Improving PMIs in Eurozone Drive Inflows into European Assets

The recent surge in demand for USD fueled by rise in Treasury yields seems to be abating as the outflow from the Treasury market slows. The 10-year T-Note yield has leveled off trading around 1.30%, but nevertheless remains at its highest level since February 2020.

The growth of oil quotes due to temporary outages of production and refining operations in the US due to storms and low temperatures seems to be retreating, WTI slipped below $60 a barrel, falling at the time of writing by 1.35%, Brent quotes held a little better, but also in the red.

Thursday pullback in the US equities could hardly scare anyone due to the fact that the minutes of the Fed meeting clearly indicated that the Central Bank, while acknowledging increasing inflation pressures and signs of growth in US real rates, refused to crack down on this trend. Such a stance of the Fed has a pronounced boosting effect on risk assets.

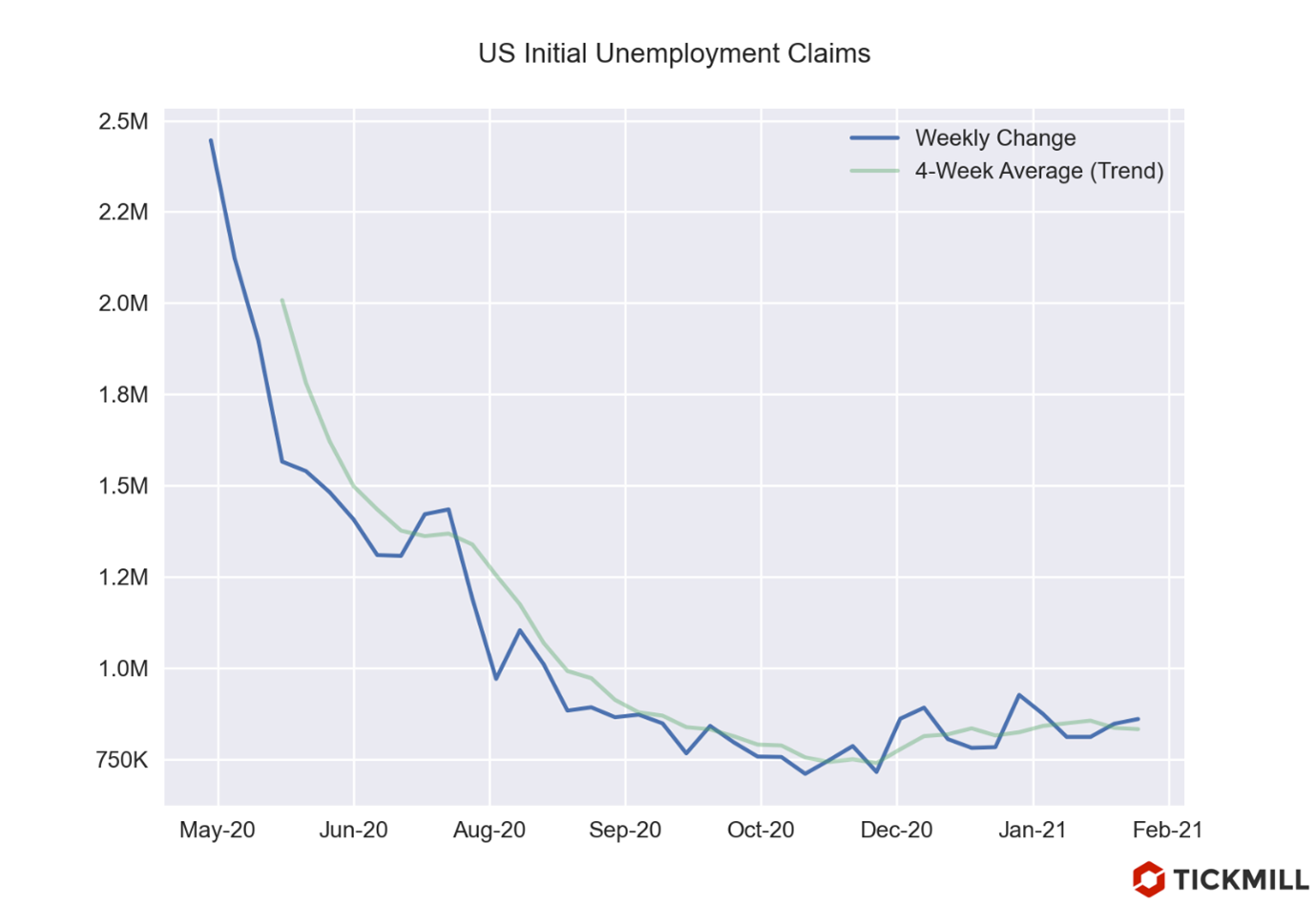

Regarding the date from yesterday it is worth noting the release of the ECB Minutes and data on US unemployment benefits. Judging by the data, the situation on the US labor market continued to deteriorate in February: initial claims rose by 861K against the forecast of 765K, continuing claims reading came higher than expected. Since the end of November, there has been a growing slack in the US labor market ...

… which, of course, justifies the coming fiscal stimulus in the US.

European equities broke their longest streak of declines since November, gaining 0.5% on average thanks to today's data.

Positive data on the European economy supported bullish momentum in EURUSD. Manufacturing PMI in Germany, France and the Eurozone surprised to the upside in February indicating continuing rebound of activity in the sector:

- In Germany - the forecast was 56.5, actual reading at 60.6 points;

- In France - forecast 51.4, actual reading at 55 points;

- In Eurozone - the forecast was 54.3, actual reading at 57.7 points.

Data on the services sector showed that the Old World is gradually getting out of lockdowns, which should lead to an inflow of capital in European assets. The minutes of the ECB meeting in January showed that officials are not very concerned about behavior of the euro exchange rate - possibly due to the fact that EURUSD remains in correction.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.