In our FX Blueprint note, we maintain a constructive outlook on gold relative to short crude oil. This perspective aligns with our recent upgrade to gold forecasts for 2026. A key point in our analysis is that ETF positioning remains below historical highs in ounces, with a notable 'headroom' of 15 million troy ounces compared to the October 2020 peak of 17 million troy ounces.

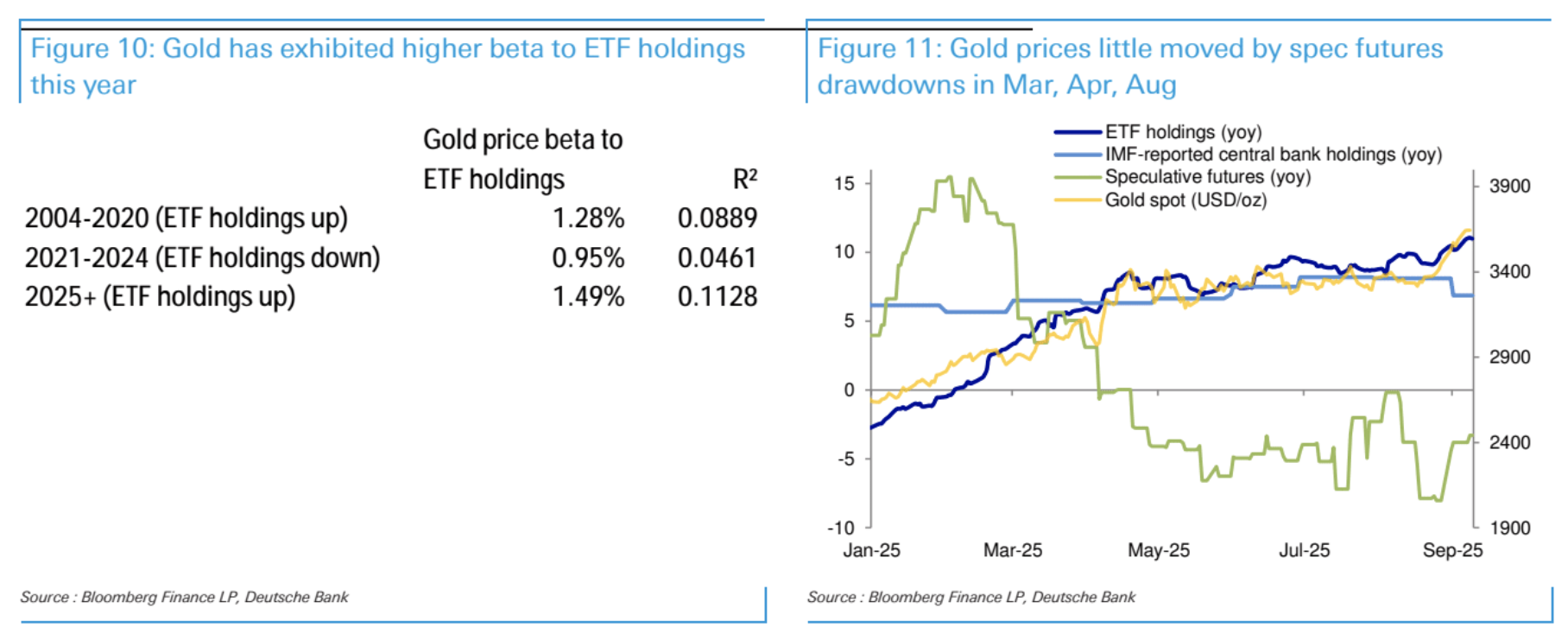

This year has witnessed a resurgence in ETF demand, marking one of the top three years for gold accumulation since ETFs were introduced. Notably, assets under management (AUM) are currently 70% above 2020 levels in USD terms, indicating that this increase in demand is not constrained by prior peaks. Furthermore, ETF demand is exerting a 50% stronger influence on gold prices based on univariate weekly regression analysis compared to the period of selling from 2021 to 2024.

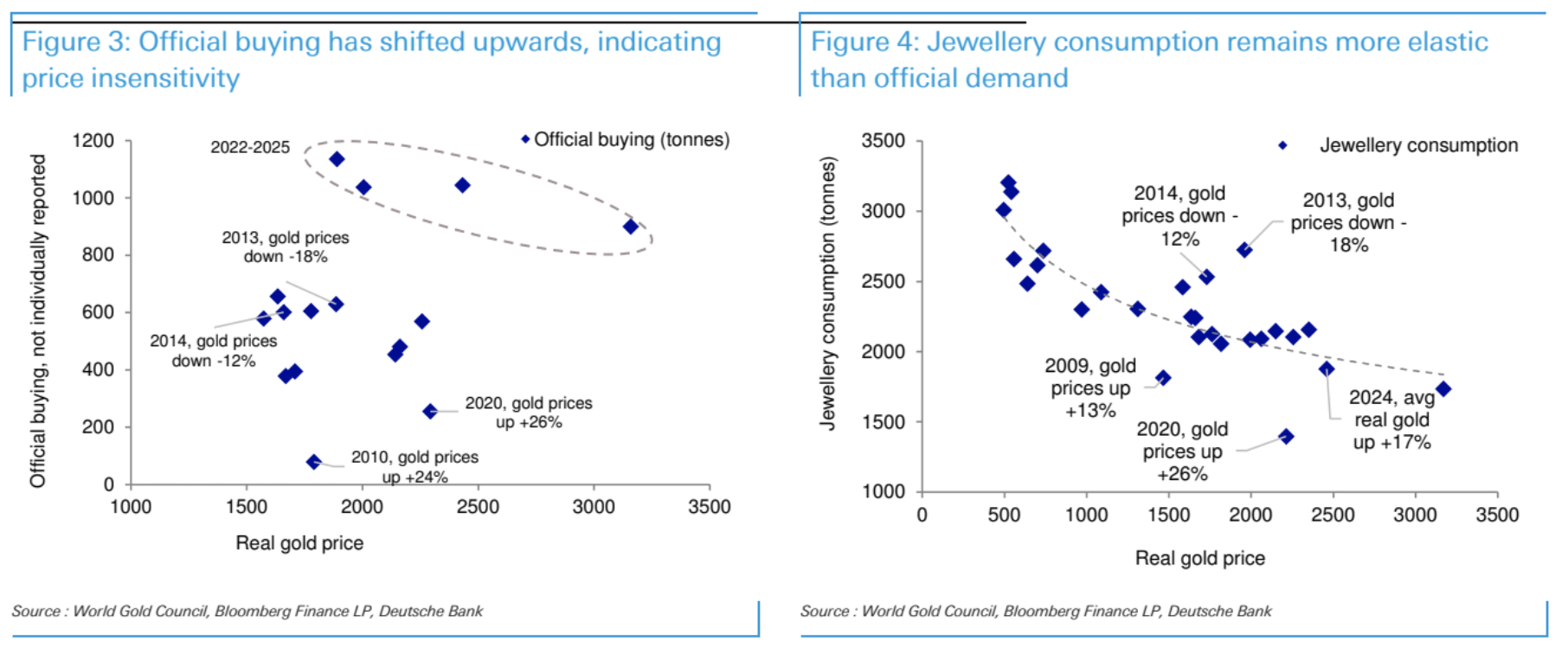

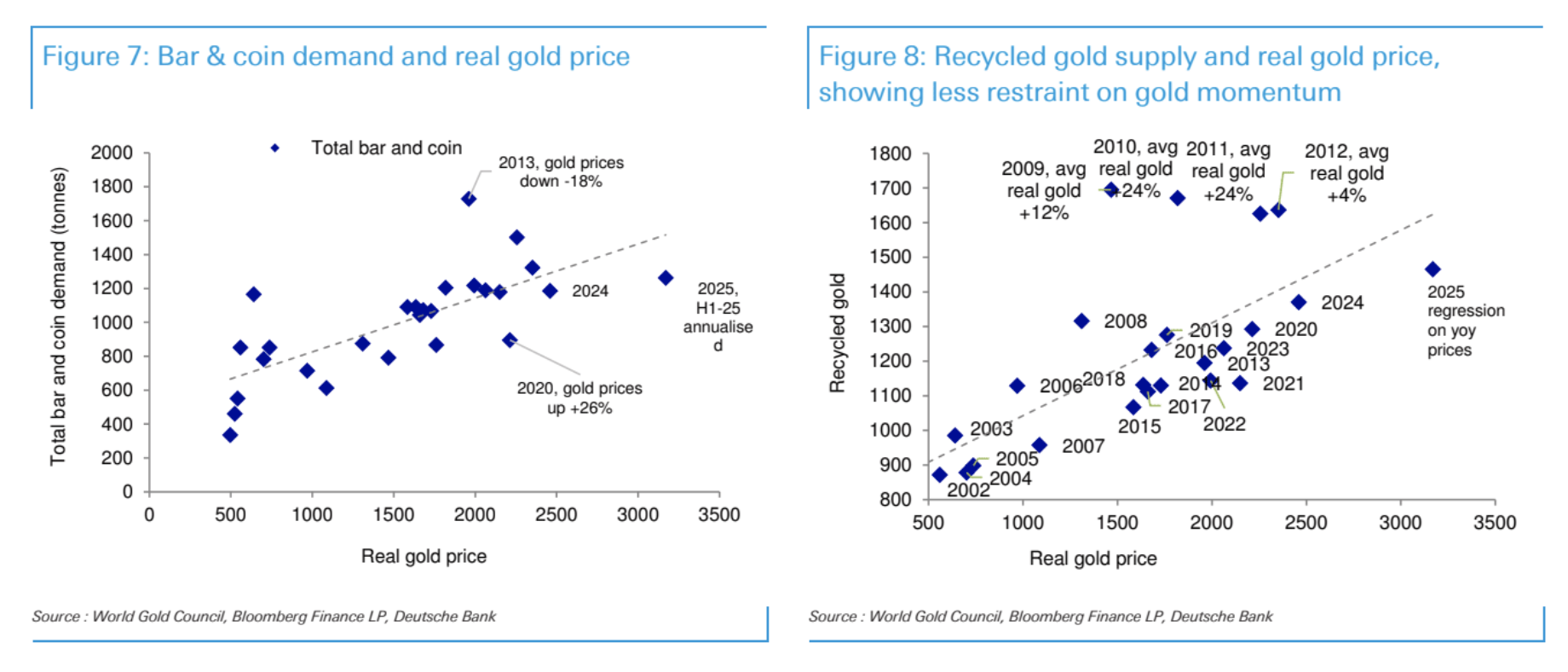

We delve deeper into the factors influencing gold prices, particularly the roles played by different categories of demand and supply. The current strong ETF demand signifies two main sources of aggressive bids for gold: central banks and ETF investors. This dual support helps explain gold's robust performance relative to models. We believe that the Federal Reserve's easing bias is likely to facilitate an increase in ETF holdings in 2026.

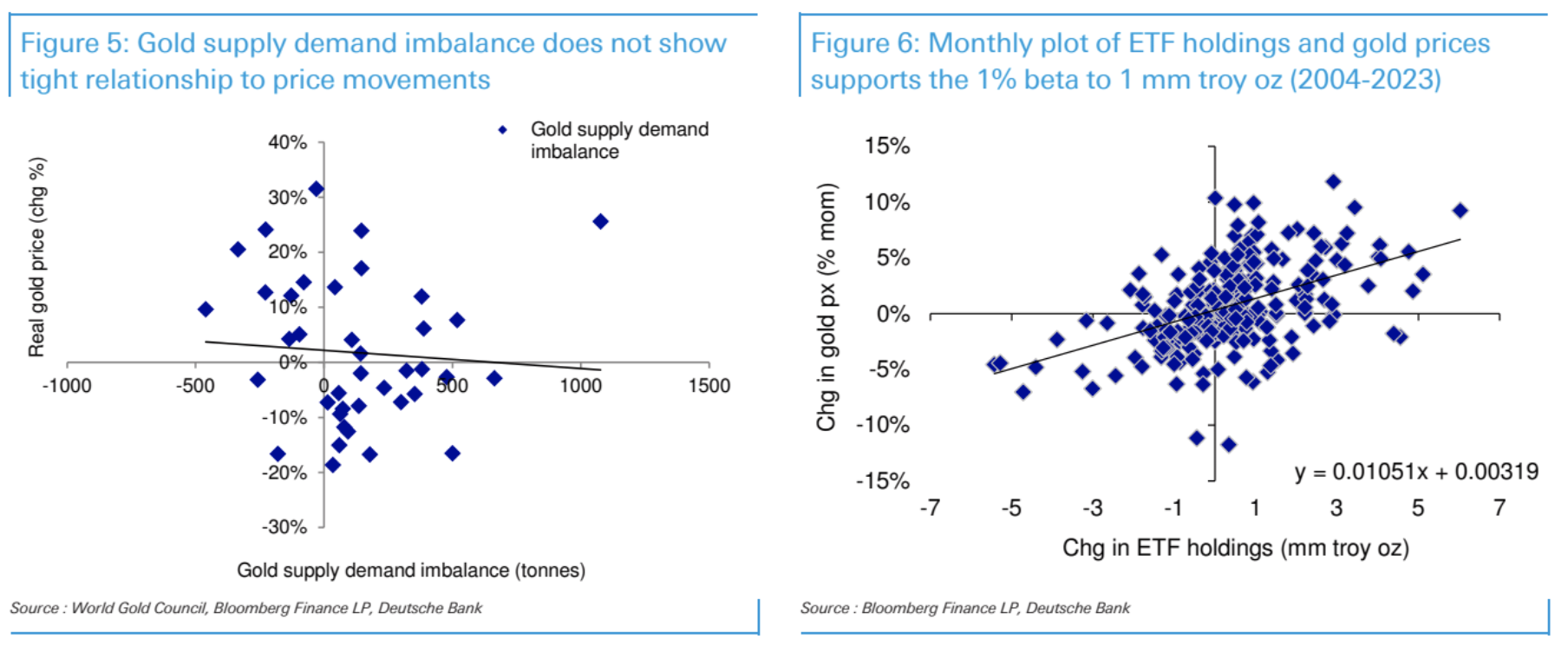

Utilizing the Granger causality test, we find that changes in gold prices lead to ETF flows rather than the other way around. Extending this analysis to our financial model indicates that changes in interest rates (but not the dollar) drive gold price fluctuations. If these findings hold, they suggest that the Fed's easing stance and potential upside risks to inflation breakevens are critical bullish drivers for gold.

### ETF Renaissance

Since returning to year-over-year growth in February, ETF demand has regained significant prominence, comparable to levels observed from 2004 to 2020. Year-to-date ETF demand ranks among the strongest since the inception of these investment vehicles in the early 2000s.

Our analysis focuses on developed market ETF holdings denominated in USD, GBP, EUR, CHF, AUD, and JPY. In contrast, Chinese ETFs, which briefly mirrored the impact of developed market ETFs in April, have seen reduced activity and a decline in holdings since then.

The outlook for gold appears positive, primarily due to strong inflows into gold ETFs, which have significantly contributed to the recent rally in prices. If these inflows were to stop or reverse, it could pose a downside risk for gold. Historically, investors tend to increase their gold ETF holdings when U.S. yields are falling, indicating a close relationship between interest rates and gold demand.

Given the Federal Reserve's current easing bias, there is a belief that ETF gold holdings may rise again in 2026 rather than decline. This easing stance is generally associated with lower yields, which can enhance the attractiveness of gold as an alternative asset.

If we accept the implications of the Granger test mentioned, it suggests that the rates market could be the primary driver of gold prices. This reinforces the expectation that lower yields are likely to support higher gold prices and positive ETF inflows. However, a potential contradiction arises if there are sustained challenges to the Fed's independence, leading to a steepening of the yield curve. Such a scenario could create unusual market dynamics, causing gold prices to behave contrary to historical correlations.

The current political climate, particularly the unprecedented attempt by a U.S. President to remove a Federal Reserve Governor, introduces factors that could disrupt historical patterns. While the outlook for gold remains favorable, driven by anticipated ETF inflows and lower yields, investors should remain cautious of external political developments that could introduce volatility and uncertainty into the market.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.jpeg)