FTSE Plunge Deepens After UK CPI

FTSE Falls Mid-Week

UK stock prices continue to push lower as move through the middle of the week. The latest UK economic data released this morning showed that inflation cooled slightly last month, though came in above forecasts and remains well above the BOE’s 2% target. Headline annualised CPI printed 3.6% in October, down from 3.8% prior but above the 3.5% the market was looking for. Core CPI, meanwhile, fell to 3.4% from 3.5% prior, in line with expectations.

Food Inflation Bounces Back

The fact that stocks remain weaker despite softening inflation is reflective of the broader risk-off tone to markets currently but also suggests some caution around the fact that CPI remains at elevated levels. Looking at the breakdown of the data, food prices were a big upside contributor, bouncing back to 4.9% after having fallen to 4.5% over the prior month. Given that the BOE has voiced concern around food prices, the rebound this month is certainly a worrying sign.

BOE Expectations

On the back of the last BOE meeting, traders are widely expecting the BOE to cut rates by a further .25% next month. Today’s data seems unlikely to derail those expectations though given the lack of conviction among policymakers (5-4 hold last time); any further upside data surprises might see the bank keeping rates on hold again. Ahead of that meeting, next week’s November budget will be another key factor to consider in whether we see an end of year cut.

Technical Views

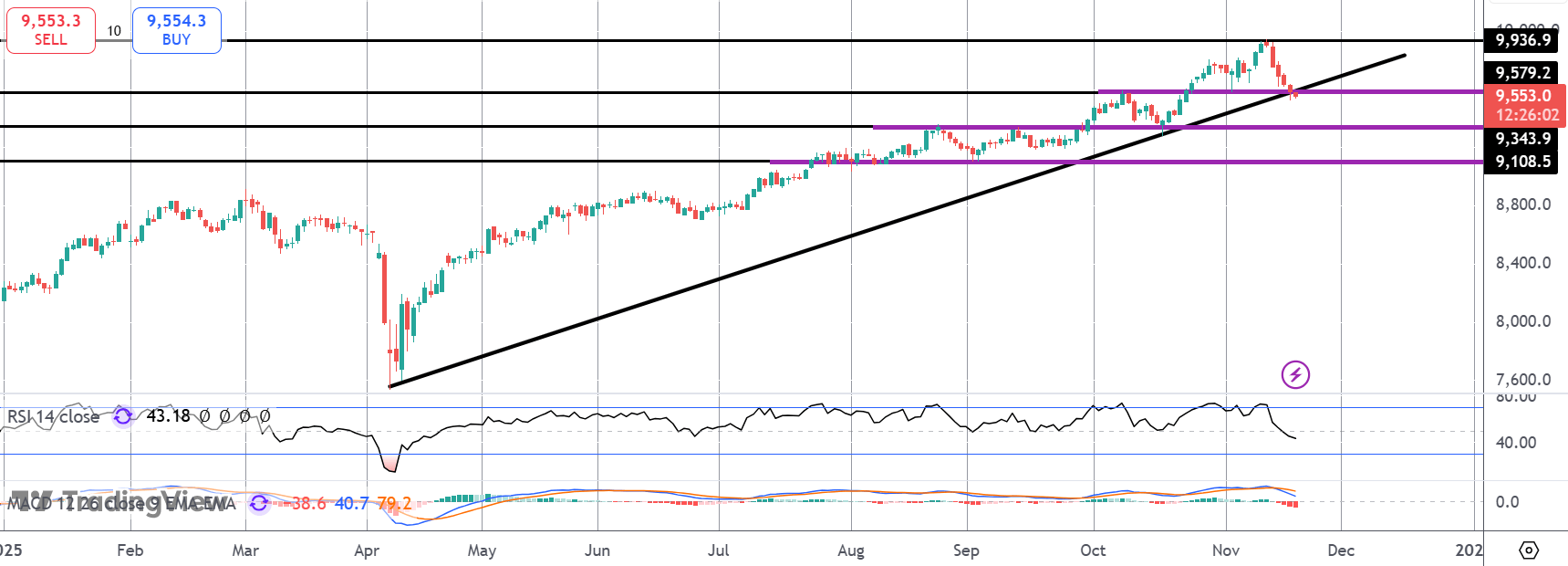

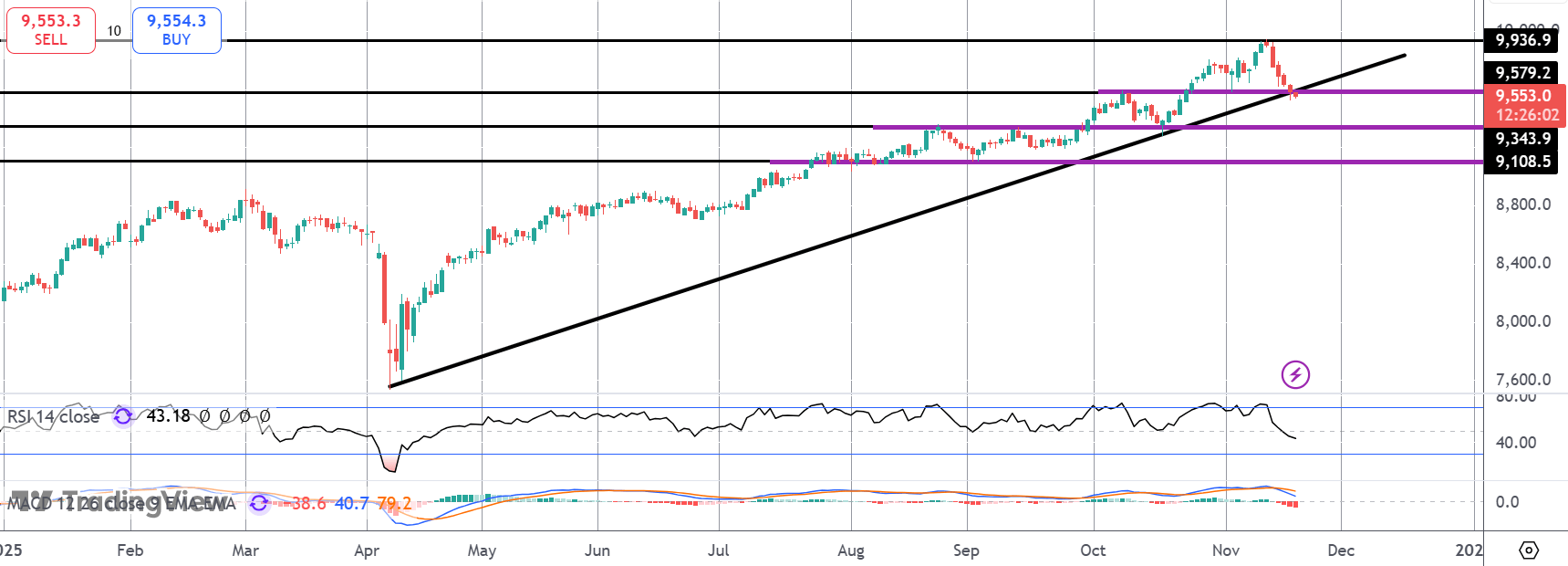

FTSE

The sell off in the FTSE has seen the market trading back down to test the rising trend line from YTD lows and the 9,579.2 level. This is a key pivot for the market and a break below here will turn focus to the 9,343.9-level next, in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.