Euro Drops and Trades Flat!

Good day!

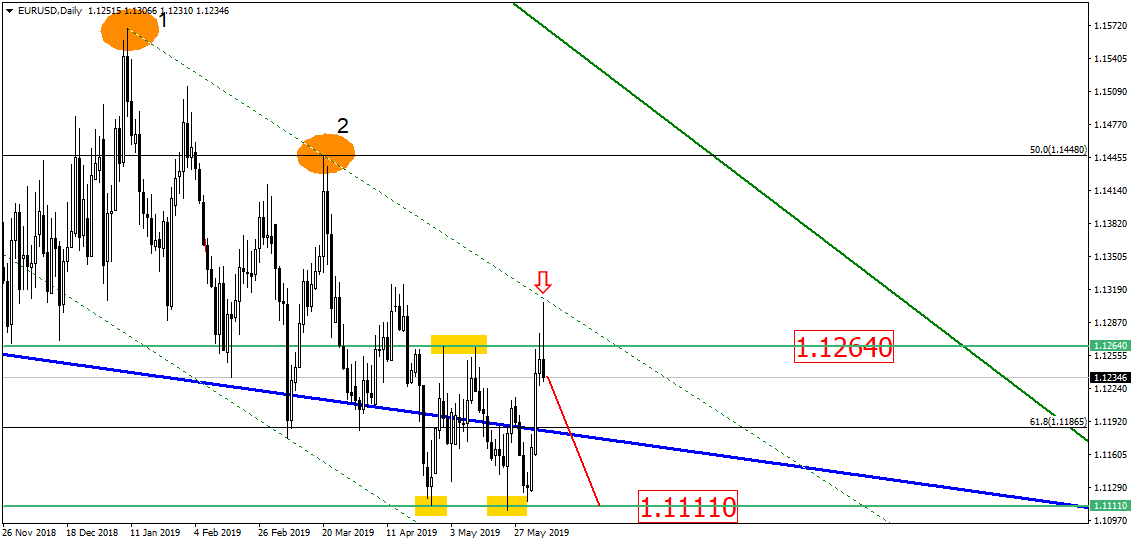

In the daily chart, the price of currency pair EUR/USD almost touched the downtrend and left a fine long shadow trying to close below the 1.1264 level. It has also formed a shooting star which is also a bearish engulfing pattern. The rates formed the range with important 1.1111 level serving as its opposite boundary. All in all, we assume that single currency should potentially drop anytime soon:

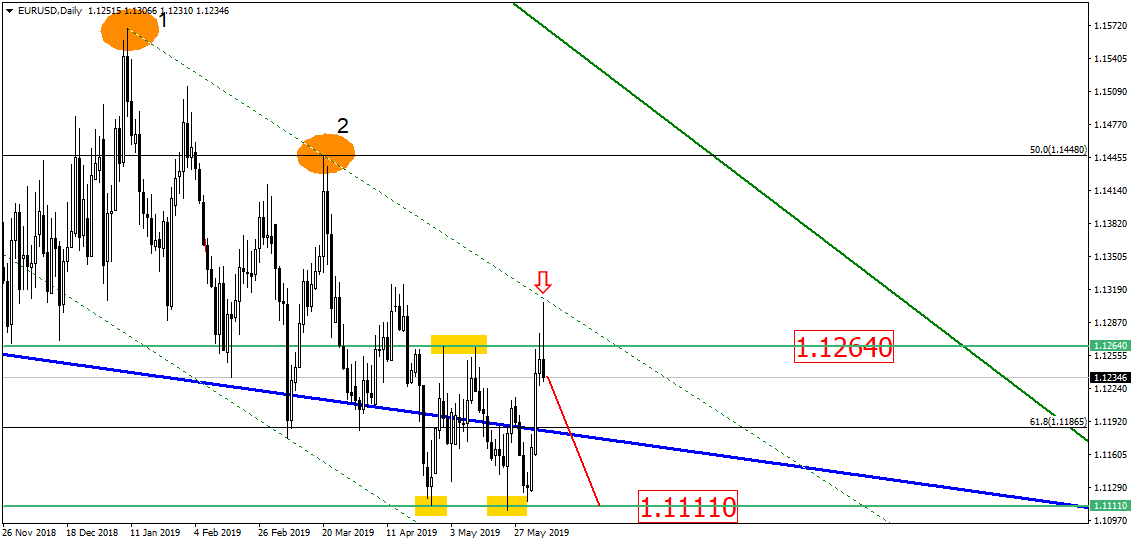

The British pound again approached the broken downtrend and is now trying to form a shooting star. Should the trading day close with this candle, the British pound will most likely drop and reach the support zone between the 1.2476 and 1.2480 levels:

In the daily chart, Australian currency pulled back from the broken support level and psychological level of 0.7000, trying to close trading day with a bearish engulfing. Should this pattern finally form, the asset’s price can potentially drop targeting the level of about 0.6830:

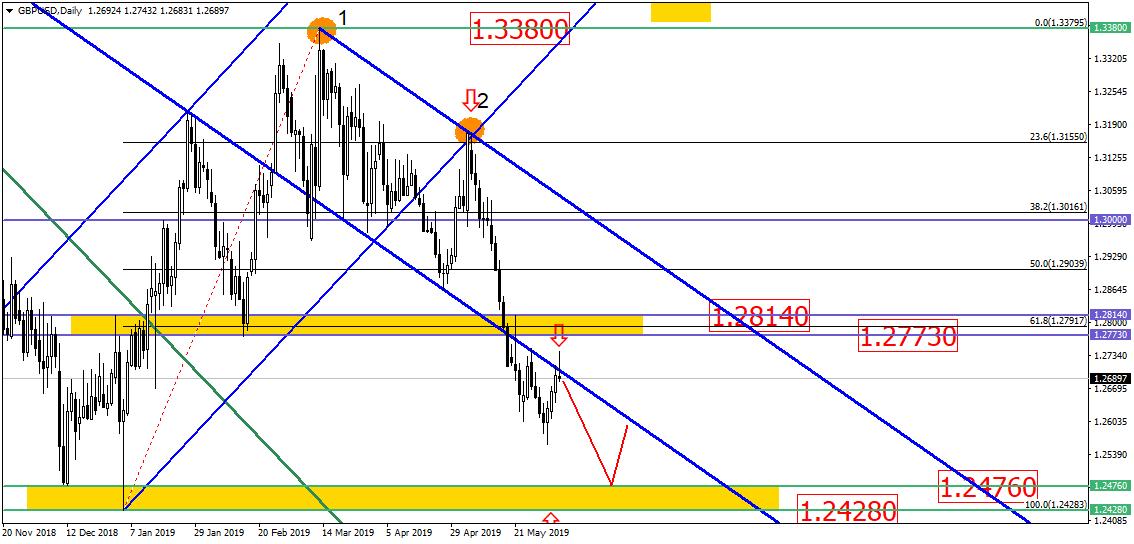

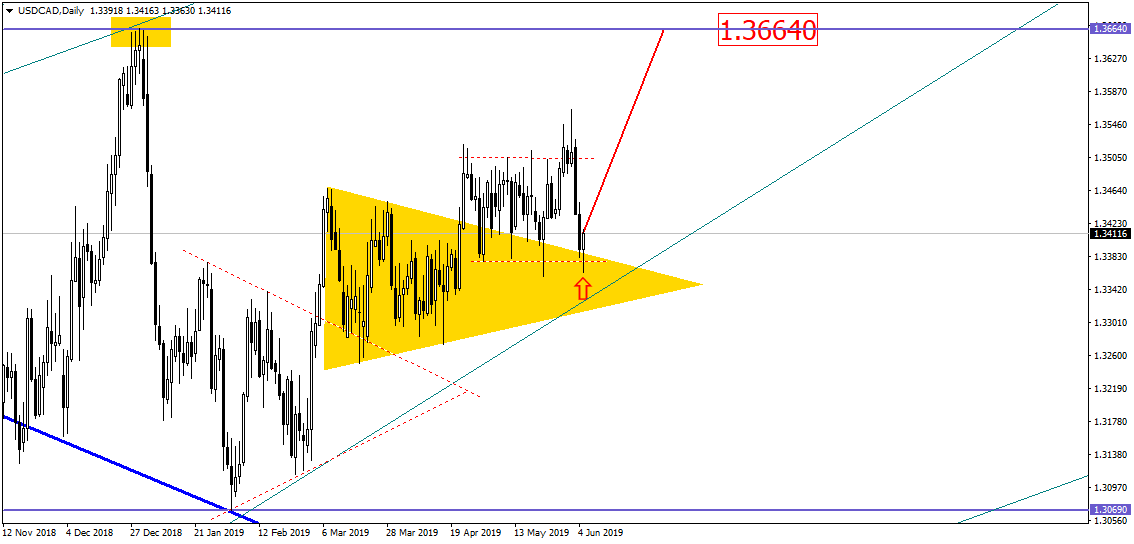

The Canadian dollar is testing the broken upper side of a symmetrical triangle for a fourth time in a row. It’s also strongly pulling away from the broken trendline. Now, the asset’s price is trying to form a bullish candle and jump again. We assume that in this case the asset will potentially target the 1.3664 level:

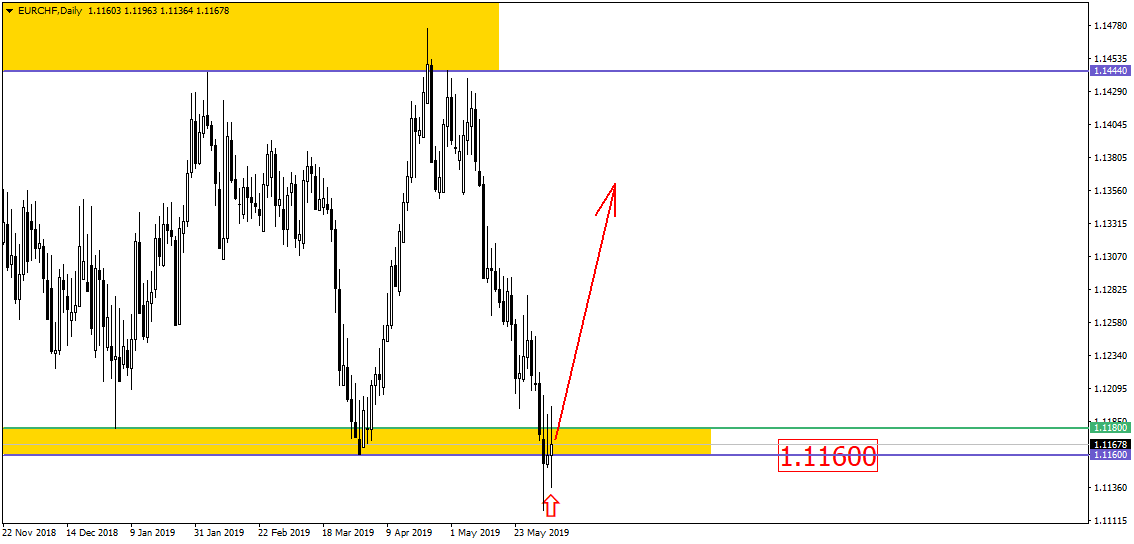

The cross rate of EUR/CHF tried to break the lower boundary of the large daily range but quickly got back into the flat, leaving a long shadow after a false breakout. Currently, the trading day might close with a pattern with white body and very long shadows along both sides of a so-called high-wave candlestick. This candle is located at the lower boundary of the flat or the 1.1160 level, which serves as a support. It signifies a potential trend reversal and jump:

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.