Institutional Insights: Deutsche Bank, Investor Positioning and Flows

.jpeg)

Institutional Insights: Deutsche Bank, Investor Positioning and Flows

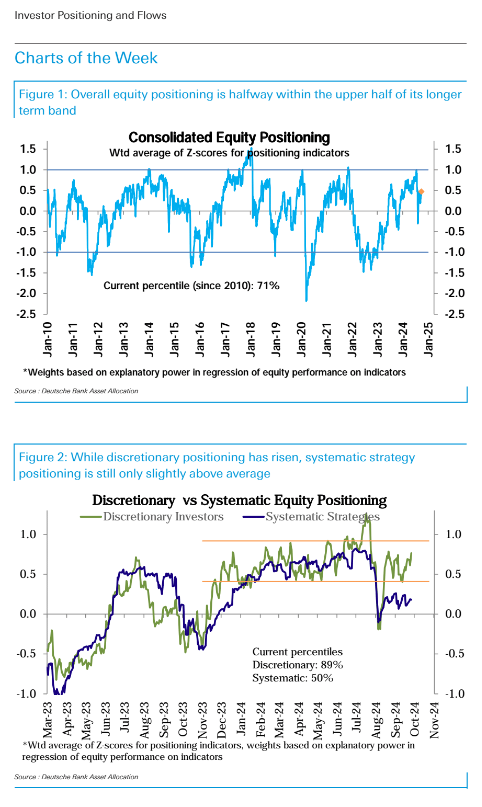

Our measure of aggregate equity positioning crept up further this week but is still onlya bout mid-way in the upper half of its longer run band (z score 0.47,71st percentile).Discretionary investor positioning rose further and is now somewhat elevated, although well supported by rising growth and falling rates volatility (z score 0.76, 89thp ercentile). Overall positioning is still being held back by systematic strategies, whose positioning has been going sideways slightly above average (z score 0.18, 50thpercentile). Systematic strategy positioning should rise as volatility recedes after theb ack-to-back pullbacks of the last 2 months. Meanwhile, there is no sign of a let upin the strong pace of equity fund inflows with another $25bn this week. Equity fundshave now seen cumulative inflows of $325bn since mid-April and $525bn since lastNovember. This week, while US funds ($11bn) continued to get robust inflows, therewas a notable surge of inflows into China($8bn) following the stimulus announcement. Bond funds ($12.7bn) also continued to get solid inflows albeit with a divergence within, as government bond funds (-$1.6bn) saw outflows for a second week in a row but credit funds such as IG ($3.8bn), HY ($1.2bn) and EM bonds($1.2bn) received robust inflows. Finally, money market funds ($129.1bn) received massive inflows this week, their largest in 18 months.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!