Institutional Insights - Goldman Sachs USD

Institutional Insights - Goldman Sachs USD

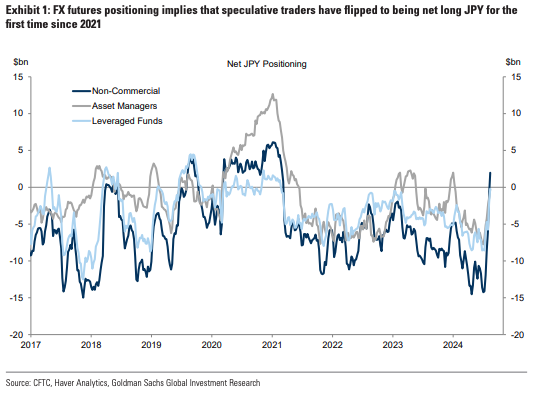

USD: Markets or macro. Investors have been asking whether the wild swings relative to small data surprises over the past few weeks was the market catching up to the shifting macro backdrop, or if it was something more technical. While clearly a mix of the two, our view is that it is more of the latter, which has created some opportunities in the stabilisation bounce. Last week we added some new carry trade recommendations and discussed room for a tactical fade in CHF, which we formalised this week with a long GBP/CHF trade recommendation. But the Dollar has been mixed, for a couple of reasons. First, the fundamental outlook has changed somewhat. With clear evidence that the economy has slowed and the labor market has cooled, the US is ‘not so exceptional’ anymore. Second, Fed cuts are likely to weigh on the Dollar to some extent, at least temporarily. We see some parallels to last December, when the Fed’s signal of rate cuts caused a brief, outsized reaction in FX markets in anticipation of shifting hedge ratios and carry profiles. That might again be short-lived if the cutting cycle proves to be more abbreviated than current market pricing, but it is hard to be an unfettered Dollar bull at least until the scope of policy adjustment becomes clearer. And the Dollar generally depreciates when growth falters and real rates have room to adjust, particularly against the Yen— part of the reason why the vast majority of speculative positioning got washed out in recent weeks. The latest CFTC data as of August 13 suggest that, in fact, non-commercial (speculative) investors have now flipped to being net long JPY for the first time since 2021 (Exhibit 1). That said, we still hold the view that it is hard for the Dollar to go down (or to be bullish Yen) substantially or durably in the current environment. While the gap has narrowed, the US still sets a high bar and growth in other parts of the world has also slowed. While the market has priced a faster Fed pivot, we still think other major central banks would ease policy more if the Fed gave them space to do so. And, even though the US presidential race has also tightened, we still think trade policy uncertainty will weigh on portfolio flows and keep the Dollar somewhat elevated in the months ahead.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!