EURUSD may Break Lower on NFP but Technical Picture Suggests Otherwise

US job growth in September is expected to average 500K, which, however, should be enough to warrant Fed QE tapering announcement in November. It should also increase chances of a first rate hike in Q4 2022. The labor data update should clarify the pace of Fed tightening and this uncertainty is apparently the key factor of bond yields and greenback resilience to pullbacks. USDJPY poised to break 2019 and 2020 highs on US capital inflows from Japan due to divergence of rate hike outlooks, CAD is set to make more gains on Canadian labor data.

Stock markets mood improved markedly towards the end of the week. Growing optimism in Western markets has also provided some respite to Asian stock markets, including China, where buyers finally appeared, which was a very positive signal against the backdrop of negative news about Evergrande and other Chinese developers.

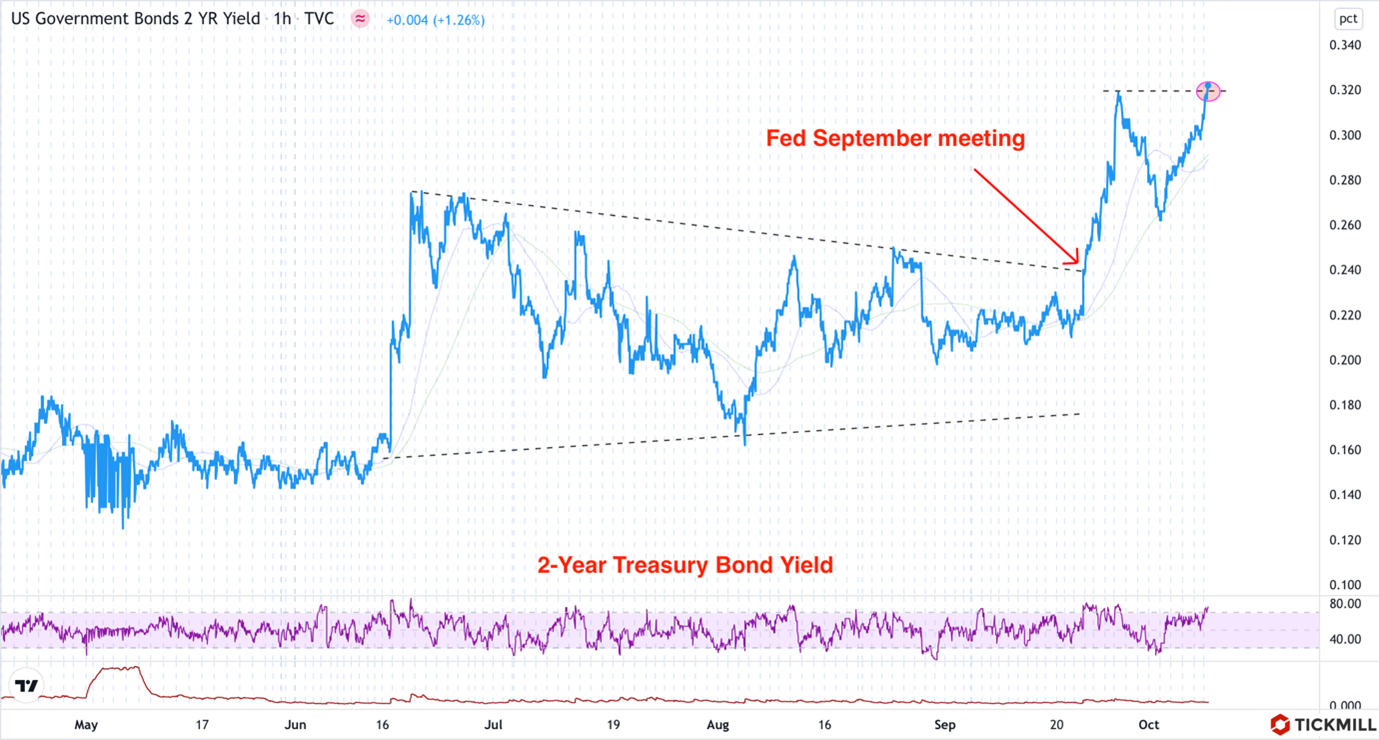

The recovery in risk demand this week correlates little with dollar sales, as the US currency is strongly supported by the upside in US bond yields, including the near end of the yield curve, which primarily responds to expectations related to the Fed decisions. The yield on two-year Treasury bonds extended advance past September 28 local high and amounted to 0.322% on Friday:

Another notable sales driver in Treasuries is the battles in the US Senate over the raising/freezing the debt ceiling. Short-term debt limit has been increased until December 3 which provided some reprieve, however lingering uncertainty on this issue negatively affects sovereign risk of the United States, which dampens demand for US bonds.

Investors focus today on the Non-Farm Payrolls report. The number of people employed in the non-agricultural sector is expected to have grown by ~ 500 thousand. If the indicator meets or exceeds the forecast, there will be another strong reason to short US bonds, especially long-term maturity. In forex, this could translate into a new episode of strengthening the dollar with a potential retest of recent bullish extreme (94.5) and resumption of upside in USDJPY. Particular attention should be paid to the technical chart of USDJPY: the pair poised to challenge the 2019 and 2020 highs with upside pressure supported by the fact that the pair remains in short-term uptrend channel. A break through the resistance at 112 yen per dollar may signal a shift in medium-term expectations for the pair opening the door for more gains:

The recent decline in EURUSD came with little buyer’s protest- the pair reached 1.15 area with quite small number of bullish pullbacks. And although the NFP release creates the risk bearish retest of 1.15, technical picture of the pair indicates the risk of a major bullish pullback:

It can be seen on the chart that the price dropped in the area of intersection of minor and major support levels (lower bound of major downtrend, horizontal support line, etc.) which poses a great risk for new sellers and may offer unattractive R/R.

Not very positive for the euro was the comment of the ECB chief economist yesterday that there is "very strong evidence" that price surge will not last long. This suggests that prices must rise longer and stronger to trigger changes in ECB policy, hence the European fixed income market may be less attractive compared to other markets where central banks are more serious about accelerating inflation.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.