EU Inflation Surprises Prompt Re-Pricing of the EU Interest Rate Curve, Lifts EUR

Financial markets face a difficult choice between two narratives: a soft landing in key economies after a period of high inflation (thanks to the restart of China's economy) and signs of a stubborn inflation that call into question the dovish policy outlook of central banks this year. The search for equilibrium is likely to keep fixed income instruments under pressure, and the currency market in a trendless environment with increased volatility.

The dollar weakened Wednesday, and emerging market currencies rose today on a number of reassuring data from China's economy. China's business activity indices in manufacturing and services significantly surpassed forecasts and indicated an expansion compared to the previous month. In the manufacturing sector, the NBS China activity index rose to 52.6 points compared to the forecast of 50.6 points; the previous figure was 50.1 points. Activity in the services sector showed an even more confident expansion, the corresponding index rose to 56.3 points while in the previous month the index was 54.4 points.

Yesterday, the euro rose after data showing that base inflation in Spain and France in February reached a new maximum in the current business cycle. The worrisome trend in consumer prices continues to fuel expectations of a tighter ECB policy in 2023, the market apparently counting on an extended tightening cycle until 2024, with a terminal deposit rate estimated at 4%.

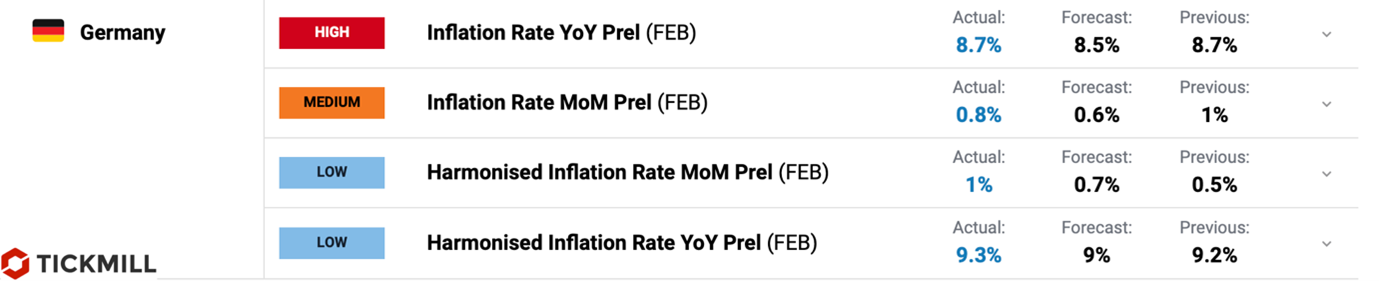

The German Consumer Price Index, which remained at its cyclical high as data showed today, lifted the EURUSD even higher, closer to 1.07. Headline inflation was 8.7% (forecast 8.5%) on an annual basis and 0.8% on a monthly basis:

The ongoing re-pricing of the yield curve in the EU provides some support to the EUR/USD pair and suggests that 1.05 will likely be the firm lower bound of the EUR/USD range in the first quarter. It's becoming increasingly clear that talks of disinflation are taking a backseat.

Euro was a clear outperformer in the complex of European currencies, gaining 0.9% against the dollar on surprising inflation figures:

Today a few ECB speakers are taking the stage, who are likely to try to reconcile their monetary policy forecasts with the hot inflation reports. Against the backdrop of hawkish comments, EURUSD may well try to test 1.07. The US will publish ISM manufacturing data today, a weak reading of 48 points is expected (i.e., a weakening in activity in February compared to the previous month). More interest will be towards the ISM non-manufacturing data on Friday. Nevertheless, China's PMI data may dominate currency trading today and support a slightly negative tone for the US dollar. DXY is likely to find support at 104.10-104.20.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.