EURUSD Sinks On Surging ECB Rate-Cut Bets

ECB Rate Cut Expectations

EURUSD has come under heavy selling pressure over the last 24 hours in response to a shift in the market’s outlook on ECB rates. Traders are now fully pricing in an ECB rate cut by April 2024 with pricing for a March rate cut currently just below the 50% level. The shift in expectations comes on the back of the latest drop in eurozone inflation. Yesterday, German and Spanish CPI readings were both seen falling lower for last month, hinting that today’s eurozone CPI was going to show similar weakness.

Eurozone Inflation Plunges

While already lower ahead of the data, today’s eurozone inflation readings have pushed EURUSD lower still. Headline CPI for last month was seen at 2.4%, down from 2.9% prior and below the 2.7% the market was looking for. Additionally, core CPI was also seen lower at 3.6%, down from 4.2% prior and below the 3.9% the market was looking for.

Market vs ECB

With inflation continuing to trend back towards the bank’s 2% target, traders are now pushing back against the ECB’s guidance that rates will need to stay at elevated levels for longer and are calling for early 2024 rate cuts. While this narrative continues to build, EUR looks vulnerable to further downside near-term.

Technical Views

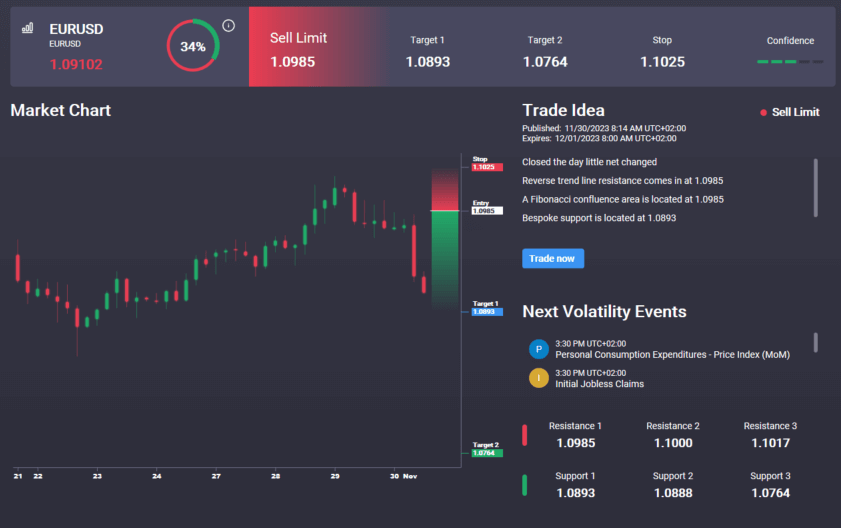

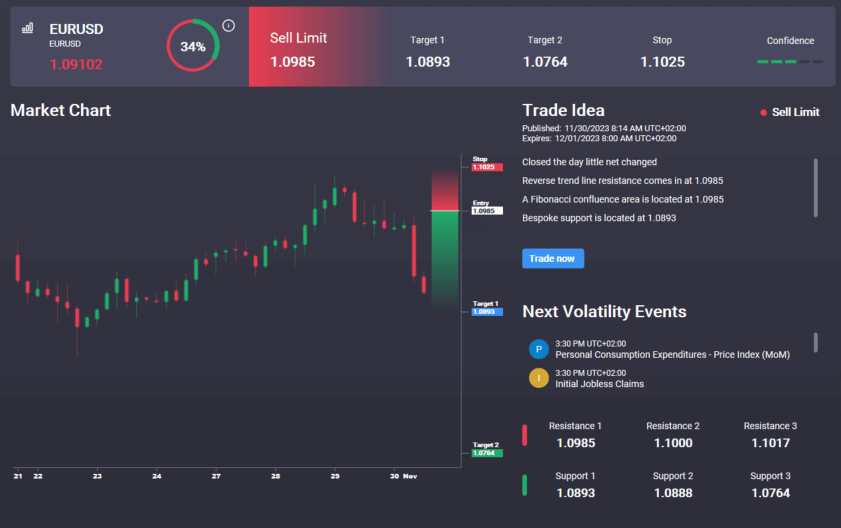

EURUSD

The rally in EURUSD has seen plenty of bearish divergence in momentum studies, raising caution over a potential reversal lower. Price is currently testing back below the 1.0937 level with risks of a deeper correction if we hold below. If bulls can get back above, however, focus stays on 1.1126 for now. Notably, we have an active sell signal today in the Signal Centre set from 1.0985, suggesting a preference stay bearish here.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.