EURUSD breakout of 1.05 level may prompt strong bullish response

On Monday, the market sees a classic relief rally after sell-off on Friday, triggered by the surprise in the Core PCE. The news led to sharp reassessment of Fed rate path which hit risk assets and bonds causing more yield curve inversion, exacerbated by speculative selling momentum, which skewed balance towards short-term oversold and which is probably being unwound today. I don't think there is much opportunity to see sustainable upside from current levels as rate futures and Treasuries, especially short-dated bonds, have priced in three federal funds rate hikes this year and to ease this heavy burden on risk assets a new batch of dovish incoming data or Fed comments is needed. Further adjustment of market expectations could potentially come after ISM Services report on Friday, but if there is a surprise, it is likely to be hawkish. Overly positive data on the economy is now moderately negative for the market, it became clear already from the NFP, CPI and retail sales in the US for January.

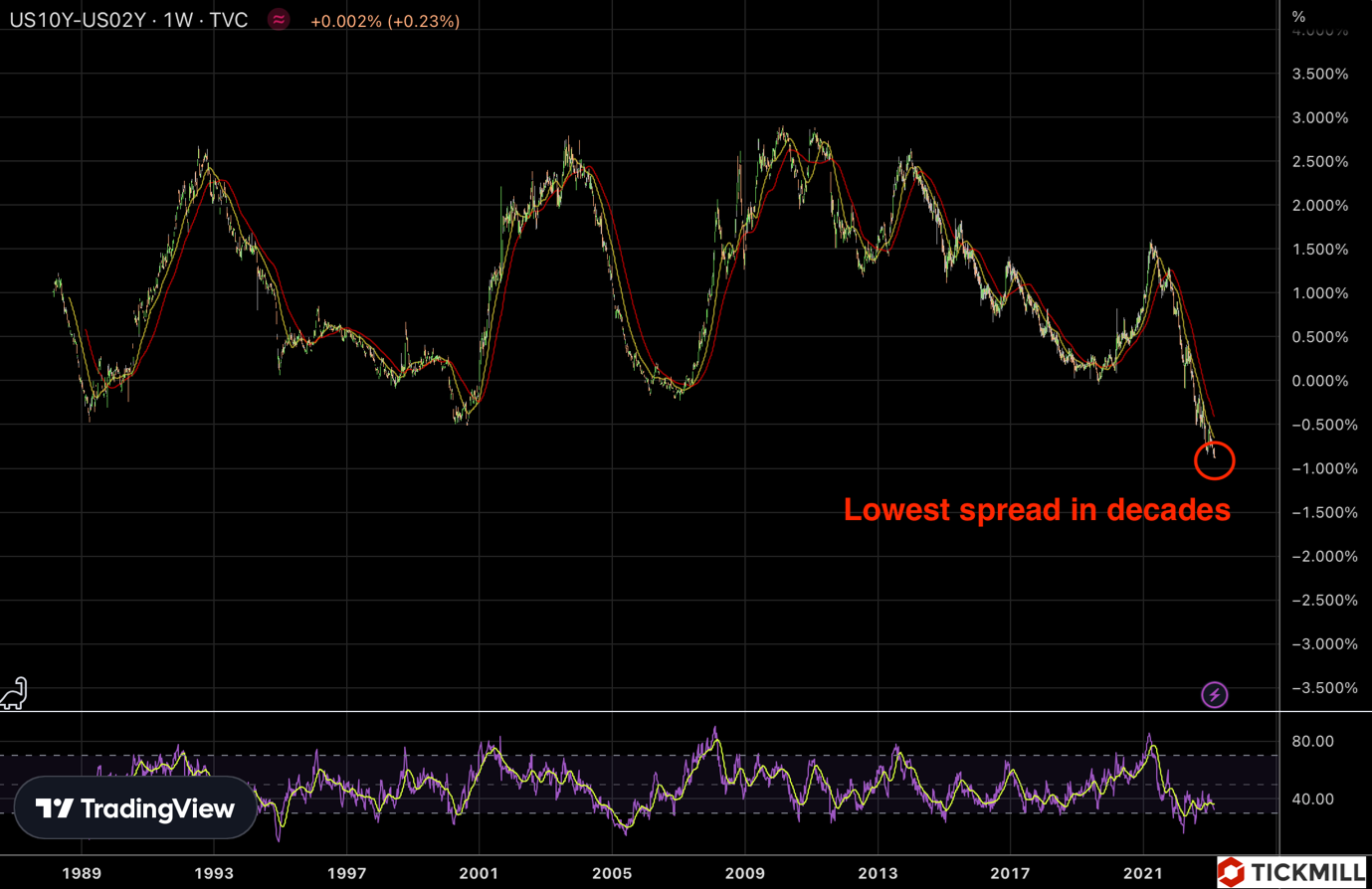

The hawkish data feed raises the question of what the Fed's new Dot Plot will look like when it is released on March 22. According to the Fed's current median expectations, the rate range should be 5.00-5.25% by the end of 2023 and 4.00-4.25% by the end of 24 years. Both of these forecasts are likely to be revised upwards. Such a prospect could well pause any significant dollar short in the next few weeks. At the same time, the 2–10-year yield curve in the US is currently inverted the most since Paul Volcker's tightening in the mid-1980s, creating a strong headwind for the stock market:

It's hard to expect a major surplus of investors in equities until there are clearer signs that the Fed and other central banks may ease their tightening cycles. With the improvement in US macroeconomic variables, firm revenue growth outlook certainly improves as well, but with the prevailing market consensus that we are nearing the end of the expansion phase of the business cycle, the pressure from rising interest rates overweigh. There were hopes and, in general, broad market bet at the beginning of January that the Fed will soon complete the tightening cycle, but now the chances of such an outcome in the short term are slim.

Of the interesting data on Monday, we can also note the monetary data for the EU. The growth of the monetary aggregate M2 (aka money supply) slowed down sharply in January in the Eurozone - to 3.5% against 4.1% in December and 3.9% of the forecast. This suggests that the growth rate of lending by banks in the European bloc is responding to the strict policy of the ECB, and at a faster pace, which improves the inflation forecast in 2023, since the growth in consumer prices is to a large extent a monetary phenomenon. Household lending slowed down to 3.6% in annual terms, commercial loans grew by 6.1% against 6.3% in January.

European currencies such as EUR, GBP rose slightly against the dollar today, EURUSD found support below 1.0550, GBPUSD - at 1.1950. Futures on the S&P 500 is trying to stay close to 4000 points, while European indices are growing more confidently - by an average of 1.5%. There is some potential to see a breakout of 1.05 in EURUSD and a dip to 1.0450, however there are no catalysts in sight that may underpin sustainable trade lower and pullback trade could be a priority in this scenario. DXY may find resistance at 105.50 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.