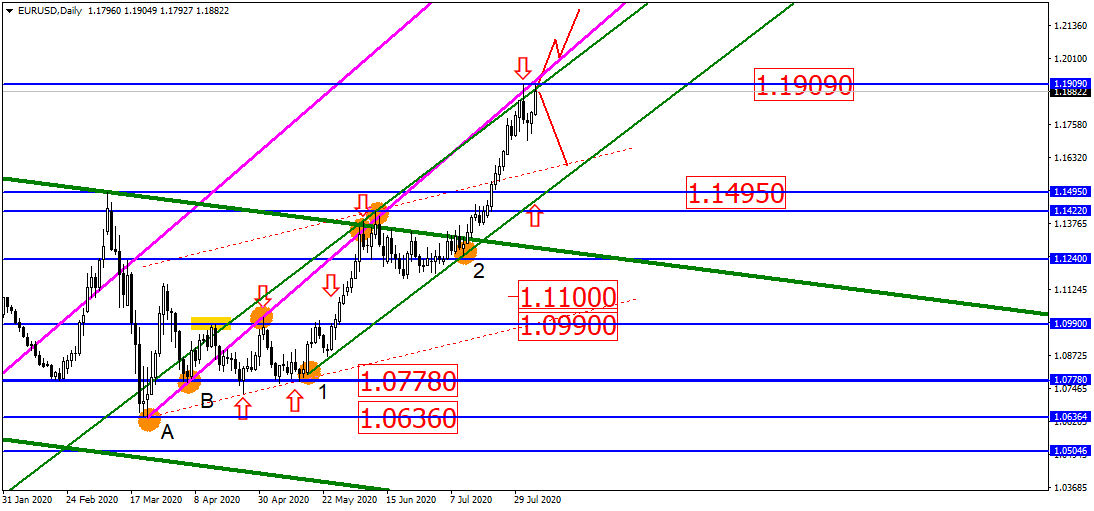

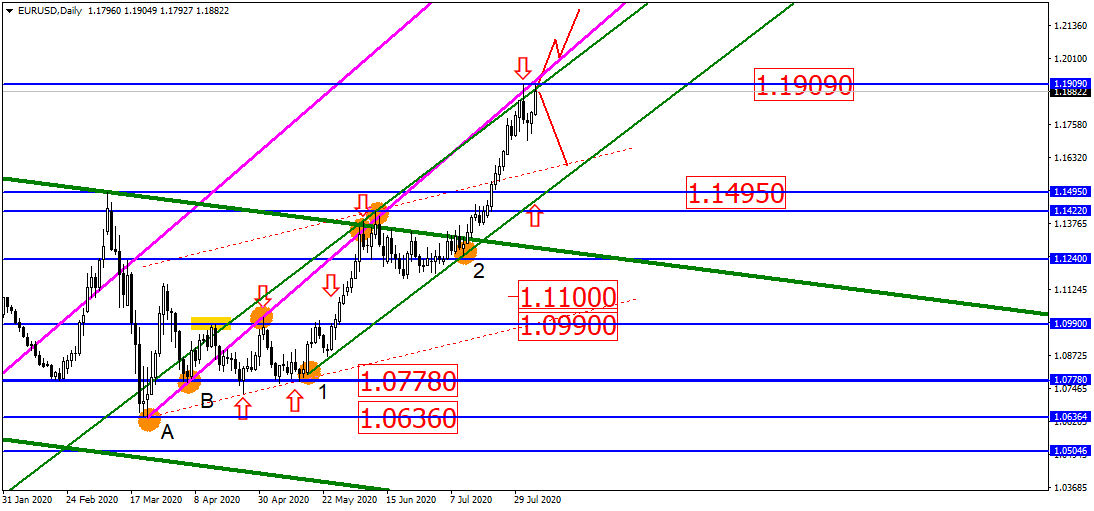

EUR/USD: New Heights Ahead?

Good day,

The European currency has repeatedly gone back to the 1.1909 maximum, repeatedly testing the level. This therefore gives a signal that there is potential for it to drop at some point soon. Once the horizontal level gets broken, the asset’s rate will get back to the broken uptrend with a jump becoming more likely.

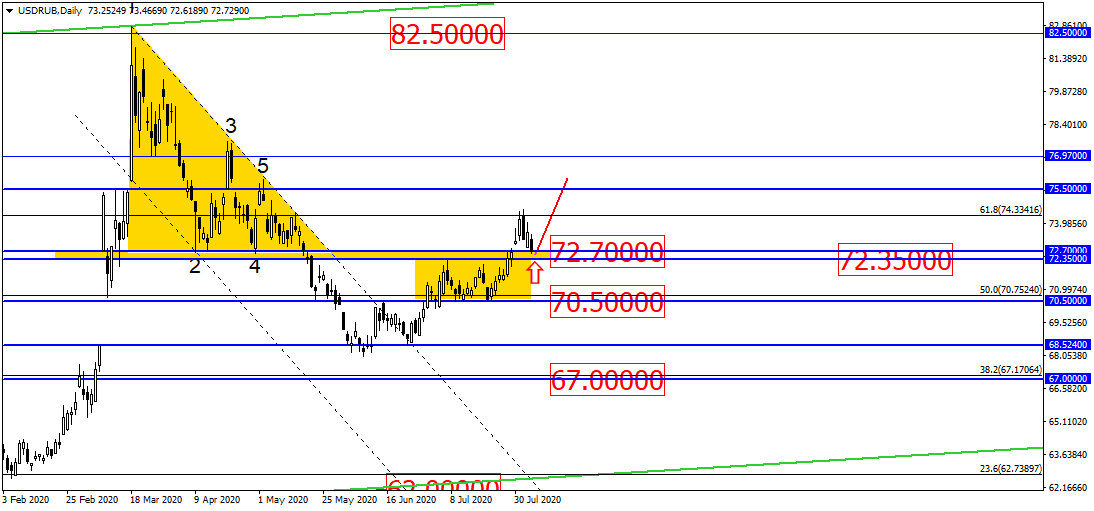

The USD/RUB moved back to the 72.70 level, away from which it has the potential to jump. Please note that asset’s rate might first drop till the 72.35 level, and only then is it feasible for it to head up.

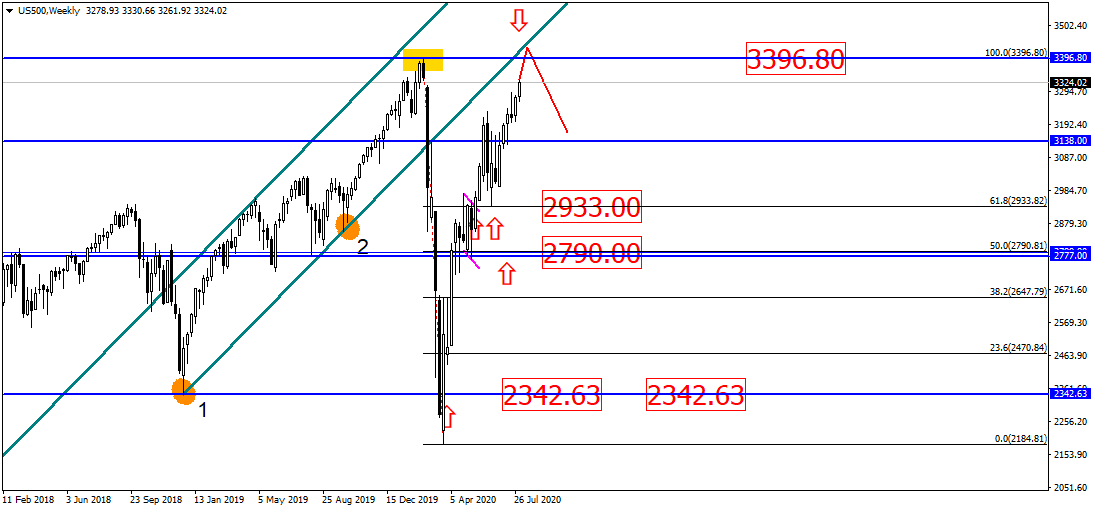

The price of the S&P500 is targeting the historical maximum of 3396.80. The asset could also pull back from this level, yet we feel that it would rather break the horizontal and pull from the broken earlier uptrend. It might even exceed the maximum of 3396.80:

Let us remind you that this material is provided for informative purposes only and cannot be considered as a direct go ahead to implement transactions in the financial markets. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.