GBP Soars As UK Unemployment Falls Again

Solid Labour Market Data

The British Pound has seen better demand this morning following the latest set of labour market data release today. The unemployment rate in the UK was seen falling back to 4.3% in the 3 months to September, marking a decline from the prior 4.5% reading and an improvement on the 4.4% market forecast. Additionally, average earnings also beat expectations, coming in at 5.8% versus the market forecast of 5.5%. Finally, the claimant count (amount of people claiming unemployment benefits) fell back to -14.9k from the prior reading of -51.k, marking an improvement on the expected -39.2k reading.

Economic Recovery Progressing

In all, this was a solid set of data for the UK and reflects the ongoing recovery in the economy. The unemployment rate in particular, is now sitting at its lowest level since Q4 2017. With inflation rising and the labour market continuing to tighten, the case for BOE rate hikes might seem clear. However, the market was recently left confounded when the BOE refrained from lifting rates in November, following a period of seemingly clear guidance that it was likely to do so.

In explaining the decision, however, BOE governor Andrew Bailey noted that the end of the government’s furlough support scheme in October meant that job losses were likely to increase, despite the broader economic recovery. Indeed, with inflation rising and many UK citizens losing government support, the BOE judged that this was not the right time to lift borrowing costs for UK households.

Q4 In Focus

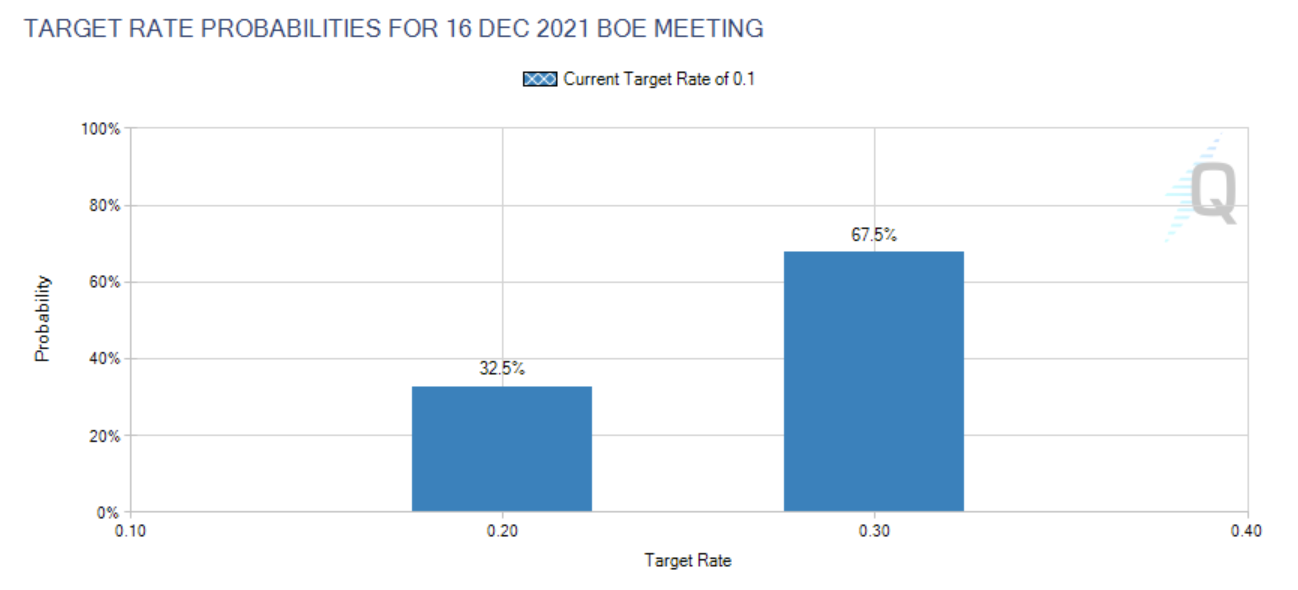

The key thing now is to see how the economy performs over Q4 following the loss of the government’s furlough scheme. Given the pent up demand for labour there is a good chance that job losses will not be as high as previously expected. If this is the case, and inflation continues to rise, then we are likely to see a BOE rate hike by February at the latest. Market pricing for a December rate hike has now increased on the back of today’s data with the CME BOE Watch showing an almost 70% chance of a hike in December. With this in mind, GBP is likely to remain well bid in the near term provided there is no material increase in COVID numbers, raising the risks of renewed lockdowns. On this note, we heard from the UK PM this week that a Christmas lockdown cannot be ruled out in a worst case scenario; so there are still risks to consider on the horizon.

Technical Views

GBPUSD

For now, price is holding towards the lower end of the bearish channel which has framed the decline over recent months. With both MACD and RSI bearish, the focus is on a continuation lower unless bulls can breach the current 1.3461 resistance. Above there, focus turns to 1.3570 and the channel top above (1.3676).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.