ECB Meeting and Inflation: What to Expect Next Week

There's only one week left until the ECB meeting and markets price in a high probability of the outcome where the regulator will deliver one more rate hike. The only thing that remains unclear is the size of the hike, which could be either 25 or 50 basis points. The chances of the first outcome, as anticipated by the market, are higher, but the lending survey and inflation data, which will be released next Tuesday, could easily tilt the balance towards a more aggressive outcome.

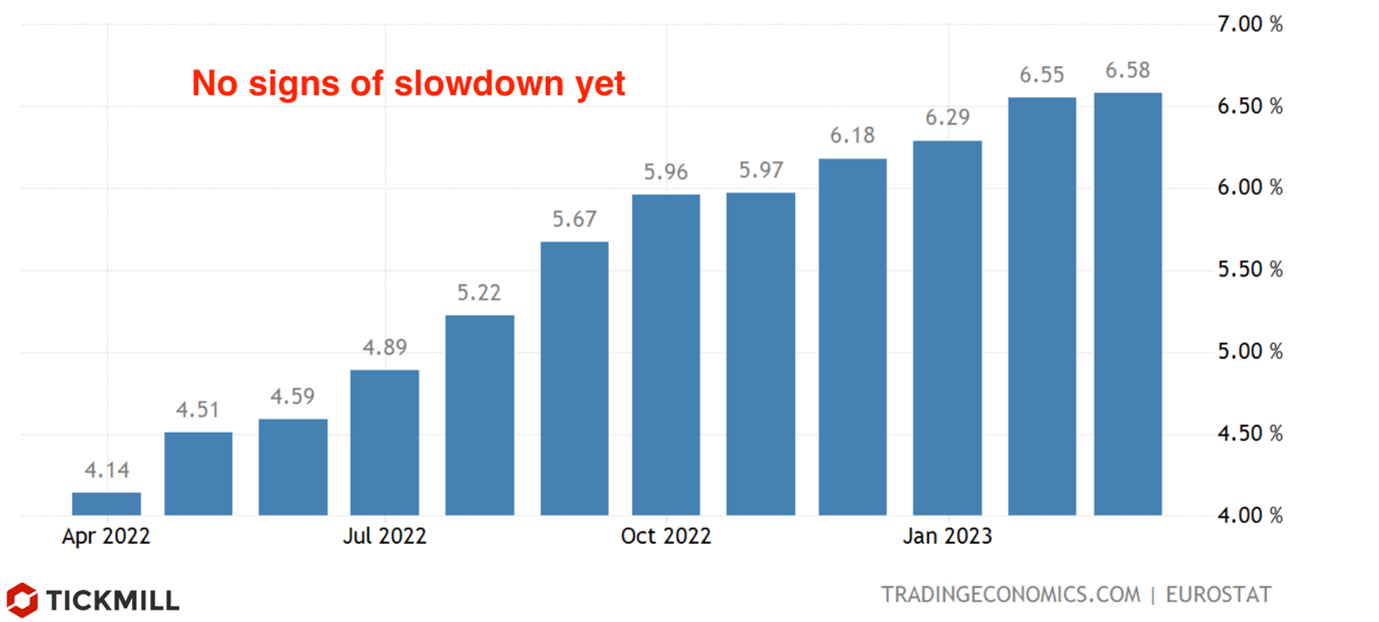

Inflation in the EU is decreasing, but the overall inflation dynamics can be misleading: the main contribution to the decrease is the effect of the high base in energy prices - against the backdrop of price growth rates last year (double-digit values for several months), this year's rates are significantly more modest. Essentially, the current decrease is due to the volatile component of prices, which was driven by a supply instability (which the ECB cannot control) and therefore officials recommend drawing conclusions from the dynamics of core inflation, which does not take into account gas and oil prices. However, core inflation behaviour is less encouraging:

The ECB meeting minutes showed that members of the Governing Council discussed the possibility that the inflation peak took place in March but found no convincing evidence of this. At the same time, several officials believed that inflation could even accelerate. This casts doubt on the ECB's forecast that inflation will return to 2% by 2025. ECB official Isabel Schnabel even stated that passing the inflation peak will not be a necessary condition for changing the course of policy.

The meeting minutes from March confirmed what was said in the March press conference: the Eurozone banking sector is stable and doesn't have any issues with capital or liquidity. The ECB was confident that the announced liquidity measures and the overall stability of the banking sector would ease "current market tensions." An interesting note was made that "the transmission of monetary policy impulses during periods of market stress is likely to be stronger than in more calm times."

This wasn't a problem in March, and it won't be a problem in May. The ECB will only focus on the impact of the recent shocks on lending and activity.

The Minutes of the ECB’s last meeting revealed the first discussion on the lags in transmitting monetary policy, leading to a wider discussion in the following two weeks on how much further rates needed to be raised. There is an increasing divergence of views among ECB members, with some arguing that "in the past, the impact of monetary policy was consistently overestimated, which could be repeated," while others argue that there is a risk that "the impact of the tightening monetary policy is underestimated." This growing divergence was also illustrated by some ECB members preferring to pause the rate hike cycle at the March meeting, according to the minutes.

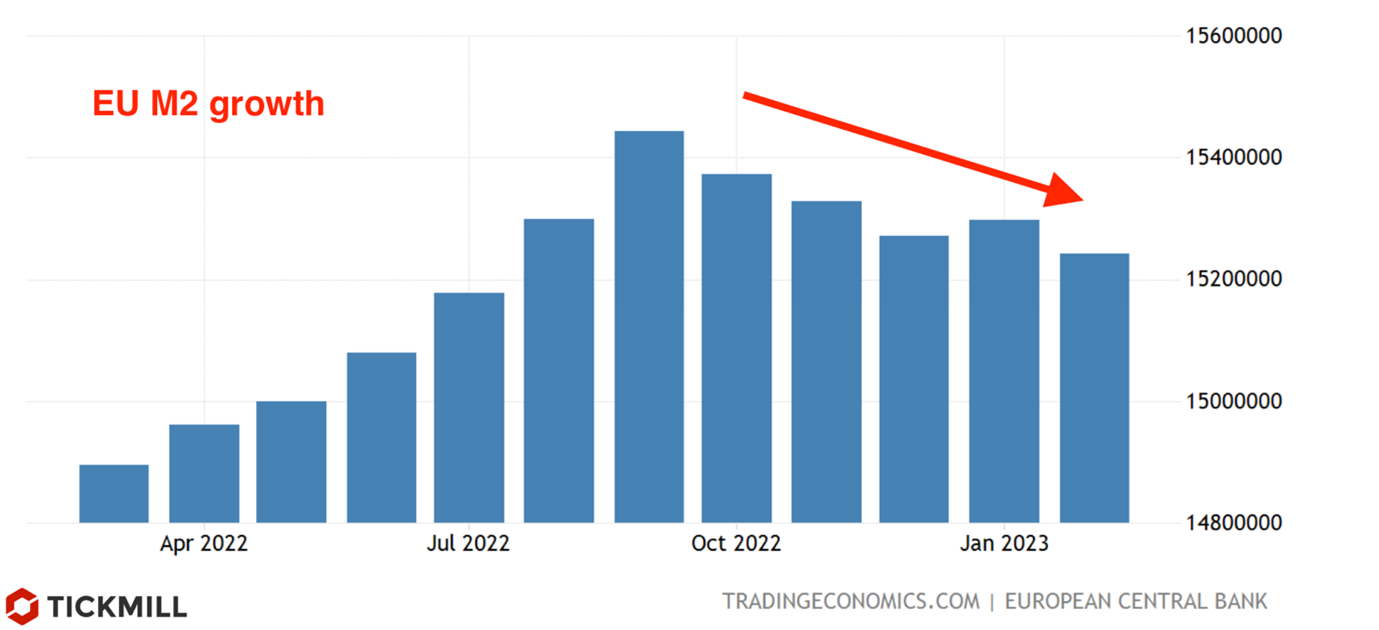

However, the official commentary has now definitively shifted to a data-driven approach. Next Tuesday, when Eurozone inflation, lending volumes, and the results of the latest bank lending survey are published, will be a decisive day for assessing the current state of how much the monetary tightening and bank shocks have affected the real economy.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.