Institutional Insights: Standard Chartered on Bitcoin

Institutional Insights: Standard Chartered on Bitcoin

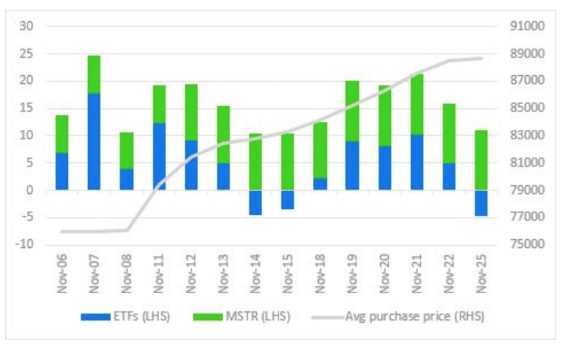

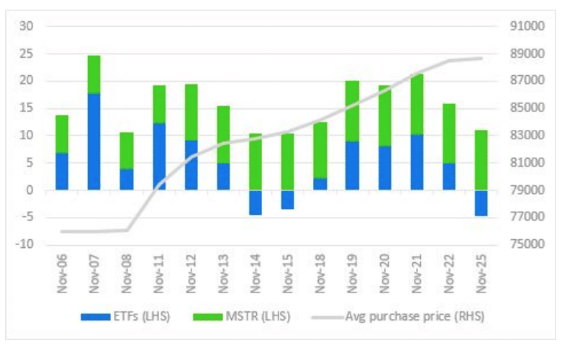

The retracement from Friday’s all-time high just below 100k has been aggressive, particularly over the last 24 hours. I think the catalyst yesterday was a post Bessent announcement (for Treasury) reduction in US Treasury term premium. The data produced by the NY Fed on term premium is lagged and only currently goes up until Friday (see ACMTP10 Index on Bloomberg) but it is likely yesterday’s rally in back-end Treasuries was due to term premium reduction. This matters for Bitcoin because one of its core use is to hedge against TradFi issues (banking sector related or Treasury related). I have written about this several times with regards a Trump administration, most recently in the attached. So lower term premium hurts Bitcoin, at least temporarily. Added to that is the monthly options expiries this Friday. Derebit has open interest in BTC calls between 85-100k strikes of 18,000 BTC notional expiring on Friday. This often means prices get stuck as we close in on expiries. And, as importantly has been the huge increase in ETF and Microstrategy (MSTR) buying of BTC since the US election. We often write about the ETF flows, and they have been an impressive 77,000 BTC since the election. But MSTR has also bought a staggering 134,000 BTC as well. This chart shows the ETF and MSTR inflows (in ‘000 BTC terms), taking daily (weekday) averages for MSTR given what they have told us:

Now MSTR is not going to sell the BTC. But it is worth noting that since the elections the average purchase price for ETFs and MSTR buying has been USD 88,700. So for me, I think we go below that USD 88,700 level before this retracement is over. Below that the BTC price has not gone below USD 85,000 since the huge up candle on 11 November. So that’s my buy zone, USD 85,000 – USD 88,700. After that we head above $100k to my year-end target of $125k and onto $200k end-2025.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!