Inflation Risks May Force the Fed to be More Aggressive in Policy Tightening

The Dollar trades near the opening on Wednesday ahead of the Fed meeting. The US central bank is widely expected to announce the start of pandemic-era QE tapering. However, the pace of tapering is unclear and the information related to this may strongly affect market prices. Also important are the changes in the Fed’s “transitory inflation” view, which will directly affect how quickly the regulator moves to raise rates.

The minutes of the September Fed meeting showed that FOMC members are going to approve the winding down of QE in November. The Fed is now buying bonds and MBS for $120 billion a month to keep the cost of borrowing at the level necessary for continued expansion. As an example, the Fed Minutes cited a sequential cut of $15 billion in asset purchases per month since November or December. If the Fed chooses such a pace, the US Central Bank's QE will end next summer.

Market participants will be watching closely how the Fed changes the wording that describes inflation. In a previous statement, inflation was described as "largely reflecting temporary factors." If the Fed gives a signal that it is worried about inflation “rooting”, then it is highly likely that the dollar will react positively to this news, and risk assets will go into correction.

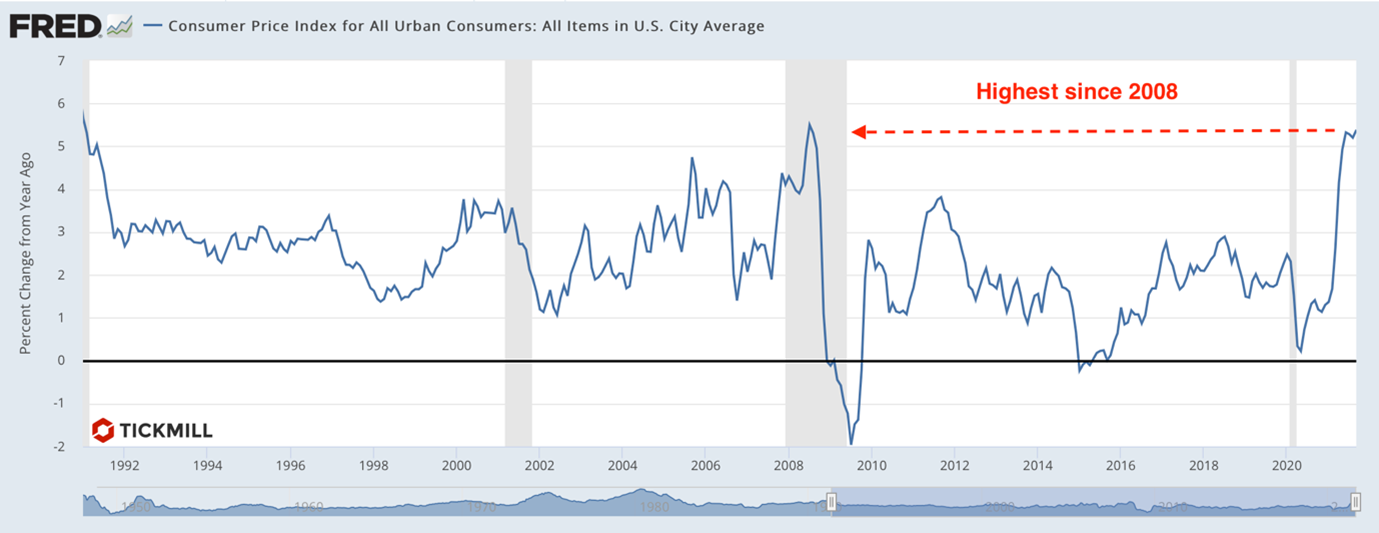

Inflation in the US is now at its highest level in 13 years:

Most Fed officials believe that in 2022, supply chains will recover, accumulated demand, stimulated by fiscal injections and lockdowns, will begin to fade, and an increase in labor supply will limit the pace of wage growth. All three factors together will cause a natural slowdown in inflation.

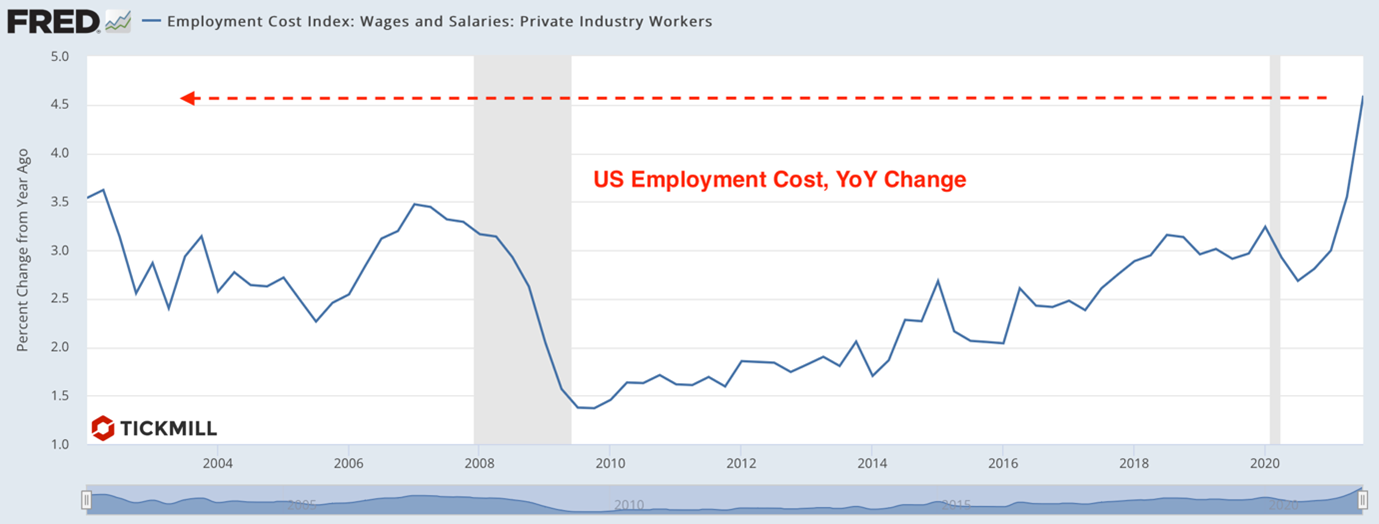

However, in recent weeks, Fed members have begun to acknowledge that the risks to such a forecast are rising. Inflation, as the data shows, is more stable, supply shocks are not receding, and wages are growing at the highest rate in 15 years, which could provoke a new wave of inflationary consequences.

Now wages are growing in the United States at the highest rate since the early 2000s, which may cause concern for the Fed officials:

If the Fed is mistaken about persistence of inflation and decides not to rush to tighten policy, then in the future the Central Bank may be forced to move too quickly to raise rates to contain too fast rise in price, which could be a shock to markets and the economy. On the other hand, if the Fed starts tightening policy too early, there is a risk that it will hurt expansion. Let’s see what the Fed decides today.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.