Institutional Insights: Credit Agricole FX Weekly 24/01/25

Central Banking in the Era of Trump 2.0

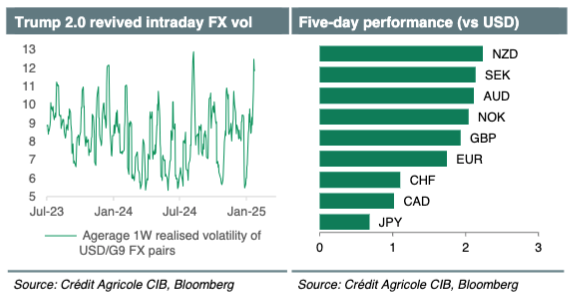

Donald Trump’s initial days in office have resulted in significant intraday fluctuations without a clear trend in G10 FX markets. In the upcoming week, focus may temporarily shift to the series of central bank meetings. Recently, central bankers have discussed the potential effects of Trump’s policies more than Trump himself has addressed monetary policy. The strength of US data suggests that the Fed will likely maintain its position during Wednesday’s meeting after implementing 100 basis points of easing over the last three meetings. While US money markets are fully aligned with a pause, it remains uncertain whether Trump will hold back from commenting on the latest FOMC decision or if he will become more outspoken about reducing rates, similar to his approach during his first term. Although he has committed to keeping Chair Jerome Powell in his position until the end of his term next year, any return to monetary policy commentary by Trump could dampen the market's hawkish expectations of not even two rate cuts this year, potentially putting downward pressure on the USD.

The ECB’s more accommodative approach compared to the Fed’s has previously been favored by the US President as it provides the Eurozone with a competitive advantage. Another rate cut on Thursday would allow the ECB to regain the lead in easing, a move that EUR money markets fully anticipate. This aligns with comments from Governing Council members suggesting that the ECB may have the most lenient near-term strategy among major central banks, which could overlook risks such as significant EUR/USD declines, while leaving the crucial question of the terminal rate open. In this regard, the less dovish outlook from our ECB analyst, if accurate, could support the EUR in the future.

Before the Fed and ECB meetings, the results of the latest BoC and Riksbank meetings appear more unpredictable. For the BoC, this uncertainty is not solely due to Trump’s recent threats of imposing 25% tariffs on Canadian imports starting February 1, but also because interest rates are already at the upper limit of the bank’s neutral estimates, and its forward guidance has become less clear. A cautious risk-management strategy would suggest a modest 25 basis point cut, as the possibility of such a move should not negatively impact the CAD. Meanwhile, the Riksbank has already indicated that one final rate cut is likely. Whether this occurs sooner or later should not disrupt the relatively stable SEK.

We have revised our outlook for the EUR/USD following the US election, but we believe that many negative factors are already reflected in the price, and the pair appears to be oversold and undervalued. Our economists do not foresee a recession in the Eurozone and anticipate a terminal ECB rate of 2.25%, which is significantly higher than current market expectations for European rates. Additionally, while recent political events in France and Germany have unsettled EUR investors, our rate strategists are not positioned for a repeat of the sovereign debt crisis from a decade ago and believe that many negatives are already accounted for. Moreover, we think that a potential reduction or even withdrawal of US support for Ukraine under President Donald Trump could ultimately lead to the end of the war by 2025. This could result in a decrease in geological risks in Europe, potentially enhancing domestic demand in the Eurozone. An end to the conflict in Ukraine could also trigger a reconstruction boom in the country, which would support recovery in the Eurozone.

The USD strengthened following Donald Trump’s victory in the US presidential elections and the ‘red wave’ in Congress. The anticipated second Trump administration is expected to introduce additional fiscal stimulus and more aggressive trade policies, which could improve the US growth outlook compared to its trading partners and make US inflation more persistent. We also expect that the Trump policy mix could shorten the Fed's easing cycle, but we believe this has already been factored into the rates markets, enhancing the USD's appeal across the board. Overall, we think that many positive factors are already priced into the USD and expect it to stay near recent highs without surpassing them on a sustained basis through 2025. While we cannot rule out further USD gains due to US tariffs, the timing and intensity of these remain uncertain. In the long run, we also believe that a return to President Trump’s ‘Weak USD Doctrine’ and concerns about the Fed’s independence could put downward pressure on the USD as we approach 2026.

Increasing struggles in the Eurozone have driven safe-haven demand for the CHF, which may remain sought after until uncertainties are largely resolved. Assuming no lingering shocks, the CHF could revert to being a preferred funding currency due to the potential return of near-zero interest rates and its high valuation, while the SNB will closely monitor FX developments and Swiss disinflation.

Among the G10 currencies, the JPY was one of the least affected by tariffs during Trump’s first term. We expect the US-Japan rate spread to continue to narrow as the Fed cuts rates and the BoJ raises them further. This compression of the US-Japan spread will diminish the carry appeal of holding USD/JPY, while the exchange rate’s volatility is likely to remain high due to uncertainties surrounding the Fed and BoJ rate paths, as well as Trump’s policy agenda, particularly regarding trade. Japan’s Ministry of Finance will also be prepared to intervene to support the JPY.

The recent decline of the GBP appears to reflect renewed concerns about the UK economic outlook, which, combined with rising government borrowing costs, could lead the Labour government to exceed its current fiscal deficit target, necessitating new austerity measures as early as March. However, we would not go so far as to say that FX investors no longer see the GBP as a higher-yielding, safe-haven alternative to the EUR. We continue to expect that the UK’s political stability and relative economic performance compared to the Eurozone will sustain market expectations that the BoE will need a less aggressive easing cycle than the ECB to support growth. This outlook continues to make us optimistic about the GBP against the EUR for 2025 and 2026. GBP/USD may continue to trade near its lows following the US election, but we anticipate a stronger recovery for this pair compared to EUR/USD in 2026.

Trump’s tariff threats have pushed USD/CAD to new highs above 1.45, but regardless of the new US administration's policy stance, risks to the CAD appear to be skewed to the downside in early 2025 due to a potentially widening gap between the BoC and Fed. However, the prospects of Canada outperforming the US in terms of growth could facilitate a gradual recovery for the CAD.

AUD/USD weakened during Trump’s first term due to his tariffs on China and a declining Australian-US rate differential. We expect Trump to be open to negotiations regarding his China tariffs, which may end up being less than the 60% he promised during his campaign, thereby supporting AUD/USD. Additionally, the RBA is expected to remain less dovish than many other G10 central banks, which will also support AUD/USD.

We adjust our XAU predictions based on current market conditions but maintain a downward trend in our forecasts for the majority of 2025. We anticipate a possible resurgence in gold prices in 2026 due to increasing market concerns regarding the independence of the Federal Reserve and the potential threat of fiscal dominance in the United States.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!