FX Options & Positioning

FX Options & Positioning

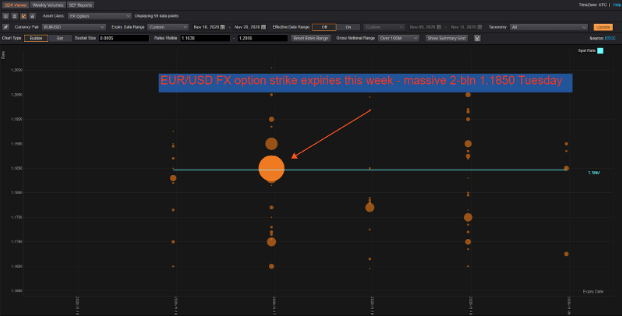

FX option expiries and related delta hedging flows can influence FX price action, so it's worth knowing where the bigger strikes reside, and there are plenty this week according to Reuters options reporting. FX option traders typically trade volatility, holding opposing views in the cash market to offset option strike risk. That offset that can draw cash toward the strike as the option expiry approaches, so it's worth knowing where the bigger strikes reside

The standout strike Tuesday is EUR/USD 1.1850 at a massive 2.1 billion euros, an example of how bigger option expiries can help draw the spot rate, but beware 1.1 billion euros of 1.19s if EUR/USD edges higher. Large EUR/GBP and AUD/JPY are nearby on Tuesday, too ....

EUR/USD sees 1.3 billion euros between 1.1870-1.1900 Thursday and 726 million euros at 1.1900 Friday.

In cable, 570 million pounds are at 1.3400 Thursday and 531milllion pounds at 1.3100 Friday. EUR/GBP sees 1 billion between 0.8900-25 Thursday.

Thursday is a big day for USD/JPY, with $1 billion 104.25-35, $1.5 billion 104.50-60, $475 million at 104.75, and $1 billion at 105.00. Friday sees $1.1 billion between 103.75-104.00, $600-million at 104.90-105.00 and $1.3 billion at 105.45-50.

AUD/USD's big strikes aren't huge – A$400 million at 0.7320 Wednesday and A500 million between 07235-0.7250 Thursday.

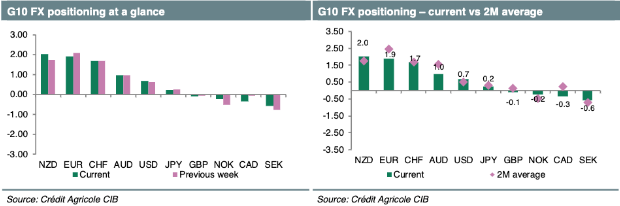

According to Credit Agricol’s FX positioning gauge, the EUR was sold last week with increased selling interest registered for all covered client groups. While this is not in line with price action, it suggests the currency was sold on rallies. With net-long positioning being well below its medium-term average, the single currency is nolonger trading close to strongly overbought territory. On the contrary, from a short-term angle, it cannot be ruled out that positioning has shifted to the short side with most longs still in place being structural in nature. From that angle, current levels still seem to be in attractive buying territory with our FX positioning-based trading model indeed suggesting that EURUSD longs should be kept. Turning to the USD, last week saw rising buying interest by corporates and real money investors. While overall positioning has stayed broadly balanced, the latest buildup in longs still implies there is some downside risk should sentiment improve further, at least as long as market rates fail to advance from here. Elsewhere, AUD positioning has been mixed with in-house data pointing towards buying while IMM data is pointing in the opposite direction. All in all, however, and just as seen with the EUR, net-long positioning has stayed well below its medium-term average. This combined with better risk sentiment is likely to keep the currency subject to upside risks. Hence, based on positioning, we recommend staying long the currency.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!