FTSE 100 FINISH LINE 24/11/25

FTSE 100 FINISH LINE 24/11/25

The UK's midcap index looked poised to break an eight-day losing streak on Monday, supported by gains in housing stocks following upbeat comments from Goldman Sachs. Investors are gearing up for the highly anticipated UK government budget announcement later this week. Chancellor Rachel Reeves is reportedly planning to implement tax increases amounting to tens of billions of pounds, marking the second hike since the last election. This strategy aims to manage borrowing levels, prevent a bond market downturn, and boost welfare spending. Reeves is expected to honour her election promise not to raise income taxes, instead focusing on tax hikes in other areas. The FTSE 250 index, which tracks domestically focused UK firms, rose 0.3%, rebounding from its longest losing streak in over two years. Meanwhile, the blue-chip FTSE 100 gave up early gains, declining 0.5% on the day. Globally, stock markets gained traction after remarks from a U.S. Federal Reserve official sparked optimism for a possible interest rate cut in December. This recovery follows a recent dip in equities, driven by concerns over inflated valuations in AI-related stocks.

Housebuilders such as Vistry and Barratt Redrow saw their shares climb after Goldman Sachs initiated coverage of the sector with a positive outlook, suggesting that the upcoming UK budget might alleviate some uncertainties affecting the industry. Despite this, the midcap index remains nearly 5% below its October peak, weighed down by a global stock market sell-off and mixed signals surrounding the UK budget set for release on Wednesday. UK bank stocks also posted gains, with Morgan Stanley forecasting a 4% increase in net interest income for European banks in 2024. Standard Chartered surged 2.5% after the brokerage upgraded its rating to "overweight," while Barclays rose 1.6%, earning recognition as Morgan Stanley’s top pick. On the other hand, advertising firms S4 Capital and M&C Saatchi suffered sharp drops of over 8%, with S4 Capital hitting a record low after both companies slashed their annual profit and revenue forecasts. Meanwhile, Anglo American’s shares held steady as rival mining giant BHP abandoned its final bid to acquire the company.

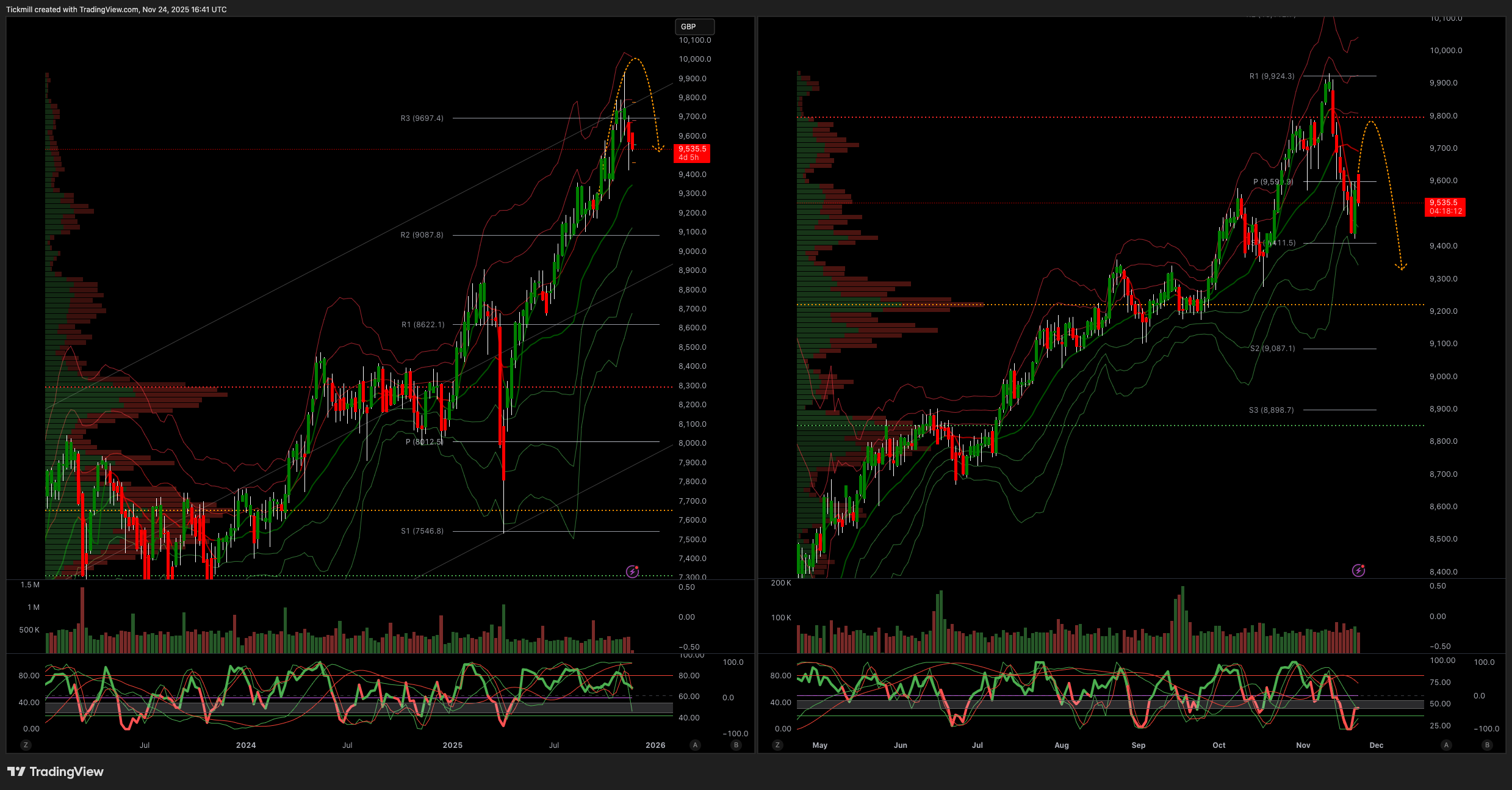

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bearish

Weekly VWAP Bullish

Above 9693 Target 9809

Below 9541 Target 9356

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!