FTSE 100 FINISH LINE 6/1/26

FTSE 100 FINISH LINE 6/1/26

The UK's FTSE 100 soared to an all-time high on Tuesday, comfortably staying above the 10,000-point threshold. This milestone was fuelled by gains in oil and defence stocks, which continued their upward trajectory following U.S. military actions in Venezuela over the weekend.

The FTSE 100 has climbed 0.5% to reach 10,150, marking another significant achievement after breaking the five-digit barrier for the first time last week. The record-breaking performance of the FTSE 100 is a continuation of its strong momentum from 2025, when it outshone both Europe’s STOXX 600 and the U.S. S&P 500. The rally was driven by robust gains in commodity-linked sectors and growing expectations of further monetary policy easing from the Bank of England.

The Bank of England’s November credit report surpassed expectations, with household borrowing for home purchases rising and net monthly lending hitting £4.5bn (up from £4.2bn in October). Unsecured credit growth reached £2.1bn, the highest in two years, driven by credit card borrowing at £1.0bn. Despite weak retail sales, negative GDP, and low confidence, borrowing demand remains strong. Household deposits rose by £13.0bn, the highest in over a year, reflecting caution. Rising credit demand is not linked to lower rates, as mortgage and loan rates increased slightly, raising concerns about holiday financial stress. The BRC reported a 0.7% y/y rise in shop prices for December, with food prices up 3.3% y/y while non-food items fell by -0.6% y/y. CPI food inflation may rise in December but remain below earlier projections, potentially leaving headline CPI (3.2% y/y) slightly under BoE forecasts ahead of February’s MPC meeting.

Energy giants Shell and BP saw their shares rise by 1.3% and 0.8%, respectively, as oil prices ticked up amid uncertainty surrounding Venezuela’s crude output following the capture of President Nicolas Maduro by U.S. forces. Meanwhile, the Aerospace and Defence sector surged 1.9%, boosted by heightened geopolitical tensions. Rolls-Royce jumped 2.1%, while Babcock International and BAE Systems gained 2.4% and 1.8%, respectively. On a more optimistic note, a recent Deloitte survey revealed that British business leaders are feeling slightly more confident after Finance Minister Rachel Reeves unveiled her budget. While overall sentiment remains cautious, CFOs are showing a greater willingness to ramp up investments.

Among individual stocks, fashion retailer Next saw its shares climb 2.5% after reporting a stronger-than-expected rise in full-price sales for the nine weeks leading up to December 27. The company also raised its annual profit forecast for the fifth time this year. Meanwhile, Ocado enjoyed a remarkable 6.3% boost after data from Worldpanel highlighted its impressive sales growth during the Christmas quarter. This dynamic mix of corporate gains and market optimism has set a promising tone for the UK’s financial landscape heading into the new year.

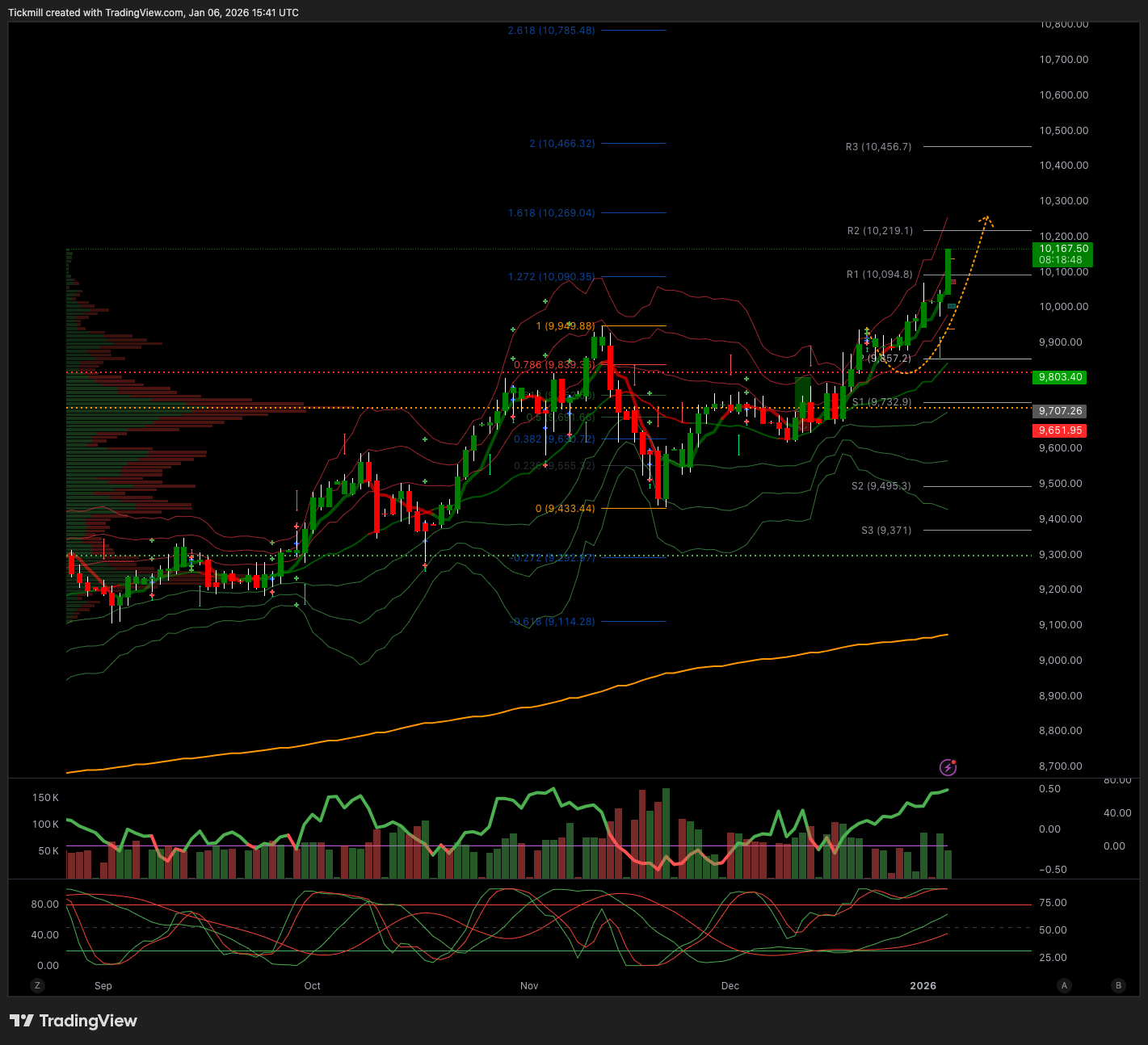

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bullish

Weekly VWAP Bullish

Above 10050 Target 10250

Below 9950 Target 9800

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!