Institutional Insights: BNPP Trading The FOMC

Key Messages

- Ahead of this week’s FOMC meeting, we recommend taking profits on USD shorts, as we anticipate potential for a near-term counter-trend rally. US equities appear vulnerable to a pullback, and we favor downside strategies that capitalize on elevated skew.

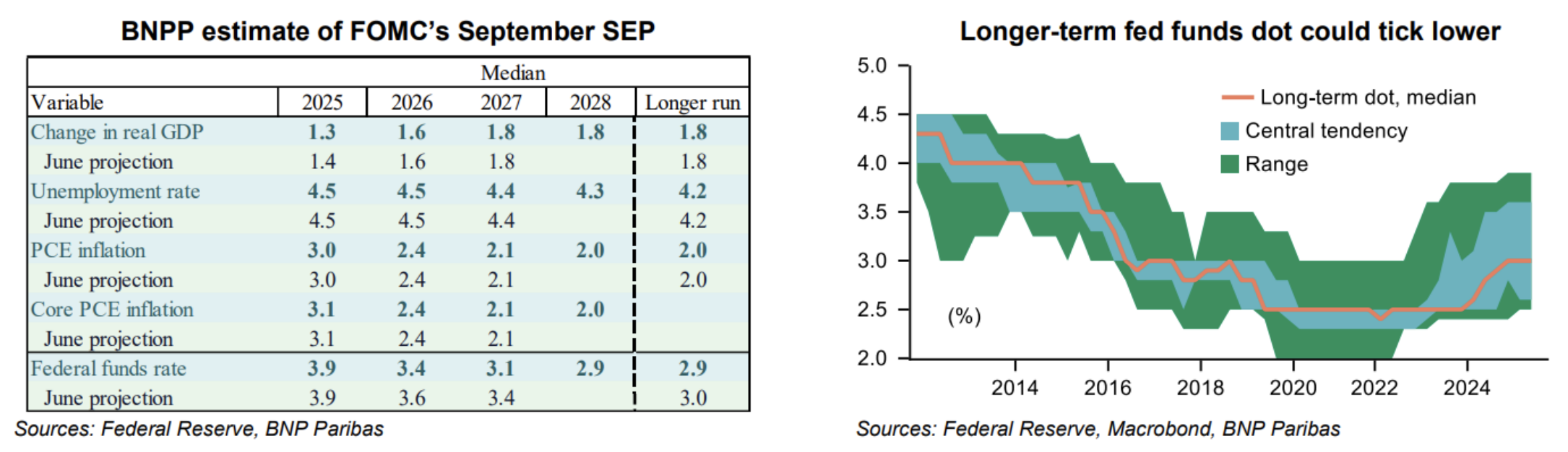

- We expect the Federal Reserve to implement a 25bp rate cut, with median projections signaling only one additional 25bp cut in 2025. However, we believe steepening pressures may persist, as markets are likely to react more acutely to hints of front-loaded rate cuts.

- The September ECB meeting has reinforced our view that the threshold for further rate cuts remains high. This aligns with our expectation of a hike in late 2026. We continue to favor long-end EUR swap steepeners and have adjusted our target for 10s40s accordingly.

Market Focus

The spotlight this week will be on Wednesday’s FOMC meeting. We anticipate the Fed will deliver a 25bp rate cut, marking the end of its nine-month policy hold and initiating an easing cycle comprising five 25bp cuts spread across September, October, and December 2025, as well as March and June 2026 (refer to our September FOMC preview: For the First Time in Forever, dated 11 September).

The FOMC’s projections are expected to outline only two cuts for 2025, reflecting hesitancy among some committee members to forecast neutral or accommodative policy amid persistently high inflation. Nonetheless, we believe Fed Chair Jerome Powell will gain broader support for additional easing measures in the coming months. For this week, we do not anticipate significant reactions in front-end rates, even if the Fed’s projections align with our expectations, given that the market is already pricing in two additional cuts.

The rates market remains highly sensitive to potential signals of 50bp rate cuts as we approach the September FOMC meeting. Currently, the front end of the curve aligns closely with our forecast for 25bp cuts at the next three meetings. However, we anticipate that the market may increasingly factor in the possibility of more front-loaded easing in the coming weeks, given lingering downside risks to the labor market and inflation data indicating that tariff pass-through is progressing at a slower pace than our baseline expectations. As such, we expect the market to closely monitor the September meeting for any dovish signals and quickly incorporate pathways for potential 50bp cuts in upcoming meetings.

In this context, we believe a steepening bias could re-emerge. The recent bull flattening appears to have been a correction of the excessive steepening priced in during late August. This steepening was driven by investor reactions to news surrounding President Donald Trump’s attempts to remove Lisa Cook from the Fed board, which emboldened market participants to adopt curve steepeners. Consequently, the yield curve steepened significantly leading into the August payroll release on September 5.

However, subsequent weakness in economic data shifted the market's focus, enabling rate cuts to be priced based on data rather than perceived political pressures. This dynamic led to a temporary flattening of the curve. We believe this counter-trend flattening has run its course and expect a return to steepening as the market increasingly focuses on the risks of more aggressive and front-loaded rate cuts.

QT Likely to End in December: Previously, we anticipated the Fed would conclude QT at the September FOMC meeting. However, following recent remarks by Dallas Fed President Lorie Logan, we now expect QT to extend slightly longer. The Fed appears prepared to tolerate some instability in funding markets, potentially around key dates such as the 15th September tax deadline and the 30th September quarter-end. Consequently, we believe the FOMC is more likely to finalize QT during the December meeting.

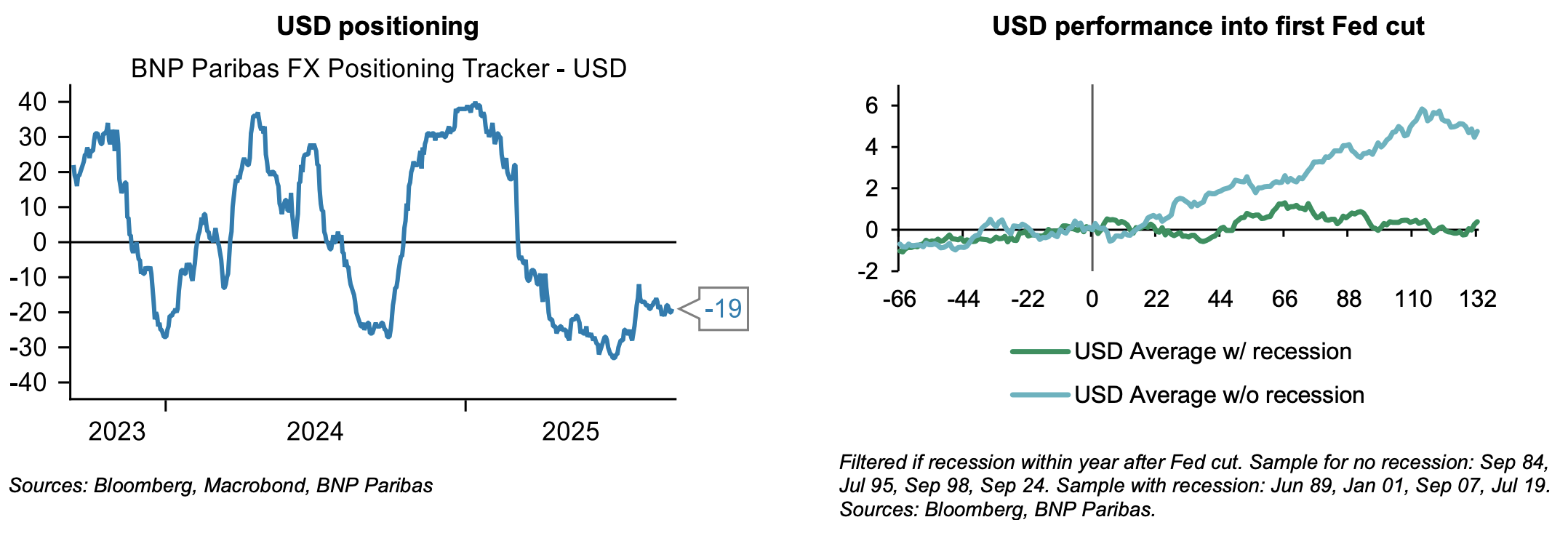

Taking Profit on USD Shorts Ahead of FOMC: Despite ongoing downside risks to US yields, we believe the risk–reward dynamic favors taking profit on USD shorts ahead of the FOMC meeting. Last week, we recommended closing EURUSD long positions. While we maintain a medium-term bullish outlook on EURUSD, targeting a rise to 1.20 this year, recent market behavior has raised concerns. EURUSD remains near the same levels as before weaker-than-expected NFP data, larger-than-expected downward NFP revisions, and mixed PPI/CPI data (refer to "Taking Profit on Long EURUSD," dated 11 September).

The market continues to hold significant USD short positions. Historically, the USD has tended to rally or remain flat following the first Fed rate cut, provided there’s no recession. This pattern reflects inflows into US equities driven by lower yields without recession, which in turn strengthens the USD. While we don’t anticipate this historical trend to persist in the current cycle (as we remain bearish on the USD), market participants aware of this pattern may use it as a rationale to unwind USD shorts ahead of the FOMC meeting.

US equities vulnerable to a late September pullback: US equities are heading into the FOMC meeting at all-time highs. Pockets of exuberance are forming ahead of the expected first Fed rate cut, with the SPX advancing every day last week and ORCL leaping nearly 40% following a positive earnings print. We think this set-up ahead of the first cut leaves US equities vulnerable to a late September pullback into a seasonally weak period and the start of the corporate blackout window, echoing 2019. Fed cuts were very bullish for the market back then – but the event itself saw a ‘better to travel than arrive’ pattern. US equities rallied into the first cut in 2019, followed by a shallow correction after the FOMC, before closing out the year at highs. Q3 earnings this year could be a catalyst to make new highs. In terms of volatility parameters, skew remains the standout. Even after Thursday’s retracement post-CPI, SPX skew is near two-year highs and the most elevated versus history compared to global index counterparts. For short-term protection, this supports put spreads, ratios, and down-and-out puts on Oct25 for a post-Fed pullback. Conversely, for investors looking to chase the upside, it favours owning outright calls into year end. The setup ahead of the likely first Fed rate cut this year could look similar to 2019

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!