Fed speakers maintain hawkish rhetoric capping USD downside

Newly minted dollar bulls after the NFP report did not hear anything encouraging from Powell on Tuesday, but other Fed representatives tried to meet market’s request for hawkish comments. Four Fed officials, who are at different positions on the spectrum of hawks and doves, have indicated that it is necessary to raise rates above 5%, or reiterated the idea to hold interest rate at restrictive level for longer. All this made it difficult for investors to quickly recover their risk appetite and helped the dollar to find some ground. Futures for European and US indices trade in positive territory today, and currencies, rising on expectations of global economic expansion, showed good growth. This may indicate that the markets see the current moment as the peak of the Fed's hawkish communication and are now looking for opportunities to re-enter US dollar pro-cyclical shorts at more attractive levels.

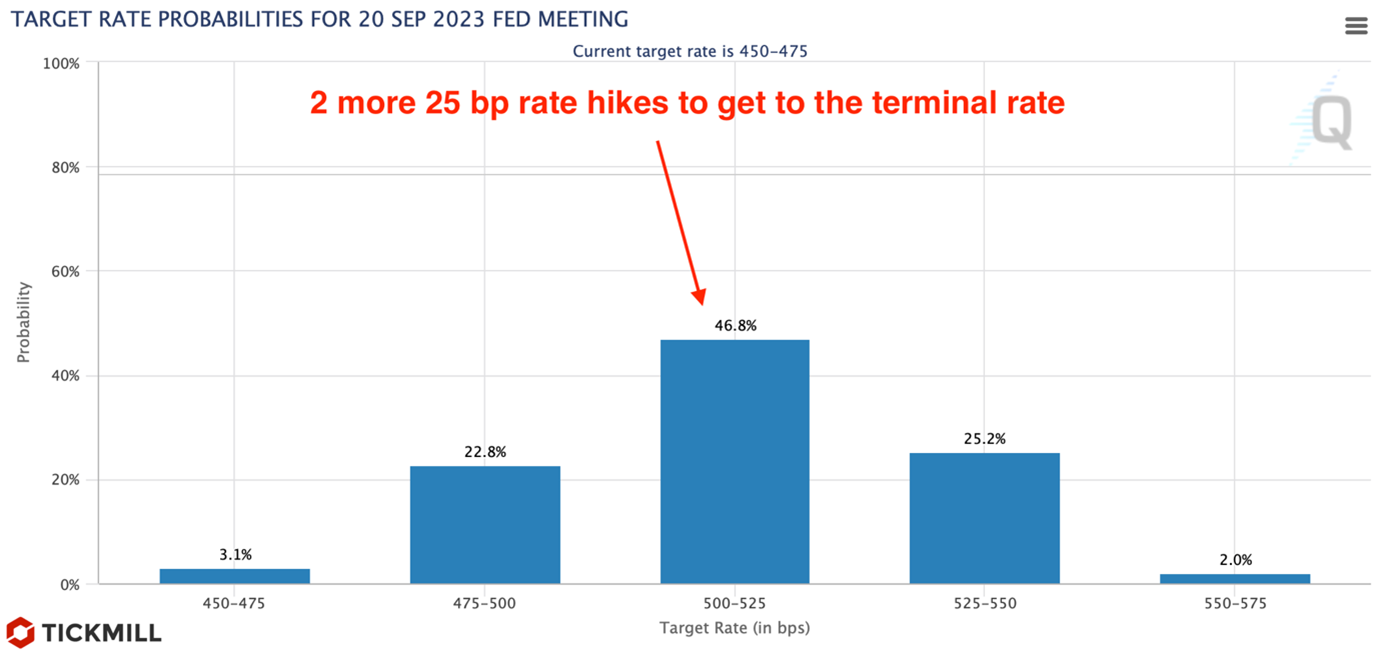

However, there is still scope for the US dollar to absorb further hawkish repricing of rate expectations, and a recovery in high-beta currencies may be premature. Markets are pricing the Fed's peak rate at 5.13%, so it still doesn't fully account for another hike after March. The pricing of Fed rate path implies about 50 basis points of easing in the second half of the year, reflecting both disinflationary and recessionary risks in the US. Perhaps the aim of the Fed's hawkish speakers at this stage is to reassure the markets that rates can rise to at least 5.25% and that rate cut speculation is out of place.

It's fair to expect that more confirmation from incoming economic data will be needed to convince markets of another 25 bps gain after March. Jobless claims are somewhat disappointing today (196K vs. 190K forecast), tomorrow's University of Michigan sentiment index is probably the only important report ahead of the weekend. A calmer trading environment could return after the morning's risk appetite and last until the main US inflation report on Tuesday. In the foreign exchange market, it seems that it is still too early for the dollar to return to a stable downward trend: instead, country factors and risks may become the focus of attention.

The data on inflation in Germany, published this morning, surprised on the downside. The overall consumer price index rose 8.7% year on year, lower than the forecasted 8.9%. This is likely to test the ability of the European Central Bank to continue to resist the bullish reaction in bond market after last week's ECB meeting. The EUR/USD pair may struggle to break above 1.08 level for now.

Elsewhere in Europe, the focus will be on the comments of BoE Governor Andrew Bailey when he testifies before Parliament. As in the Eurozone, we have seen a lot of hawkish commentary in the UK since last week's Bank of England interest rate decision, and markets are likely to expect any political commentary today to be hawkish as well. The weakness of the euro confirms the recent fall of the EUR/GBP pair, and the level of 0.8800 may be tested in the near future.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.