Gold Prices are Expected to Jump Soon!

Good day!

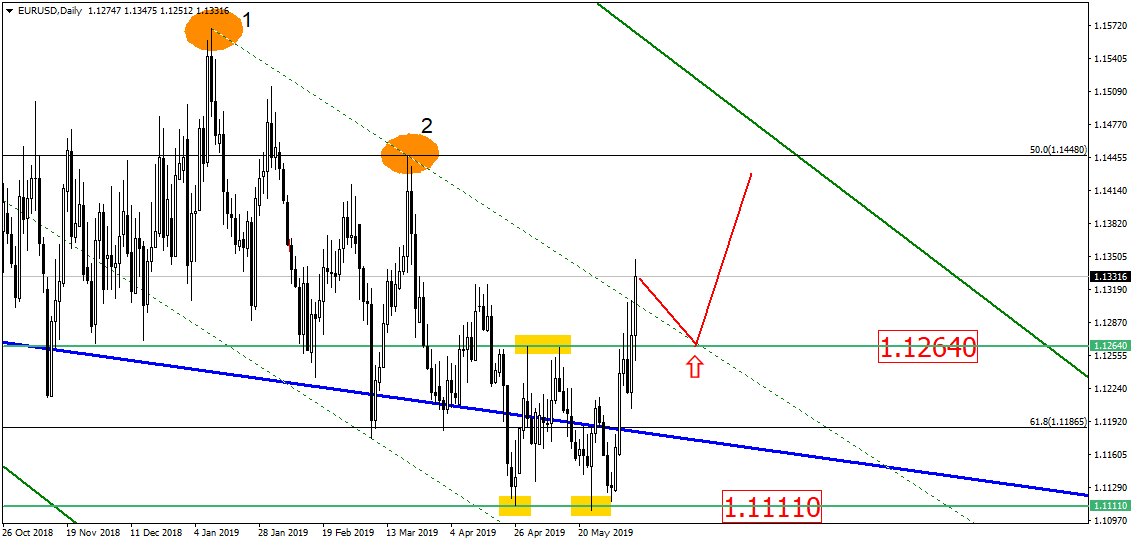

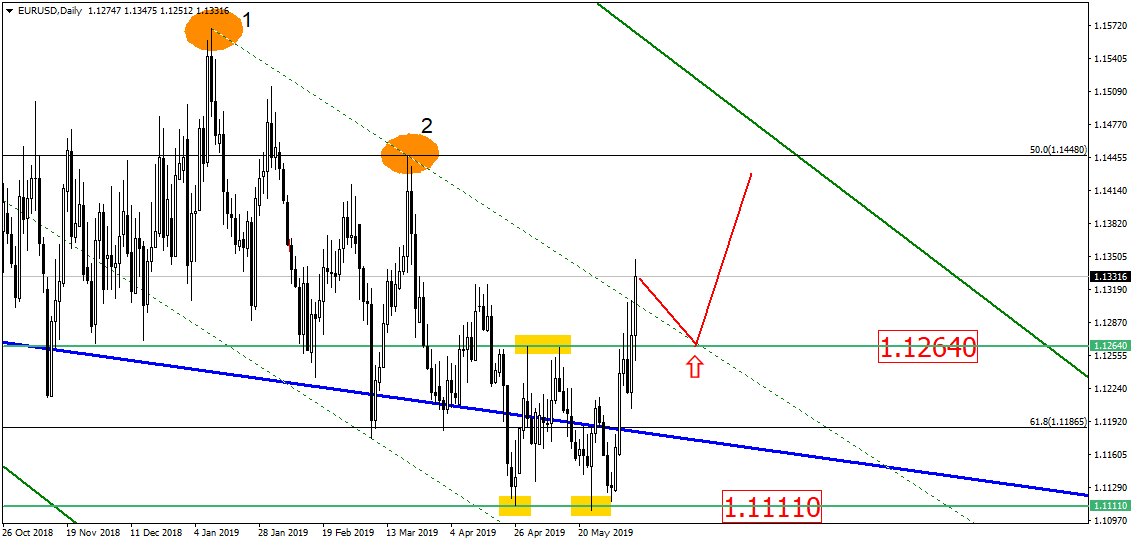

Single currency jumped against Friday’s nonfarm payroll report even though it did not turn out that great. Single currency broke the level of 1.1264. Getting back to the broken level, the asset’s price is likely to get required support:

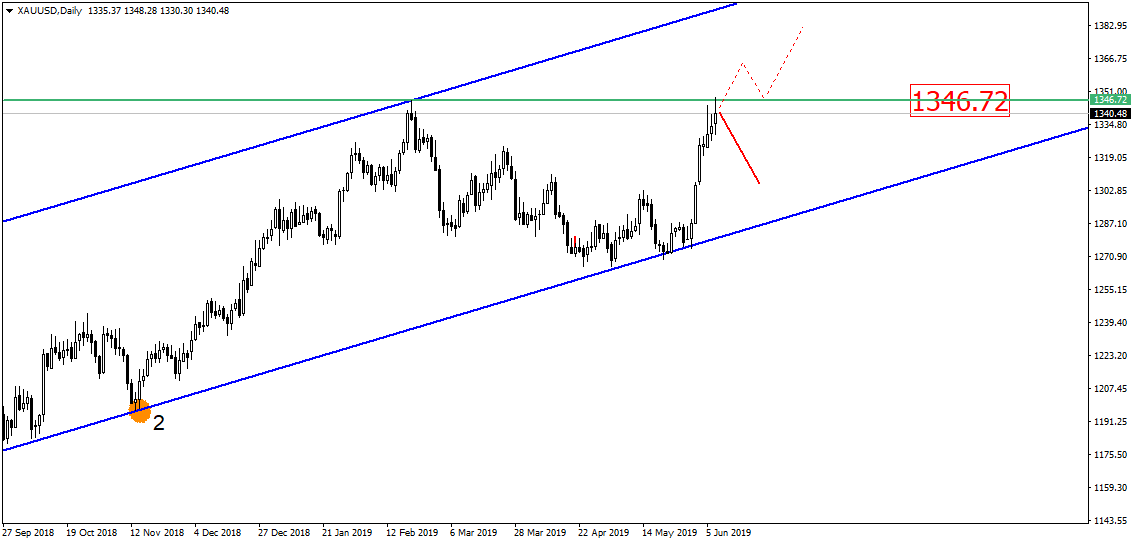

Gold touched the level of 1346.72 but did not break the resistance. In principle, this asset may either pull back or break the level. Since US dollar dropped everywhere in the market by the end of this week, we assume that it will go down next week as well. This could mean that gold might jump like it did last Friday against the nonfarm payrolls. All in all, this is the key level that should be carefully looked after:

What comes to the American stock index S&P500, the head and shoulders pattern did not form, and asset’s price did not jump as expected. Historical maximum of this index, which was established on May 1, is located above and it represents an important resistance. Index rates tend to break own maximums quite often therefore we should rely on the candlestick patterns that usually precisely signify what is about to happen next:

Let us remind you that this material is provided for informative purposes only and cannot be considered as a direct go ahead to implement transactions in the financial markets. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.