Fed Pause in Tightening Looms Large according to Fed Minutes & Incoming US Data

US equities posted a buoyant reaction to the minutes of the Fed meeting, released on Wednesday. The report showed that the majority of FOMC members judged that it would be appropriate to slow down the pace of rate hikes in the near future due to uncertain lag between monetary decisions and their impact on the economy. Incoming data on the US economy released yesterday had a favorable mix of readings in terms of household consumption and change in inflation pressure:

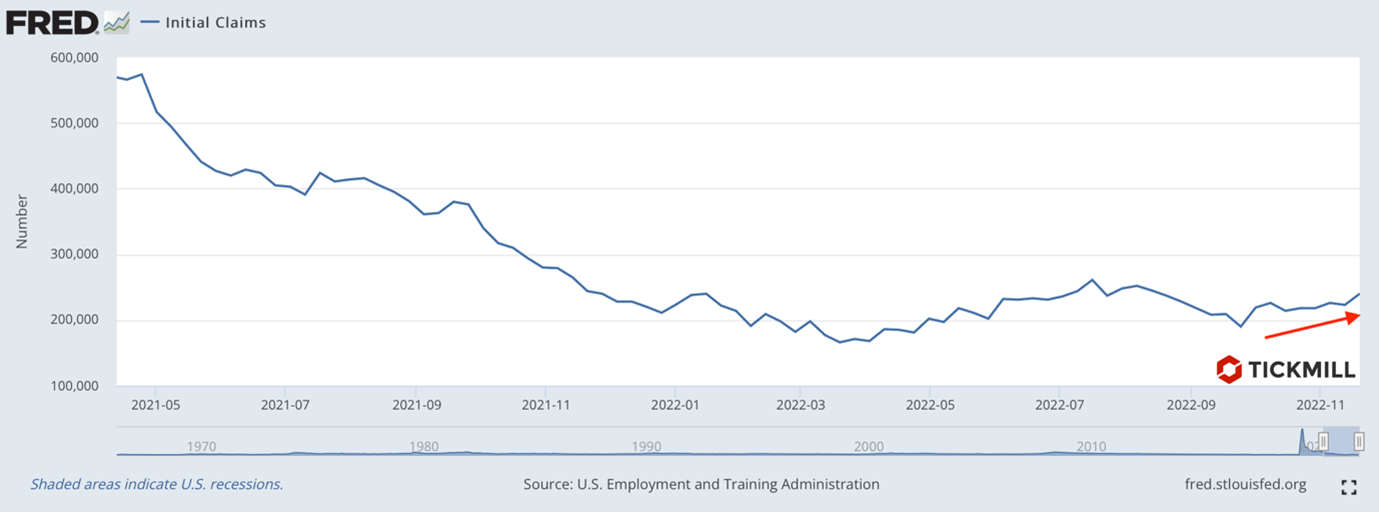

Initial jobless claims showed the highest weekly increase in several months (225K -> 240K):

PMI indices in services and manufacturing from S&P Global were slightly worse than expected. The activity index in the manufacturing sector fell from 50.4 to 47.6 (forecast 50 points), in the service sector - from 47.8 to 46.1 points (forecast 47.9 points). In other words, the situation in both manufacturing and services has changed for the worse compared to the previous month, and in the services sector, the deterioration has accelerated;

Orders for durable goods grew stronger than expected - +1% against the forecast of 0.4%. This indicator indirectly reflects the expectations of households regarding future income, since when making expensive purchases, consumers are guided by future opportunities to restore their savings level or repay a loan;

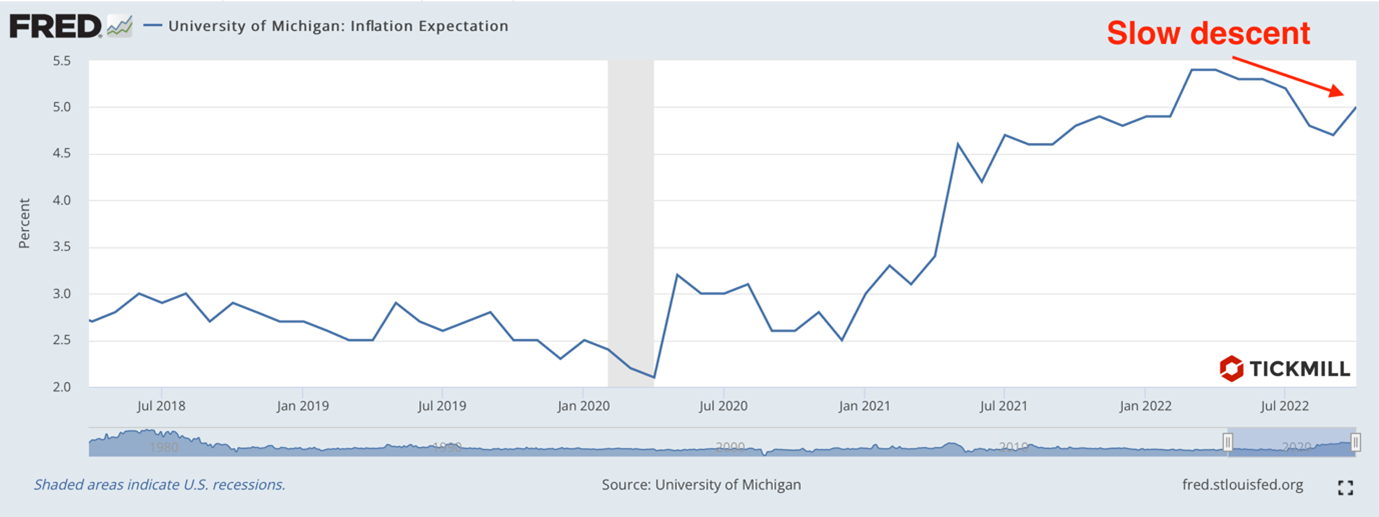

Consumer sentiment index from the U. of Michigan came in slightly higher than expected - 56.8 points against the forecast of 55 points. One-year inflation expectations of households declined from 5% to 4.9%. The indicator has been on the slippery slope from March and at its peak was 5.4%:

US equities react positively to downside surprises in US data as the continuation of the Fed's tightening cycle is a function of the state of the economy - the more signs that it slows down, the more likely it is that the Fed will announce a pause soon. In this sense, a significant increase in the number of initial jobless claims could be a signal that the labor market is starting to cool faster, which will soon convince the Fed to announce a pause in tightening.

The dollar came under pressure after the release of the Fed Minutes and US labor market data, DXY tumbled below 106 points. EURUSD topped 1.04 and GBPUSD climbed above 1.21. A slowdown in hostilities in Ukraine due to the approaching winter could also mean a pause in the growth of sanctions pressure on Russia, as well as its response, causing increased volatility in the energy and commodity markets. In turn, declining odds of the energy crisis may increase demand for European currencies.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.