Institutional Insights: Credit Agricole FX Weekly 19/9/25

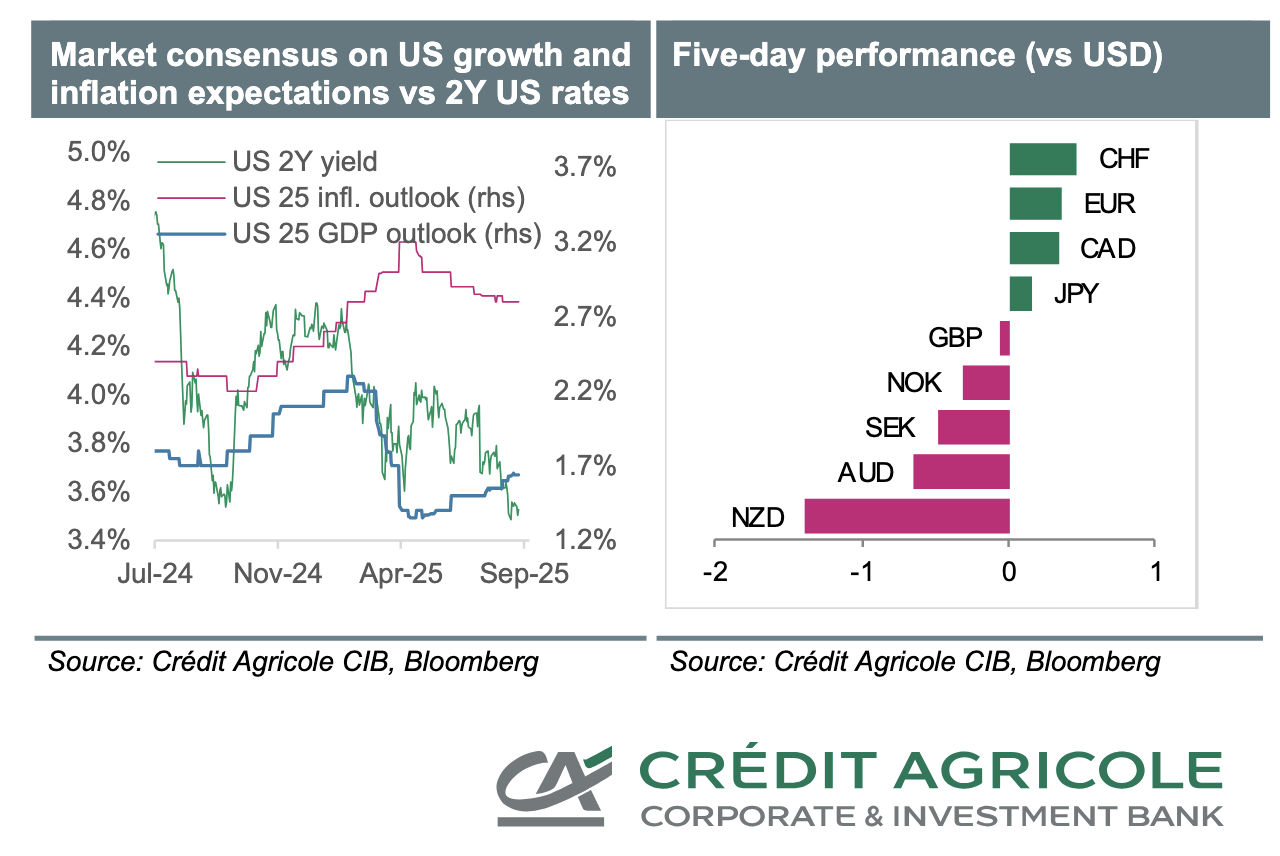

The Fed did not endorse the overly optimistic market expectations during its September meeting, which contributed to the USD regaining some strength across the board. The lingering question is whether the FOMC's resistance will be enough to enable the currency to recover on a more stable basis. We believe this is possible, partly because the market's USD-bearish sentiment has significantly changed recently.

Specifically, concerns about the Trump administration's policy mix leading to a global trade conflict and a US recession—which would exacerbate external imbalances and drive foreign investors away—have largely dissipated. Instead, current fears surrounding the USD primarily arise from the belief that the Fed will undertake aggressive easing measures moving forward. While rate cuts could aid the US economy's recovery, they might also keep inflation elevated, effectively undermining the USD. Additionally, decreasing currency hedging costs could motivate foreign investors to hedge their substantial long-USD positions more aggressively, increasing risks for the currency.

Moreover, FX investors are apprehensive that the Trump administration might compel the Fed to implement a 'dynamically inconsistent' monetary policy—using the correct macroeconomic terminology. This could jeopardize the Fed's credibility, ignite long-term inflation expectations in the US, and exacerbate fears of USD debasement.

We disagree with that viewpoint. We believe that the current institutional framework in the US should be robust enough to protect the Fed's independence, and thereby its credibility. Therefore, we anticipate the USD to rebound by 2026 amid a recovering economy and persistent inflation in the US, along with fewer Fed rate cuts than the current US rates market anticipates.

In the short term, the USD's outlook will depend on Fedspeak and the quality of incoming US data as FX investors assess the strength of the dovish consensus within the FOMC. The upcoming core PCE and September PMIs could be particularly noteworthy. Additionally, attention will be given to the European PMIs and Germany's Ifo index for September. Despite an uptick in rate cuts compared to stable rates among G10 central banks this week, both the SNB and Riksbank seem poised to maintain their current monetary policy, as both the CHF and SEK continue to perform well.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!