Goldman Sachs and Deutsche bank warn investors about a pipe-dream

Goldman Sachs has recently been a token of vocal opposition to market consensus regarding the path of the Fed interest rate. In the context of capital flows into defensive assets in the last week of May (the yield of 10-year US gov. bond fell from 2.4 to 2.1%, gold jumped from $ 1,280 to $ 1,340), Goldman, with its rate hike forecasts, looked like an absolute outsider. More recently, German colleagues from Deutsche Bank joined the Goldman camp, warning customers that the three rate cuts priced in the asset valuations may turn out to be a false dream. Now that the tectonic shift in expectations has come to an end (as can be seen from the stabilization of 10yr yield near 2.1%), it may be useful to take into account alternative points of view on the Fed's short-term plans, as well as analyze the arguments that support them.

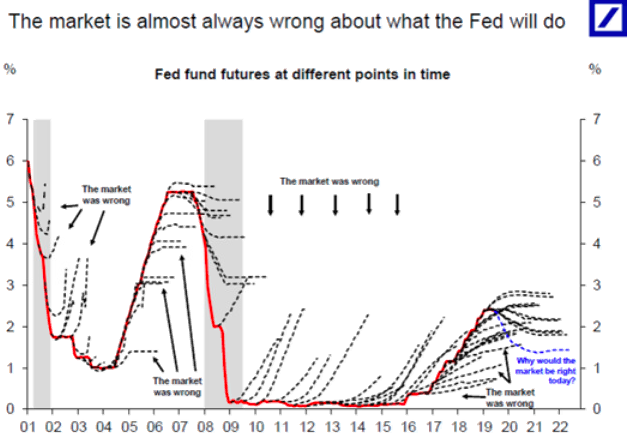

To explain their point, Deutsche Bank analysts shifted away from speculative attempts to justify why a narrowing number of signals of US expansion should outweigh the threat of recession due to a trade war and a bunch of other weak data, suggesting a much simpler idea – to check the accuracy of market assumptions. Using data from 2001, they compared market expectations for changes in interest rates with actual rate cuts or hikes and came to surprising conclusion: the market is almost always wrong.

In the picture above, the red line shows the interest rate path of the Fed from 2001 to the present. The dashed lines show market expectations of the interest rate derived from futures trading on interest-bearing assets like US Treasury bills. It can be seen that in the overwhelming number of cases, the red and dashed lines do not match, which tells us that current changes in the rate have diverged from expectations. From this, German bank experts concluded that the market is often wrong, so relying on the current expectations of three rate cuts should be done with caution.

In my opinion, the mini-study of Deutsche Bank is not without flaws. First, judging by the blue line (expected rate trajectory till 2022), each dashed line probably represents point estimates of the rate trajectory extracted from the futures market, that is, estimates for a specific date. Like what 1M, 3M, 1Yr, 2Yr interest rates are expected by the futures market on 12 December 2009? Plotting these rates against time we get one dashed line.

It is reasonable to assume that the error of market expectations of interest rate will grow faster than time (quadratically, for example, from 2009 to 2016), this is evident from the fact that at the beginning the dashed line and the red line coincide for a short time and then begin to diverge with acceleration. In addition, point data selection is subject to the problem of chaotic tides and ebbs of investors in safe heaven assets, and at such times trading does not reflect interest rate expectations. Since we don’t know what dashed lines precisely mean we can switch our critics on the wording “almost always wrong”. Given the number of observations (about 50 dashed lines), the statement “almost always” is rather subjective and there is no reason to believe that the current expectations of the three rate cuts will not be included in the group of “correct predictions”.

In any case, the market has successfully convinced itself that the Fed will soon begin to cut rates, the S&P 500 is heading towards the 3000 level again, and the VIX is returning to the long-term average. But in fact, the Fed maintains a neutral position and will probably prefer to retain the optionality at a meeting in June, before the meeting of the leaders of China and the United States to discuss the trade deal. Accordingly, there is a dangerous imbalance of expectations towards Fed easing, which is basically not backed by fundamentals (like strong Fed hints) and stock market growth may face serious challenges at the end of June.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.