Institutional Insights: Credit Agricole FX Weekly 10/10/25

The USD has performed better than expected during the ongoing US federal shutdown, largely due to the challenges faced by other major currencies. However, the prolonged stalemate poses significant risks, including potential mass layoffs and loss of backpay for federal employees, which could disrupt the usual rebound in spending and potentially impact the USD. Additionally, the closure of the Bureau of Labor Statistics (BLS) and other statistical agencies is likely to delay the release of key economic data, such as next week’s US CPI and retail sales figures, mirroring the situation in 2013. In this uncertain environment, the Federal Reserve’s Beige Book, due on Wednesday, is expected to draw heightened attention as investors seek insights into the resilience of the US economy.

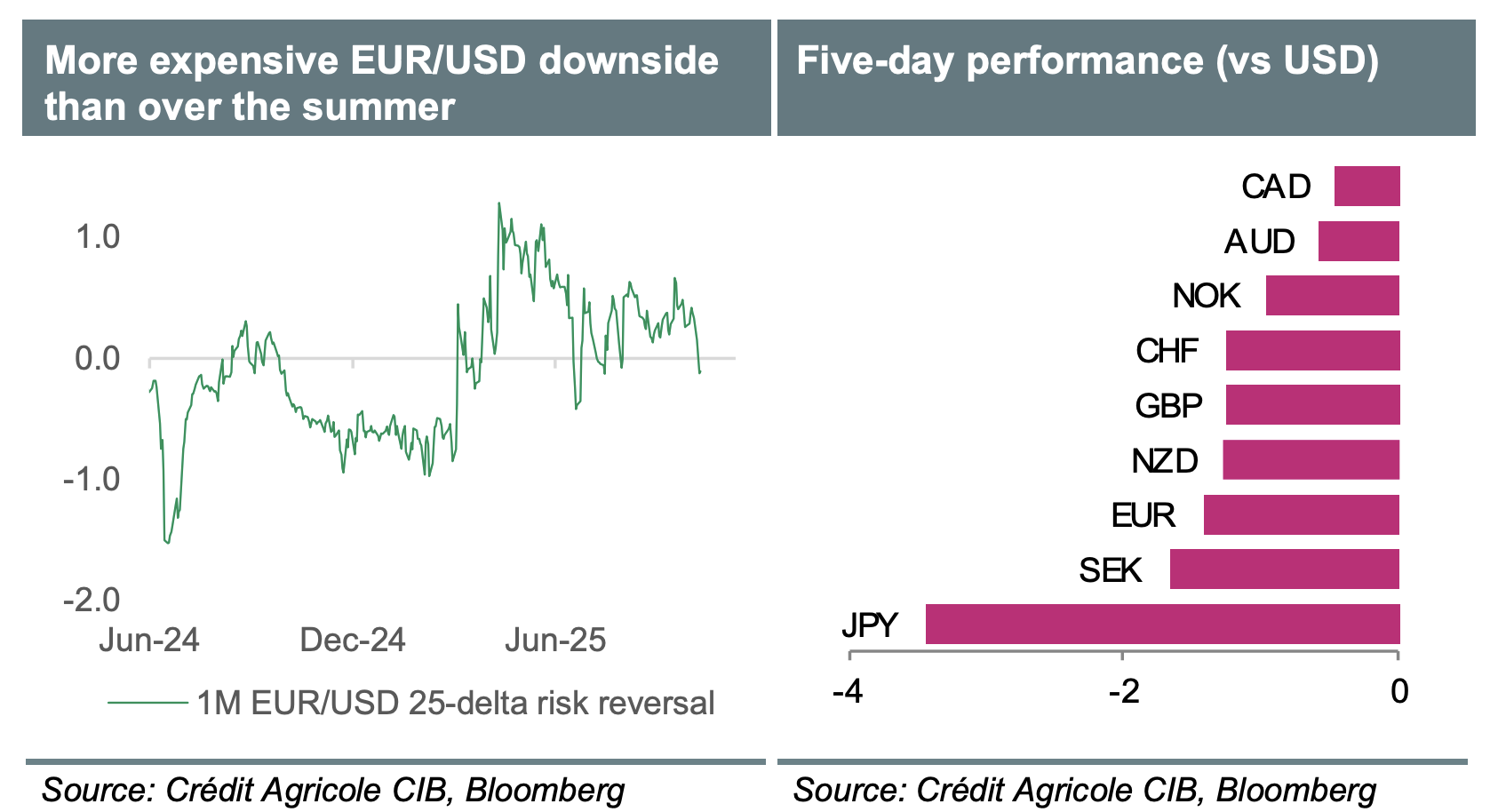

The EUR has been a collateral victim of escalating political turmoil in France. A new Prime Minister is set to be appointed following the swiftest government collapse in recent history. The incoming leader faces the challenging task of navigating a precarious political landscape, avoiding a rapid vote of no confidence in the National Assembly, and securing approval for next year’s budget. Critical deadlines are approaching, with the 2026 budget draft due by October 13 to allow the required 70 days for parliamentary review and passage by year-end. Any deviations from the delicate balancing acts of former PM François Bayrou and Sébastien Lecornu will be closely scrutinized. While it may be premature for the IMF to issue strong warnings during Monday’s World Economic Outlook presentation, FX markets could shift their stance on the EUR. The recent trend of buying dips in the EUR could give way to a more bearish outlook if snap elections are called, especially given the weak macroeconomic data from the Eurozone, which suggests limited room for sustained EUR gains.

In Japan, Sanae Takaichi’s surprise victory in her third bid to lead the Liberal Democratic Party (LDP) has sent the JPY tumbling. The USD/JPY pair surged by six big figures since last Friday’s close, rising above 153. Market participants appear eager to test the Japanese authorities’ response, which so far has been limited to mild verbal warnings, falling short of signaling imminent FX interventions. With expectations of slower monetary policy normalization by the Bank of Japan (BoJ) and increased fiscal expansion, we have revised our USD/JPY forecasts to 148 by year-end and 154 by the end of next year. This development may also indirectly challenge the Swiss franc’s position as the preferred funding currency for investors.

Here's a comprehensive outlook on FX and gold based on the provided analysis:

## FX Outlook

### EUR/USD

- Current Sentiment: The EUR is expected to remain supported in Q4 2025, but significant gains against the USD are unlikely.

- Key Factors:

- Many positive factors for the EUR and negative factors for the USD are already priced in.

- Foreign inflows into US capital markets have eased concerns about US external imbalances.

- Political uncertainties in France may hinder EUR performance.

- Future Expectations: Anticipate renewed EUR/USD weakness in 2026.

### USD Outlook

- Stabilization: The USD has stabilized due to reduced fears of aggressive portfolio outflows and concerns over its reserve currency status.

- 6-12 Month Projection: The USD may rebound due to:

- Improving US economic outlook.

- Persistent inflation and an independent Fed.

- Record inflows into USD assets and potential FDI in 2026.

- Reserve Currency Status: The USD remains the leading reserve currency with no credible alternatives.

### CHF and EUR/CHF

- Safe Haven Demand: Increased demand for safe havens like the CHF due to tariff uncertainties.

- Future Movement: EUR/CHF may rise as ZIRP in Switzerland makes the CHF an attractive funding currency, though lower inflation differentials could temper real valuations.

### JPY Outlook

- Political Influence: PM Sanae Takaichi's policies may:

- Delay BoJ rate hikes.

- Increase fiscal spending, boosting the Nikkei but raising concerns about fiscal sustainability.

- USD/JPY Range: The BoJ's comfort zone is seen at 145-155; movement above 155 may trigger faster rate normalization.

### GBP Outlook

- Cautious Stance: Recent developments pose downside risks to the UK economy:

- Potential fiscal austerity measures.

- Lingering stagflation risks limiting BoE support.

- Long-Term View: Expect the GBP to recover against the EUR and USD in late H2 2025 and outperform the EUR in 2026.

### CAD Outlook

- Recent Pressures: A frosty US-Canada relationship and weak job data have weighed on the CAD.

- Current Range: USD/CAD likely to hover around 1.40 without breaking key bounds.

### AUD Outlook

- Trade War Impact: Concerns about US tariffs are easing, particularly with a narrowed focus on US-China relations.

- Positive Indicators: Strong correlation with CNY and a tight labor market support the AUD, alongside government spending post-election.

### NZD Outlook

- Economic Recovery: Despite challenges from US tariffs, recent trade agreements and RBNZ rate cuts are fostering recovery.

- Sector Improvements: The construction sector shows signs of life, and dairy payouts may boost consumer spending.

### NOK and SEK Outlook

- NOK: Strong fundamentals and rate appeal suggest long-term appreciation, despite recent setbacks.

- SEK: High-beta nature has led to YTD outperformance, but economic challenges and a return to easing may limit further gains.

## Gold Outlook

- Support Factors: Gold (XAU) is expected to remain supported due to:

- Concerns over government borrowing and sticky inflation in G10 countries.

- Fears of fiscal dominance affecting US real yields.

- Future Risks: A rebound in the US economic outlook and higher real rates/yields could challenge gold's strength in 2026.

### Summary

Overall, while there are various factors influencing each currency and gold, the outlook suggests a cautious approach with potential for USD strength and ongoing support for gold amidst economic uncertainties.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!