EUR/USD Steadies Near 1.0850 Amid ECB and Fed Speculations

In Tuesday's European session, the EUR/USD remains tethered near the 1.0850 mark, indicating a lull in market volatility. This stasis reflects the greenback's stabilization as traders anticipate pivotal data releases later this week, notably the FOMC Minutes and the preliminary S&P Global PMI data for May.

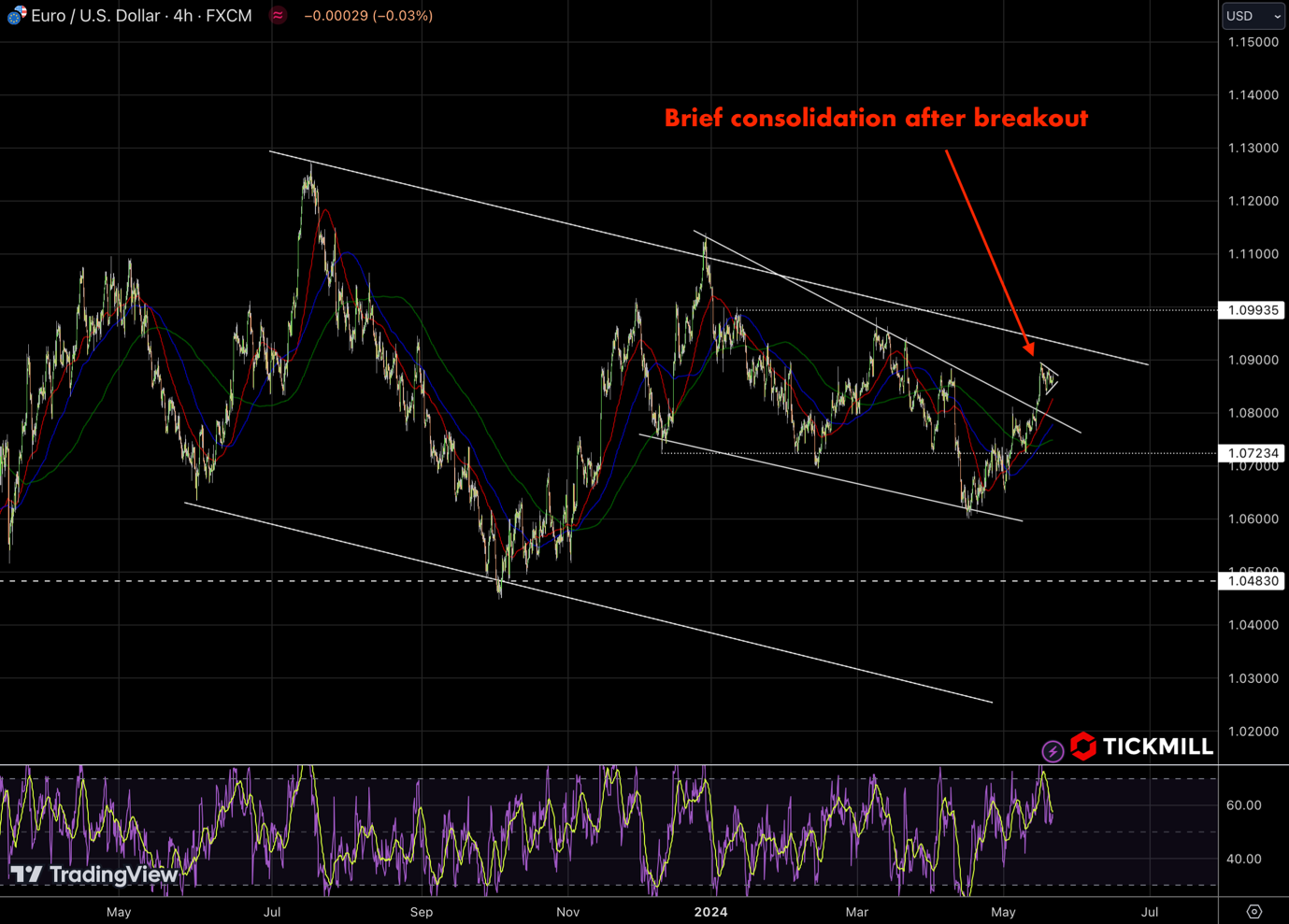

On the technical side, the pair recently broke out of a descending channel, signifying a potential shift in trend. However, the pair is currently experiencing a brief consolidation phase just below the 1.0900 level, as indicated by the recent price action. The Relative Strength Index is hovering near the 60 mark, suggesting that there is still some bullish momentum left in the market. If the pair manages to break above the immediate resistance around 1.0935, it could target higher levels. Conversely, a failure to maintain this breakout could see the pair retreating back towards the 1.0723 support level:

The Euro is holding its ground against the Dollar despite brewing uncertainties around the ECB’s potential rate cuts post-June. ECB policymakers exhibit a cautious stance, leaning towards initiating a rate reduction next month while refraining from committing to further cuts. They emphasize a data-dependent approach moving forward.

However, some ECB officials have voiced concerns that additional rate cuts in July could reignite price pressures, undermining efforts to control inflation. The ECB's cautious optimism is juxtaposed against the backdrop of US inflation, which showed a predictable decline in April. Nonetheless, the Federal Reserve remains unconvinced that inflation is steadily retreating towards its 2% target.

Michael Barr, the Fed's Vice Chair for Supervision, underscored on Monday that the first quarter's inflation data was disheartening, lacking the reassurance needed to relax monetary policy. Barr's remarks highlight the Fed's commitment to a stringent policy stance until further evidence of disinflation emerges. Complementing this, Atlanta Fed President Raphael Bostic told Bloomberg TV that the Fed requires additional time to ascertain a consistent downtrend in inflation.

Investors are now eagerly awaiting the FOMC minutes from May's policy meeting, due Wednesday. These minutes are expected to convey a hawkish sentiment, driven by the stubborn inflation seen in early 2023, which suggests a stalled disinflationary trend.

Across the channel, the Pound Sterling is maintaining a solid position, trading slightly above 1.2700 in the European session. The trajectory of GBP/USD will likely be influenced by the upcoming UK CPI data for April and the FOMC minutes.

Should the anticipated decline in UK inflation materialize, it would bolster investor confidence that inflationary pressures are easing back towards the 2% target. This would fuel expectations for the Bank of England to initiate rate cuts sooner, with the debate centered around whether the first cut will occur in June or August.

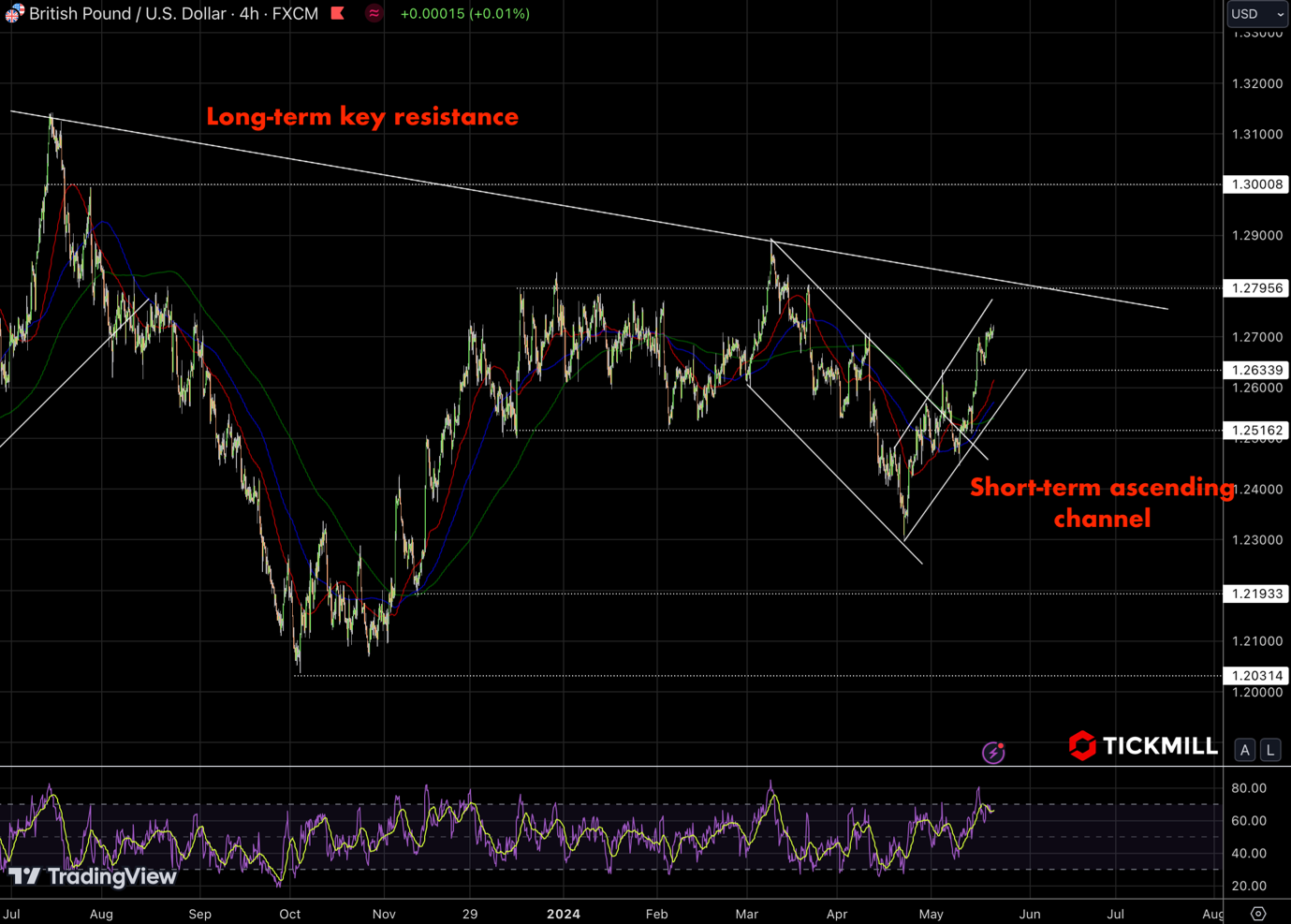

The GBP/USD pair is currently trading within a short-term ascending channel, suggesting a bullish outlook in the near term. The pair is approaching the long-term key resistance around 1.2795, which, if breached, could open the door for further gains towards the 1.3000 level. The RSI is hovering near the 60 mark, indicating there is room for additional upward momentum. Immediate support is found at 1.2634, and a drop below this level could see the pair testing the lower boundary of the ascending channel around 1.2516. Overall, the bias remains slightly bullish as long as the pair stays above the 1.2634 support:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.