First Batch of US Labor Market Data Trims Chances for a Fed Rate Cut in March

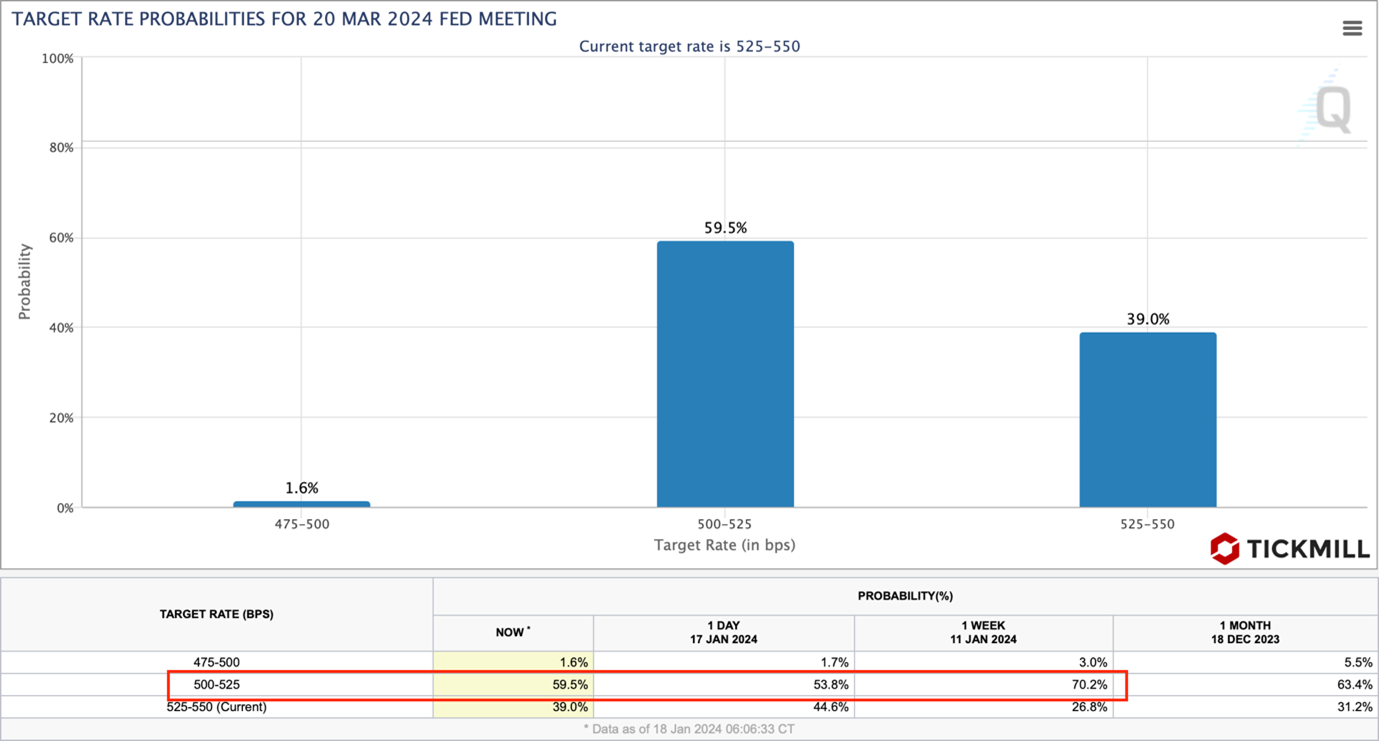

The EURUSD is attempting to develop the ascending impulse that emerged in the second half of the American session yesterday. However, resistance appeared above the 1.09 level, causing the price to drop below, and it is consolidating near the round level. Higher timeframes indicate a breakout of the ascending corridor, which strengthened after the release of the US retail sales report on Thursday. The data exceeded expectations, with both the overall and core sales indicators growing significantly stronger than forecasts. As a result, the market was forced to reassess the chances of a Fed rate cut; futures are now pricing in a 60% chance, down from 70% the previous week:

Since the beginning of the year, data on the US economy has consistently improved. The trend was set by the December NFP (Non-Farm Payrolls) report: job growth, wage payments, and the unemployment rate exceeded expectations positively, indicating that the labor market in December was stronger than anticipated. This was followed by the December CPI (Consumer Price Index), which showed that a significant component, such as prices for housing-related services, accelerated growth in December. Yesterday's retail sales and comments from Fed officials convinced the market that it had jumped ahead of 'dovish' rate expectations. The first batch of labor market data in January – initial unemployment claims for the week ending January 13 – showed an increase of only 187K, compared to expectations of 207K. This is close to the minimum of the current business cycle and should be interpreted as a strong argument in favor of the Fed extending the pause in March.

However, the market's reaction in the form of a strengthening dollar and rising bond yields still appears disproportionate to the improvement in December data. It is likely that the market is trying to attribute the strong indicators to a seasonal effect, based on increased consumer spending in December. Therefore, the market is likely to wait for January figures to draw a final conclusion about the outcome of the March Fed meeting.

The ECB, in turn, is also trying to convey to the market that expectations for monetary policy easing in the EU are somewhat exaggerated. Several heads of European banks, predominantly known for their hawkish positions, have slightly adjusted their stance on the easing cycle this year, indicating that the market's expectations for a cumulative rate cut of 150 basis points this year appear overstated. However, in an interview with Bloomberg on Wednesday, Lagarde did not actively resist dovish expectations. As a result, the risk balance for EURUSD, considering the positions of central banks and taking into account data on unemployment benefit claims, looks biased towards a slightly greater decline, probably towards the 1.0750 area (December's low):

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.