Institutional Insights: Goldman Sachs, Thanksgiving Flow of Funds

.jpeg)

Institutional Insights: Goldman Sachs, Thanksgiving Flow of Funds

GS Tactical Flow-of-Funds: Family FOMO Family FOMO tends to kick-in around the Thanksgiving dinner table watching the parade and football. In case “Uncle Joe” and “Aunt Sally” ask why the S&P is up ~25% this year, here is a quick checklist of the biggest themes in the market.

This is my 20th year of the “Thanksgiving Dinner” email. As we prepare for 2025, I have included my Thanksgiving wrap from 2017 (i.e. Trump 1.0). The biggest themes that stuck out to me after reviewing the Flow-of-Funds data (from January 1, 2017 to November 22, 2017): we need to be open-minded and think big. a. Strong global growth (highest in 6 years) b. Accommodative financial conditions (loosest in 3 years) c. Major single stock picking opportunities - active managers had a great run the highest alpha in 5 years. d. Low realized volatility: 100-day S&P vol was 6.5 e. Out of consensus rally for non-dollar equities f. Passive inflows into equities were consistent all year g. Corporate demand was the highest on record back then This is my baseline re-wind of Trump 2.0 playbook to start 2025 with “animals spirits.”.

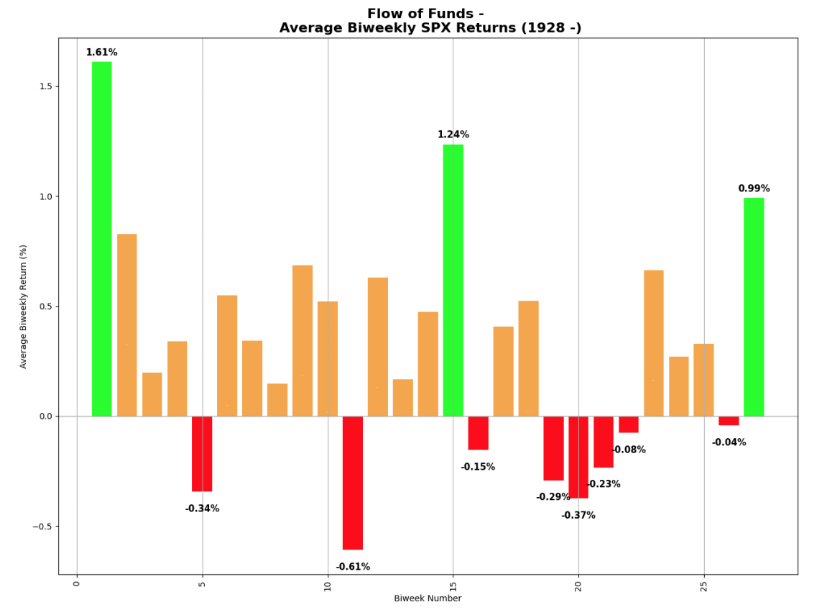

The best seasonals of the year start in December.

1. There are 20.5 days left to trade in December. The bar for being bearish is very high during the best trading days of the year.

2. The first two weeks of January are the best two week period of the year with an average return of +1.61%. 3. The last two weeks of December are the 3rd best two-week period of the year with an average return of +.99%.

4. The last two weeks of December and first two weeks of January are by far the best four-week period of the year with an average return of +2.60%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!