Institutional Insights - Goldman Sachs SP500 CPI Scenario Analysis

Institutional Insights - Goldman Sachs SP500 CPI Scenario Analysis

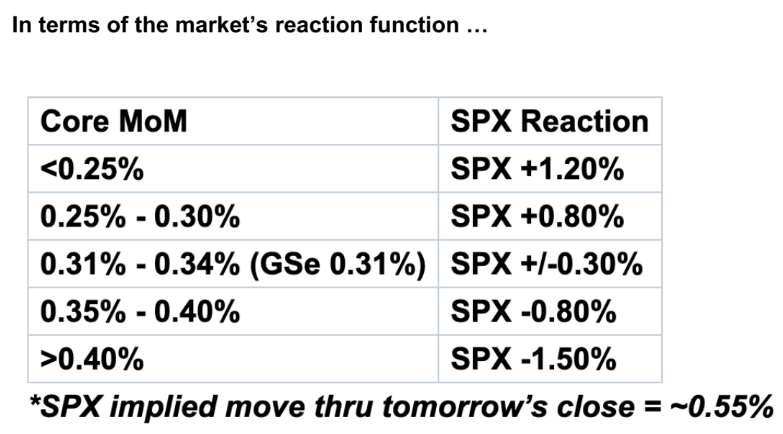

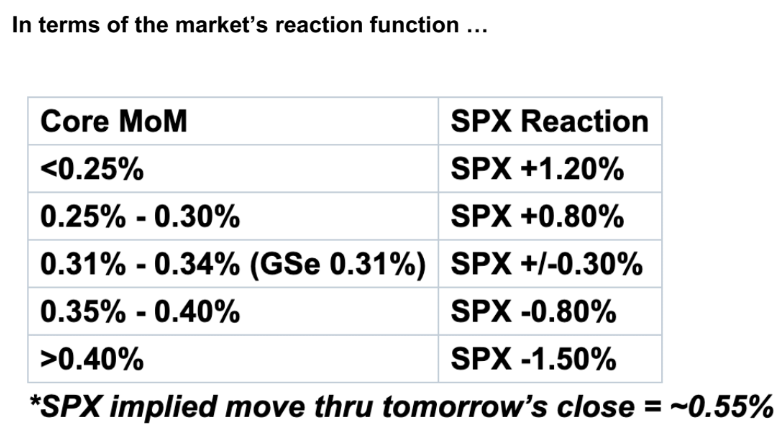

GS Research: We expect a 0.31% increase in October core CPI (vs. 0.3% consensus), corresponding to a year-over-year rate of 3.30% (vs. 3.3% consensus); link.

• Our October core CPI forecast is roughly in line with the pace of the August and September readings but above the +0.14% average of the three readings before that. Those softer readings were aided by large declines in the airfares component—which declined 3.4% on average— and the used cars component—which declined 1.1% on average. In October, we expect increases in airfares (+1.0%)—reflecting a modest boost from residual seasonality and strong pricing trends—and used car prices (+2.5%)—reflecting a rebound in auction prices. • We highlight two additional key component-level trends we expect to see in this month’s report.

1. We expect another firm increase in car insurance prices, reflecting continued, albeit decelerating, increases in premiums.

2. We expect the health insurance component to remain roughly flat this month as the BLS incorporates updated source data on insurance premiums.

3.Going forward, we expect monthly core CPI inflation around 0.2% for the rest of the year.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!