FTSE 100 FINISH LINE 3/12/25

FTSE 100 FINISH LINE 3/12/25

The UK's FTSE 100 edged slightly lower on Wednesday as declines in financial stocks overshadowed gains in the mining and energy sectors. Investors are keeping a close eye on the U.S. Federal Reserve's upcoming decision on interest rates next week. The FTSE 100 was down marking third consecutive session of losses. UK Finance Minister Rachel Reeves' recent Budget has maintained stability, but concerns over its sustainability persist. Wealth management firm Premier Miton announced reduced investments in UK stocks, citing the Budget's failure to encourage domestic or international investment. CIO Neil Birrell noted limited investor confidence across various asset classes, except for UK real estate, particularly central London properties. Meanwhile, Reeves and PM Keir Starmer face criticism over pre-budget claims, raising concerns about potential gilt market repercussions amid leadership change rumors.

Shares of major banks took a hit, falling nearly 1%, after showing gains in the previous session. In regulatory news, Britain's financial watchdog announced it will lift the halt on processing motor finance complaints earlier than planned, moving the date up to May 31, 2026. This comes as part of a compensation plan tied to a mis-selling scandal dating back to 2007. The controversy involves lenders like Lloyds, Close Brothers, and Barclays, accused of charging excessively high interest rates in car finance deals and including additional bonus payments. Shares of Lloyds Banking dropped 1%, while Close Brothers and Barclays slipped 1.5% and 0.6%, respectively. HSBC Holdings also saw a decline of 1.1% despite naming interim chair Brendan Nelson as its permanent CEO in an unexpected move. Investment banks and brokerages fell by 1.2%, while asset manager Intermediate Capital Group slid 2.3%.

Among individual stocks, Spire Healthcare tumbled 15% after the hospital group warned that its annual profit would likely hit the lower end of its forecast range. Sainsbury’s shares fell 4% after reports revealed that Qatar's sovereign wealth fund plans to reduce its stake in the supermarket chain. On a brighter note, energy stocks climbed 0.7% as geopolitical tensions flared, with Russia reporting unsuccessful talks with U.S. officials in Moscow regarding a potential Ukraine peace deal. Industrial metal miners also advanced, benefiting from higher copper prices. Companies like Glencore, Rio Tinto, Antofagasta, and Anglo American recorded gains between 1.3% and 1.8%. Precious metal miners also saw a boost of 1%. Engineering firm Smiths Group added 1.5% after announcing a deal to sell its baggage-screening division to CVC Capital for $2.65 billion, further bolstering optimism in certain corners of the market.

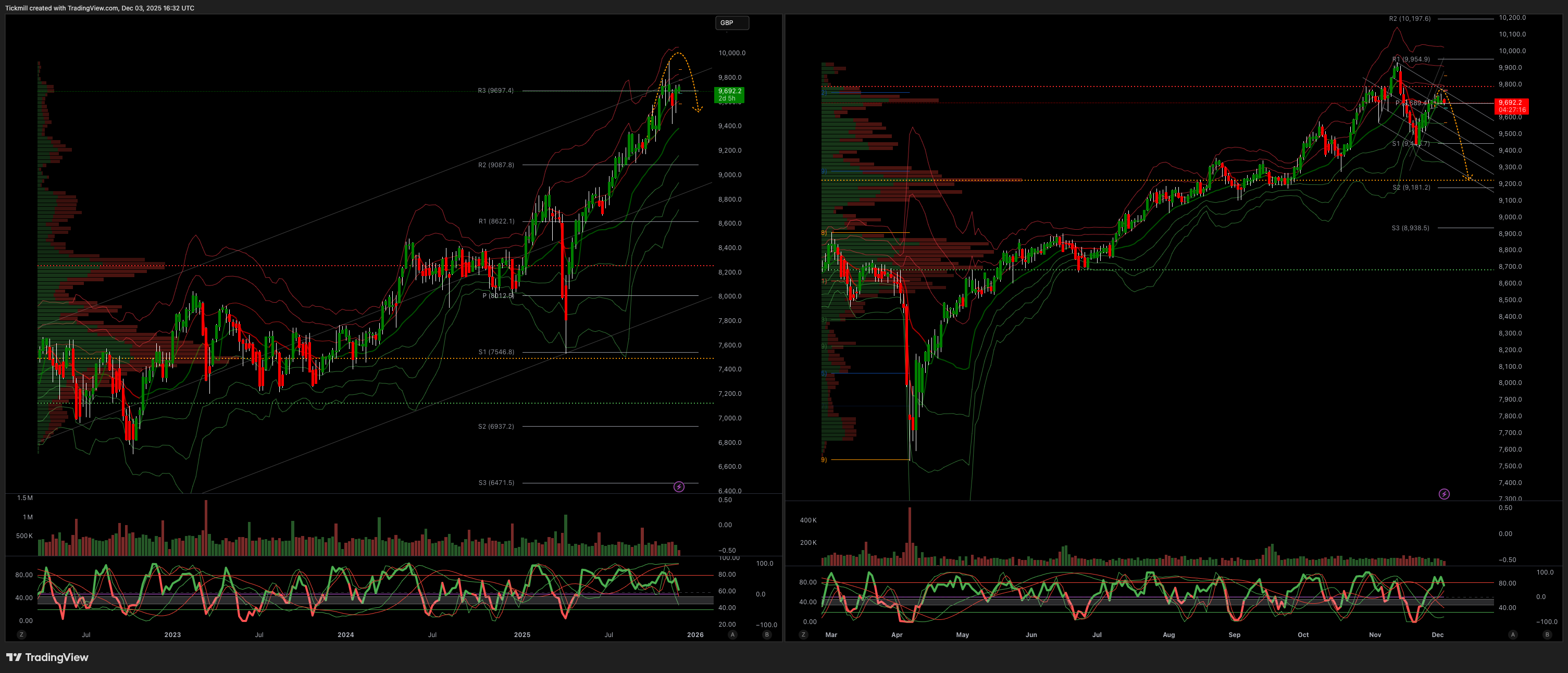

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bullish

Weekly VWAP Bullish

Above 9701 Target 9760

Below 9677 Target 9566

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!