Heavy USDJPY Reversal Underway

USDJPY Heading Lower

USDJPY is under heavy selling pressure as we head towards the US session on Monday. Traders continued to offer the pair through early European trading, extending the declines seen form the Asian open overnight. The pair has now shed almost 3% from the YTD high as a shift in expectations regarding the BOJ continues to drive sentiment.

BOJ Tightening Expectations

Traders are becoming increasingly expectant of a shift in BOJ monetary policy. Recent inflation data shows that CPI continues to hold above the bank’s 2% target, arguing the need for a rate cut. The BOJ itself has warned that it is getting closer to needing to exit its ultra-loose monetary policy, in line with inflationary trends. Overnight, the latest Japanese GDP data came in above forecasts, putting further pressure on the bank.

Fed/BOJ Divergence

While the market is expecting the BOJ to begin policy normalisation as early as March, this outlook is reversed for the Fed. In line with falling US inflation data and weakening economic data, the market is expecting the Fed to begin cutting rates soon. Speaking last week, Powell said the Fed is waiting for juts a bit more evidence before it begins cutting rates. While no shift is expected this month, a weak CPI reading tomorrow should confirm expectations of a June rate cut, to be highlighted this month, keeping USDJPY pressured lower near-term.

Technical Views

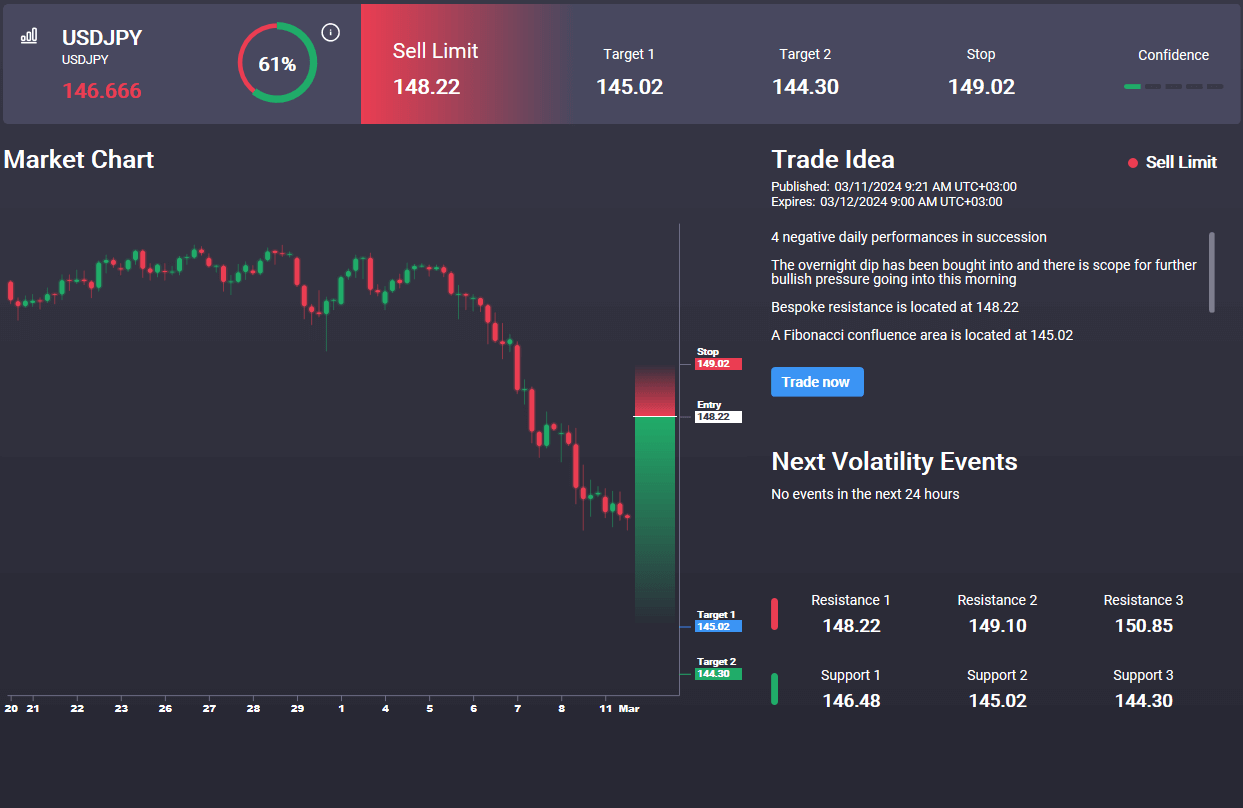

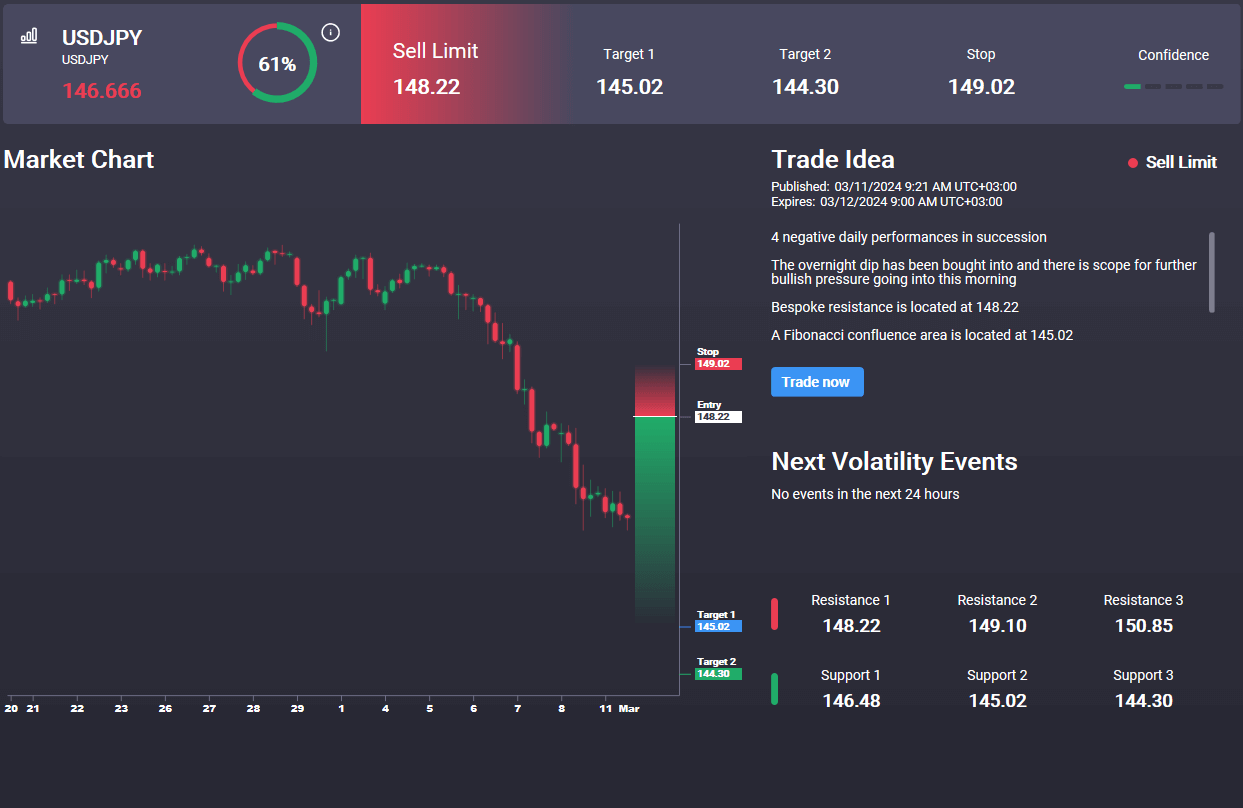

USDJPY

The failure at the 151.81 level has seen the market turning heavily lower. Price has now broken below the 148.98 level and with momentum studies bearish, the focus is on a continuation lower near-term and a test of the 145 level next. Indeed, we have a sell signal in the Signal Centre today set above market at 148.22 suggesting a preference to fade any correction higher and stay short.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.