EU Inflation: Too Early to Relax

EU inflation plunged into contractionary ground in August for the first time since May 2016. As the gap between actual inflation and the target continues to widen, the ECB feels more pressure to roll out new support measures to stimulate price growth.

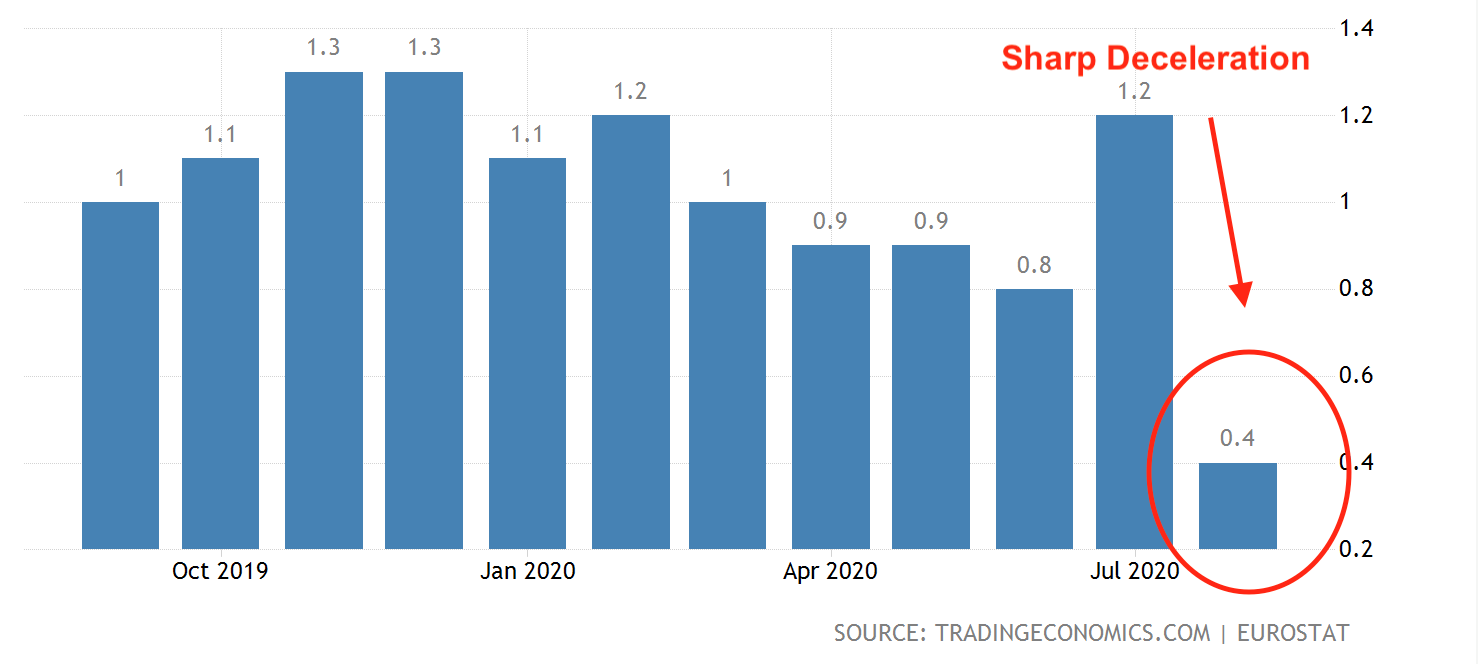

Annual inflation in the block of 19 countries fell to -0.2% in August against the forecast of 0.2%. Core inflation, which better reflects consumer trends (as it does not take into account volatile and essential goods such as food, tobacco, fuel), slowed sharply from 1.2% in July to 0.4% in August (0.8% forecast):

Unemployment rose from 7.7% to 7.9%.

The ECB is expected to increase credit support to the economy in December, raising the limit of the pandemic asset-buying program. Its current size is 1.35 trillion Euro. I would like to note that, unlike its American peers, the ECB prefers to remain flexible when dealing with the duration of a low interest rates environment. Also, the central bank did not change inflation guidelines, which gives the Euro an advantage over the USD due to a growing discrepancy in the easing bias between the Fed and the ECB.

ECB chief economist Philip Lane recently warned that the Central Bank's low-key stance risks entrenching current low inflation and inflation expectations, making it difficult for the bank to achieve macroeconomic targets. The market interpreted this comment as a hint that the ECB, if necessary, may announce additional stimulus measures. However, this is not expected before December.

The German government also made positive comments. Economy Minister Altmaier said on Tuesday that there is a V-shaped economic recovery and it is unlikely that the government will resort to sanitary restrictions on the same scale as in March and April.

The government revised its forecast for the fall of the German economy in 2020 from 6.3% to 5.8%. In 2021, economic expansion, according to government estimates, will lead to an increase in output by 4.4% in annual terms against the previous estimate of 5.2%

The European and British currencies continue to actively reclaim territory from USD and this trend is expected to continue this week, despite the record USD short observed in currency futures.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.