EIA Data was a Surprise for the Market, Casting Doubts on US Demand Strength

Oilprices came under pressure on Wednesday; WTI struggled to stay above the $70mark. The catalyst for the decline was bearish EIA report on commercial oil andrefined products inventories in the United States. The report is now having abigger impact on the market than usual, as it presents one of the majoruncertainties on supply side. OPEC pumps oil in accordance with establishedquotas, and therefore supply from the cartel is more or less predictable.

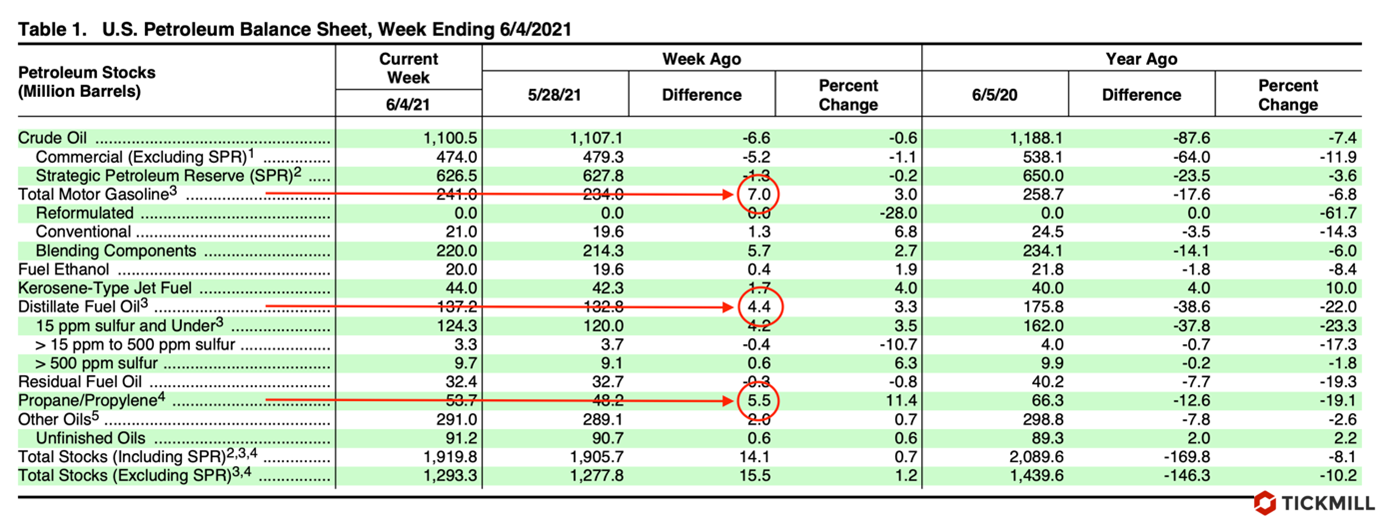

TheEIA report was a bit ambiguous as it contained both positive and negative informationfor the market. Stocks of crude oil decreased by 5.24 million barrels in thereporting week, confirming the API inventories data (which also indicated areduction in reserves), nevertheless, refined products - gasoline, distillatesand propane reserves jumped 20.71 million barrels which was a kind of a shockfor the market:

Thegrowth of finished products may indicate that the demand for them has decreased(i.e., fuel consumption in the United States has decreased) or supply hasincreased, or there was a combination of these factors.

Insearch of an answer to the question of what caused the increase in inventories,it is worth paying attention to the capacity utilization of refineries. Thereport showed that it rose 2.6% to 91.3%, the highest since January last year:

Takinginto account the change in the activity of refineries, the change in demand forfinished oil products turned out to be negative and amounted to -1.43 mln bpd.However, it should be borne in mind that we are approaching the travel seasonin the United States, which is a seasonal factor of increase in fuel demand.

Onthe supply side, the bulk of the negative news for the market comes from Iran.The country has ambitious supply growth targets, from 2.4 million bpd to 3.3million bpd in the first six months to 4 million bpd. over the next six months,provided that the United States lifts the sanctions.

Iran'ssupply is expected to rise, however any news indicating progress in the nucleardeal could trigger a correction in the market, which, however, should short-livedas the demand side situation improves.

Latertoday, OPEC is to publish a monthly bulletin that will report on the cartel'sproduction in May, as well as provide updated forecasts by the end of the year.On Friday, the IEA will release a report, which will also provide its views onthe market. Both reports could cause increased price volatility, especially if theoutlook changes for the worse, as the market remains fragile after recentgains.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.