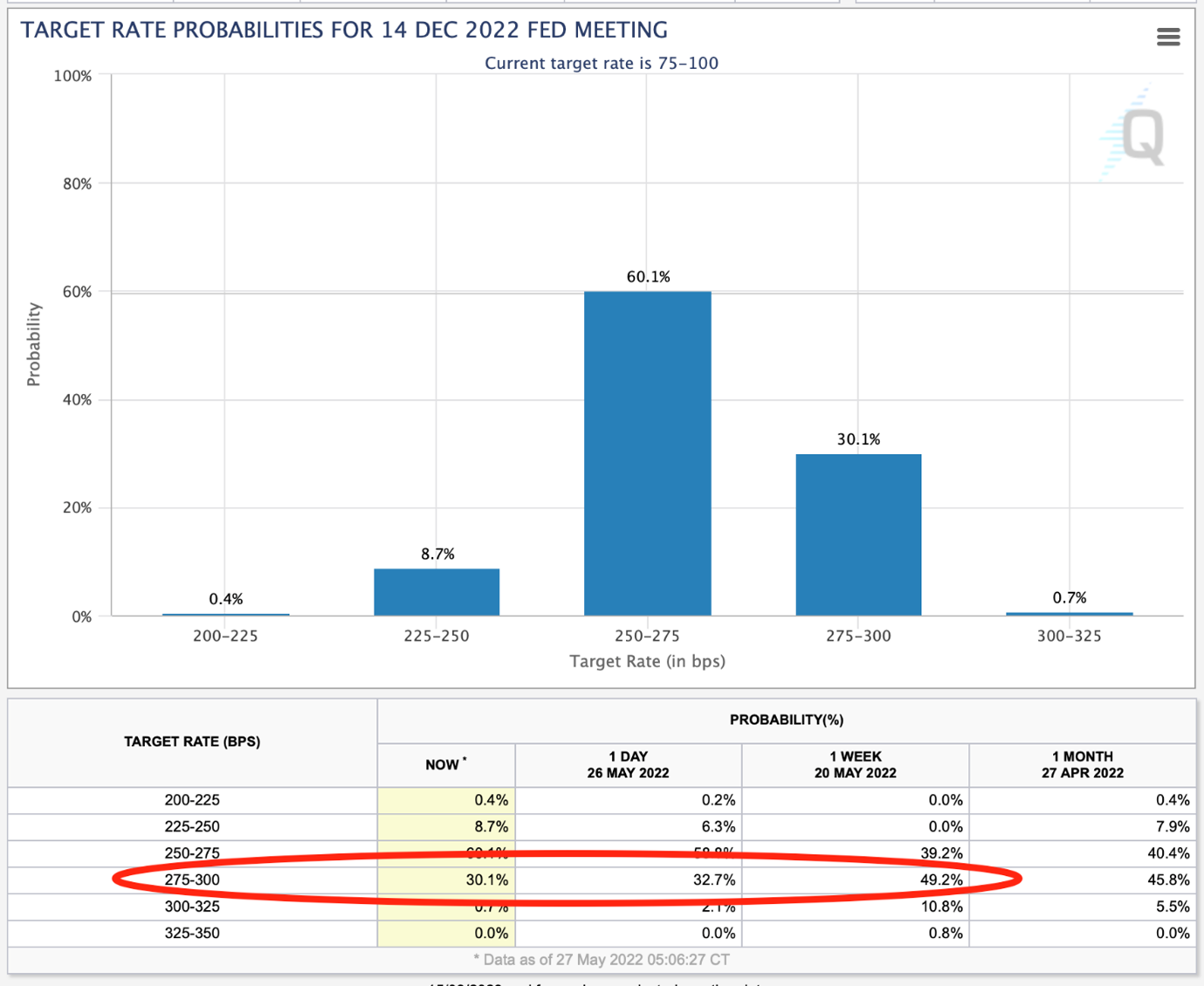

The US Dollar is down against G10 currencies for a second consecutive week, there was a major attempt to break below the key 101.50 level in DXY following notable recovery in risk sentiment in the US equity market on Thursday which also provided some bullish momentum to APAC and European markets today. And while fluctuations in risk appetite remain the key determinant of near-term returns in FX market (thanks to the recent major equity markets retracement, which boosted correlation of returns between different asset classes), markets also started to dial back expectations of ultra-hawkish Fed scenario, which resulted in more persistent bearish dollar momentum. According to Fed funds rate futures, the odds of the target rate rising to 2.75-3.00% by the end of the year slipped over the week from 49.2% to 30.1%:

At the same time, after comments by Lagarde and several other ECB policymakers this week, the odds of faster policy tightening by the ECB increased, which helped Euro to gain ground against USD.

Despite signs of rising demand for risk assets, its prolonged recovery is under big question since many central banks voice concerns about inflation and committed to fight with it using available policy tools while other big risks that could derail the global economic recovery from the pandemic, including the covid epidemic in China and the conflict in Ukraine, persist. In addition, Fed rate hike expectations look poised to recover again as the pause after two summer rate hikes is debatable, which in turn may support the dollar. The risk of deeper greenback correction appears to be low and the fact that the price is now near 50-day DMA, import technical level, could help the US currency to rebound:

In turn, the level of 1.0750 in EURUSD may become a local extreme and next week the pair may resume its downward course. The ECB officials have already said quite a lot that has been reflected in Euro valuation, and since no new surprises are expected on this front, investors could struggle to find catalysts related to the strength of economy or its resilience to inflation pressures. The space for positive surprises in the EU economy appears to be quite limited.

The report from U. of Michigan is due today, the headline reading seen dropping to fresh multi-year low of 59.1 points. This extremely low forecast (90-100 points is normal) comes from the negative impact of inflation on consumer spending. If the index comes below the forecast, the dollar is likely to come under greater pressure, while risk assets may also react negatively, as during central bank tightening cycle, signals of falling consumer sentiment can be interpreted as a risk of lower consumer spending, hence lower firm revenues.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.