What to Expect from the Euro after the Release of EU CPI Today?

December US retail sales report released on Thursday showed that the shopping season paid off and there were no signs of consumer spending weakness at the end of last year. The broad reading grew 0.3%, however, excluding volatile sales of cars and fuels, retail sales rose 0.5%, beating the estimate of 0.3%.

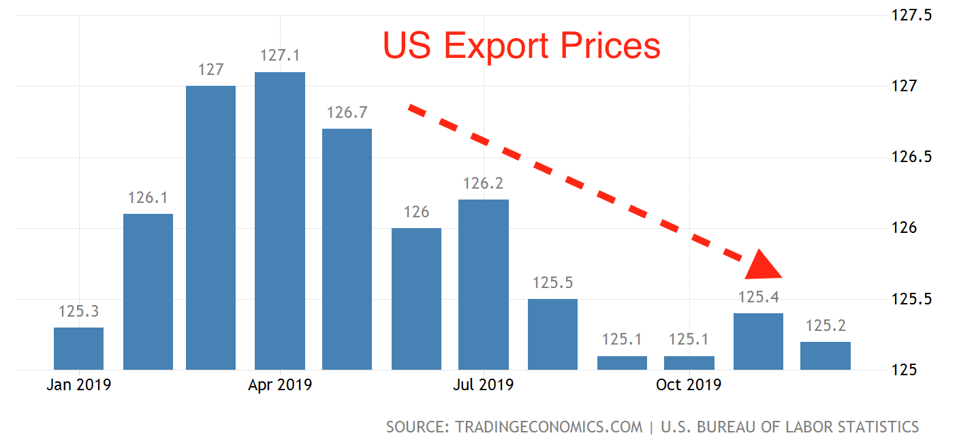

Positive expectations related to de-escalation of the trade war staged onset of a positive trend in export prices in the United States. The corresponding index rose 0.7% in December compared with the same period in 2018, while in November it fell by 1.3%.

The Philadelphia Fed index jumped to 17 points in January against expectations of 3.6 points. Recall that this index is calculated for three US states and covers mainly firms in the manufacturing sector which took the brunt of the trade war.

Updated figures from the Ministry of Commerce, however, showed that retail sales excluding sales of vehicles and fuels had been declining in the previous three months in a row.

The data on Chinese economy showed that the pace of GDP growth in the fourth quarter slowed down to the lower bound of the government’s target range in 2019 and amounted to 6.0%. Investments in fixed assets grew by 5.4%, industrial production by 6.9% against the forecast of 5.9%, retail sales - by 8% against the forecast of 7.9%. It is worth noting that unemployment increased by 0.1% compared with the previous period and amounted to 5.2%.

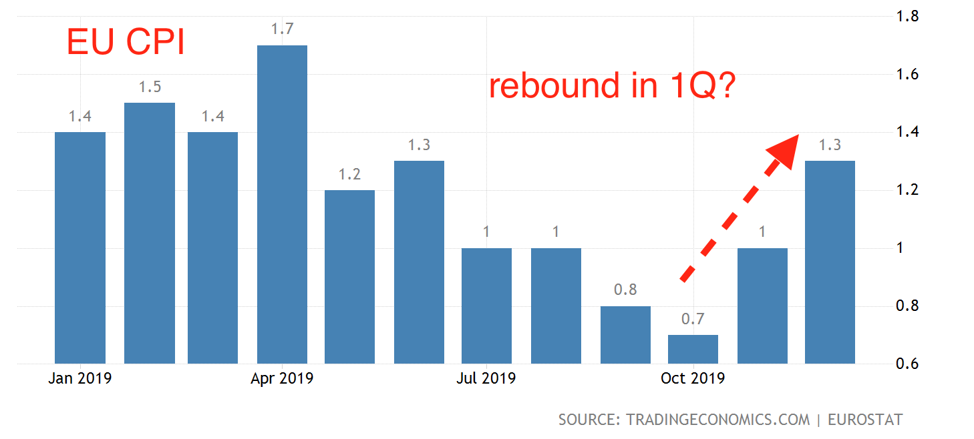

Today, the data is expected on the European economy, in particular consumer inflation in the Eurozone, which is expected to accelerate to 1.3%. In the previous period, it decelerated to 1.0% and reflected a slowdown in the German economy, which was almost caught in the grip of a recession, a decline in export prices and orders, as well as the burden of the trade conflict between the United States and China.

It is worth noting that the expected growth in economic activity in the first quarter in the Eurozone is likely to be temporary, since soon export firms (in particular, the German auto industry) will face a reorientation of Chinese demand for American products, which follows from the details of the trade agreement published after the ceremony signing on Wednesday.

Nevertheless, speaking of “more applied” facts related to medium-term outlook for the euro, December ECB Minutes released on Wednesday revealed an onset of crucial bias in the policy. One of the comments says that the ECB officials are very concerned about the side effects of negative rates on European households (probably referring to the saving part of the population, which faces low rates, what discourages savings). This suggests that despite the need for credit stimulus of the economy, the policymakers are looking for a way out, meaning that the belief in unlimited power and depth of QE is put under a doubt. Growing concern about the side effects suggest that markets should start to pay more attention to this part of the communication and interpret future policy statements accordingly.

If consumer inflation in the Eurozone today exceeds the forecast or becomes a sign of mini-expansion having strengthened to 1.3%, we can probably expect EURUSD to leave the narrow trading range and move up, because due to the problems of the German economy, the prospects for expansion in the Eurozone remain significantly underpriced.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.