FX Options & Positioning

FX Options & Positioning

FX option expiries and related delta hedging flows can influence FX price action, so it's worth knowing where the interest resides, and there are plenty this week according to Reuters options reporting.

DTCC-reported FX option data is telling when it comes to the outlook for USDCNH. The data shows traded USDCNH FX option volumes are at levels last seen in February 2020 – $38 billion last week. But more telling is the huge increase in USD put/CNH call volumes – options that give holder the right to sell USDCNH at lower levels. They reached highs since November 2019 last week, with over $23 billion traded. DTCC data also show the actual strikes that are trading in the FX options market, with 6.50 through 6.35 proving popular. These strikes are where holders can sell USDCNH, which if it keeps falling, can reap rewards. The most popular strike is 6.5000, with expiries through December and January, with 6.35 and even 6.30 strike expiries mostly set for early 2021. FX option market flows show that traders are concerned about continued USDCNH losses and are prepared to commit premium to protect against/benefit from deeper declines.

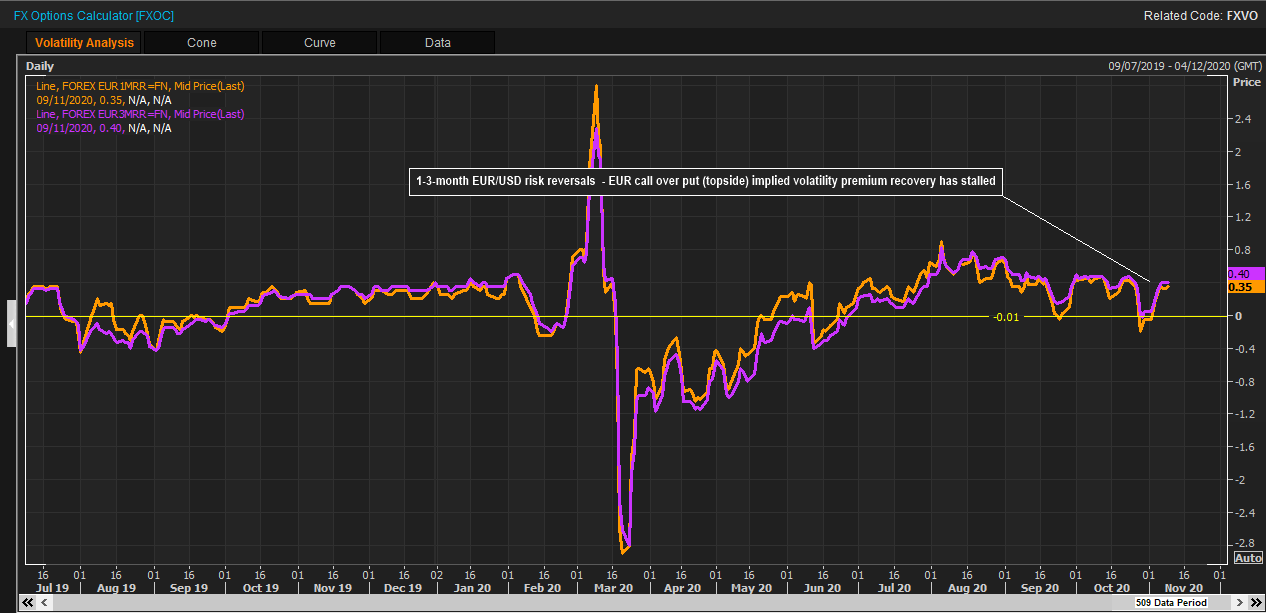

EURUSD FX options turned bullish last week, raising prices for upside protection as demand for EUR call strikes increased, but that pricing has peaked for now, suggesting the options may see limited potential for the current rally to extend much further.Implied volatility, which gauges future actual volatility and determines option premium, fell from 8.5 to 6.5 after initial U.S. election volatility on Nov. 3-4, before regaining a 7.3 peak in Asia Monday – it's been sold at 6.9 in early London. Risk reversals saw EUR calls (topside strikes) regain a 0.35 premium over EUR puts (downside strikes), but that has also now peaked. A EUR call risk-reversals premium would typically lift implied volatility as the EURUSD spot rate gained, so the fact traders are choosing to sell implied volatility fits with the narrative that EURUSD spot gains may be peaking for now.There's a massive 3.1 billion euros at 1.1900 expiry today, the hedging of which can contain and cap price action near term

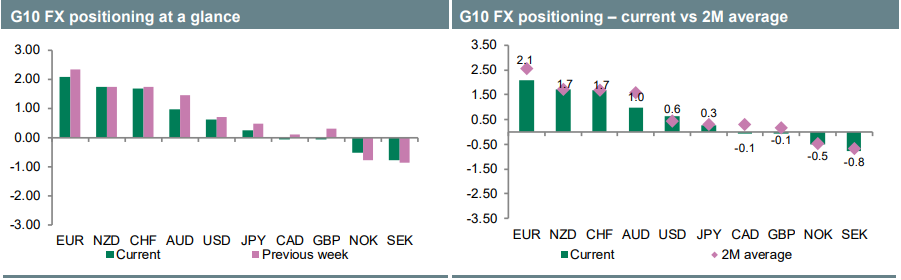

According to Credit Agricol’s FX positioning gauge, the EUR was sold last week with selling largely reflected in IMM data. While this suggests most selling occurred ahead of the US election, the latest development was sufficient to help the EUR enter less overbought territory. Although this stands in contrast to price action later last week, positioning as it stands does not stand against further upside going forward. While this makes sense on the back of reduced political uncertainty as related to the US, our positioning model suggests EUR/USD should be bought. Elsewhere, the AUD was sold. Similar to the EUR, most selling interest may have occurred ahead of the US election with in-house data suggesting it was short-term oriented clients such as hedge funds selling the currency. Although the AUD rebounded in tandem with better risk sentiment in the aftermath of the US election, positioning as it stands suggests the currency is trading nowhere close to oversold territory. On the contrary, based on our positioning model, AUD/USD should be bought, at least in the short term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!