Here is the Key Reason why US Equity Downside may Have Legs

The Monday rebound of US equity markets increasingly resembles yet another "dead cat bounce" - already on Tuesday, futures on US indices (an indicator of sentiment on the US equity market after the close) and European stock indices have suffered significant losses, indicating that the S&P 500 will likely retest 3900 level at the New York session today. I have already written several times before and once again I want to draw the attention of readers that inverse correlation of SPX returns with dollar returns is no longer in place - both assets are moving in the same direction (previously it was the other way around, dollar cash was considered a safe haven asset), which clearly indicates denting hopes that the US market is better than others to protect against the much-rumored looming stagflation. In other words, there is a reassessment of growth prospects of the US economy relative to foreign economies and what we see may be a rotation of non-US investors back into local assets.

The key driver of the bearish equity markets trend now is the Fed's "unbending" in terms of the fact that it is not going to rescue falling equities by softening policy rhetoric (for now) in combination with deteriorating news background, namely, shocking surprises in the reporting and guidance of large US companies. The first was Cisco, a $200 billion company that, contrary to expectations of fourth-quarter revenue growth, warned about a potential cut, which wiped out 20% of the company's capitalization and generated waves of anxiety in the rest of the market. After the close of trading yesterday, a negative surprise came from Snapchat, which said that since the last earnings announcement on April 21, the macro environment has deteriorated and done it faster than anticipated, which could put Q2 revenue below the lower end of the previously announced range. The share price fell 26% after the ultra-dovish statement:

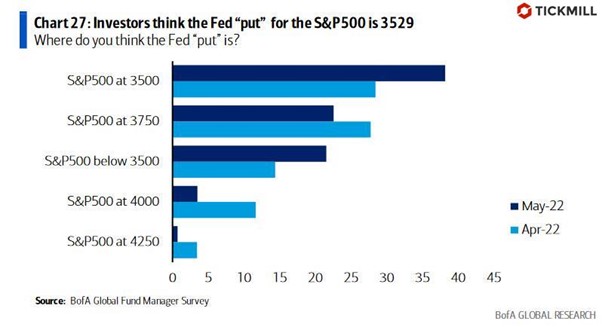

Based on this, it is plausible to assume that until the Fedsoftens its policy stance or when counterarguments appear in the form ofpositive corporate earnings forecasts of other large US firms, the chances fora sustained rally of the US equity market are set to fade. For instance, thehead of equity research at Morgan Stanley, Mike Wilson, believes that SPX willdecline and find ground somewhere near the level of 3400, which will reflectthe risks of new negative surprises in the reporting of US companies. A surveyof asset managers conducted by MS showed that most see the SPX level at whichthe Fed will intervene (the so-called “Fed Put”) is at 3500 points:

The reason why the Fed is in no hurry to save the fallingmarket is the stock markets’ welfare effect. It's no secret that Americanhouseholds are heavily invested in the stock market, so stock marketperformance largely reflects changes in the dollar value of their wealth. Inturn, the higher the wealth, the higher the propensity to consume and viceversa. One of the Fed's goals in curbing inflation is demand destruction, andfalling equities do a great job of that. The only question is what should bethe level of SPX at which the Fed considers that the welfare effect hassufficiently affected consumption.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.