Institutional Insights: BofA ECB Preview

.jpeg)

ECB Preview: running out of reasons not to go below 2%

Key takeaways

• ECB to cut policy rates by 25bp, fully priced, with guidance broadly unchanged.

• Some acknowledgment door open to move below 2% neutral, but no explicit signal.

• We maintain a bullish bias on Euro duration. The meeting should be a non-event for the EUR.

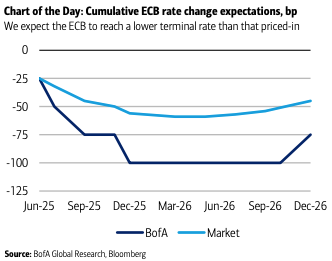

We anticipate the ECB will implement a 25bp policy rate cut this week, which is already fully priced in by the market, with guidance remaining largely unchanged. While there may be some acknowledgment that rates could move below 2%, a clear and explicit signal is unlikely. The uncertainty surrounding tariffs provides the Governing Council sufficient justification to avoid committing to further actions, as the road ahead is expected to be uneven. We maintain a bullish outlook on Euro duration, driven by our expectations of a lower terminal rate. This meeting is likely to have minimal impact on the EUR; attention should instead shift to US economic data and EU reforms.

No EUR implications

With the ECB cut fully in the price and other drivers being much more important for FX this year, we expect the meeting to be a non-event for the EUR. The ECB remains cautious, data-dependent, and open to options meeting-by-meeting; to a large extent, it is dependent on US policies and EU reforms, having to deal with substantial uncertainty and balance multiple risks. The market is currently pricing a terminal rate below 2%, indicating that a departure from neutrality would not significantly impact the market. We would focus more on the forecasts and the discussion about on risks around them, to help us assess the ECB’s latest thinking and their policy reaction function.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!