Easing Selling Pressure in US Bonds Takes Off some Steam from Greenback Rally

This year's final quarterbegan on a pessimistic note, with the US stock market losing more than 1.5percent on Friday, cementing short-term risk aversion and bearish sentiment. Riskassets picked up the baton on Monday and extended the bearish trend. Europeanmarkets sank by more than half a percent, the S&P 500 futures struggle to defendthe foothold at 3600 points. The dollar, after pulling back from multi-yearhighs, moved into consolidation (111.70-112.50 on DXY), the key factor of theUSD parabolic rally – Treasury market sell-off, somewhat weakened itsinfluence, as bond yields after rebounding from key levels (4% on a 10-yearbond) remain range-bound:

Oil prices climbed 4% afterrumors emerged that oil exporter group OPEC+ could announce a 1 million bpdoutput cut on Wednesday. On the one hand, the balance of supply and demandshould move into equilibrium with higher prices, which, in fact, the market isnow pricing in, on the other hand, there is a more subtle consequence of such astatement - a signal that the alliance may be worried about a slowdown, andperhaps even a decrease in global demand for oil, and therefore forced to announceoutput tweaks. Undoubtedly, in terms of medium-term expectations, thisstatement will likely have negative rather than positive implications for thedemand for risk as commodity market trends are tied to business cycle swings.

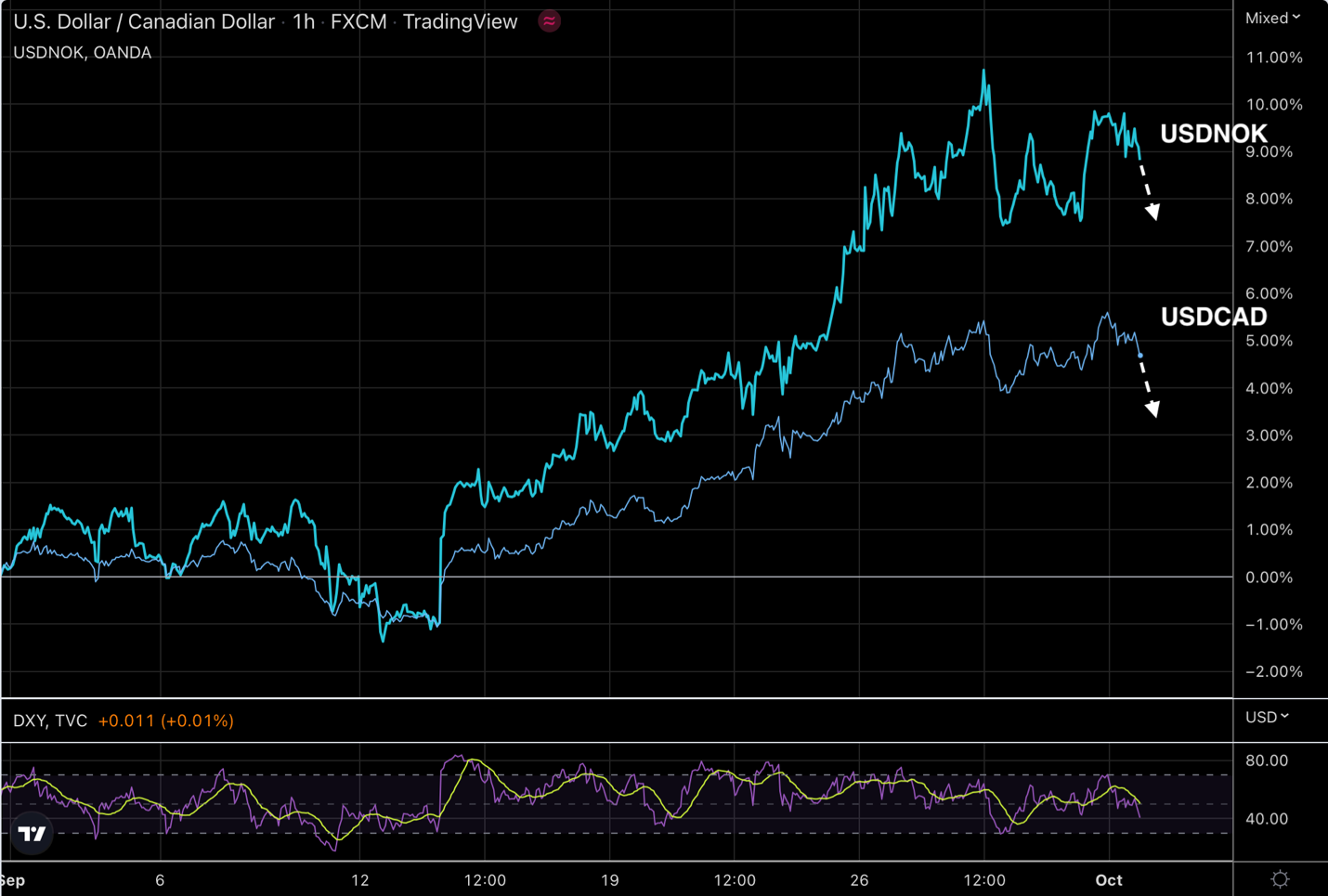

In the short term, the OPEC+decision may lend a bullish impetus for CAD and NOK, which have fallen 5% and8% against the dollar since the beginning of September, but whether thesecurrencies will be able to hold gains remains in question, since they usuallyrise along with demand for risk assets in general:

Investor confidence in thePound, and more specifically in Britain's sovereign debt, continues to recovergradually after the UK government was forced to make a U-turn on the mostcontroversial measure in the new fiscal stimulus package – tax cut for UK’stop-earners. Nevertheless, it is not clear whether it was enough to addressinvestors’ concerns, because, firstly, the Bank of England is trying to restoreconfidence in Gilts market, conducting bond purchases, which distorts pricingand deters sales, and secondly, the U-turn reduces the cost of the fiscalpackage by only 2 billion pounds. The final reaction will be clear after the CB’sinterventions are over, the announced deadline is October 20. In the shortterm, the risks for the pound sterling are likely to be skewed to the upside,given that since the beginning of September, sterling has fallen by 11% andthen recovered just 6.5%, the BoE continues to support the bond market, and thegovernment is willing to compromise and may be expected to deliver more tosoothe market concerns.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.