#InstitutionalInsights BofA Investor Sentiment

#InstitutionalInsights BofA Investor Sentiment

Investor Sentiment: Risk-Love

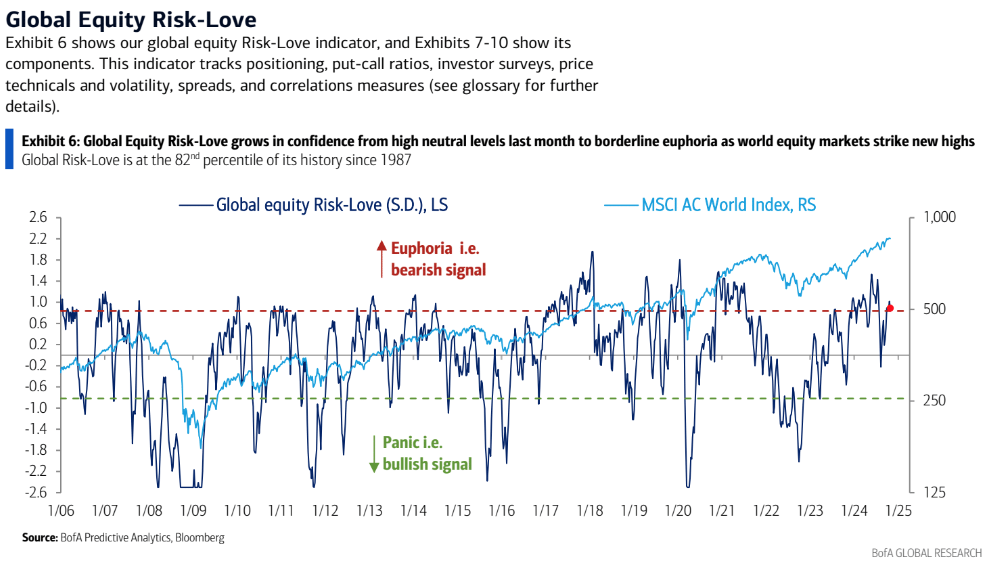

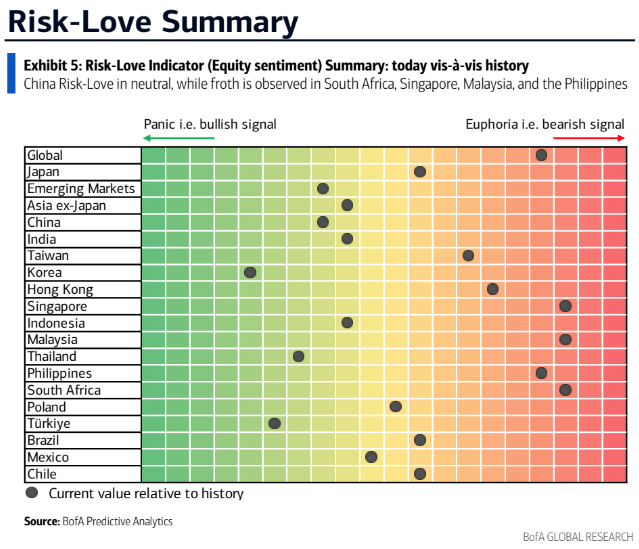

That time of the year Global Risk-Love: euphoric vibes Global Risk-Love, our contrarian equity sentiment indicator, has grown in confidence from 68th percentile of history last month to borderline euphoria (82nd percentile) now, as world equity markets strike new highs. Positioning metrics, especially in Asia/EM, leaped to the optimistic end of the scale, while investor surveys turned more ebullient.

Japan: riding out the uncertainty corridor Eastwards in Asia, Japan Risk-Love is trudging sideways within the neutral zone (56th percentile of history) as investors seek to wait out the uncertainty ahead of the Lower House elections on 27 October. Media polls conducted in the early stages suggested that the ruling LDP may fall short of establishing a majority on its own.

China/HK: relief rally breaks the shackles of panic Risk-Love for China / Hong Kong broke out of the panic zone following the policy pivot last month but is still afar from any shred of complacency, leaving room for further upside in the coming months. Policy conditions are becoming incrementally more accommodative, prompting investors to build back exposure in China (see note).

Asia/EM: weighed down by a strengthening dollar Yet, sentiment in the Asia/EM composite was largely contained on a rebound in the USD sentiment with a 3% rise in the greenback MTD. India slid down the neutral zone (43rd percentile) as investors look to trim allocations in favor of China. ASEAN still looks frothy with Singapore, Malaysia, and the Philippines treading in/near euphoria. So does South Africa, while LatAm is subdued on rates risk in Brazil and policy concerns in Mexico.

Seasonality over sentiment The Global Proprietary Signals suggests that the bull market is intact. Growth is modest, disinflation is persistent, earnings are thriving, and policy has just started to turn accommodative. Not to forget, the tailwinds of favorable seasonality. While the summer, as a whole, was better than usual this year, history suggests prospective returns from here through the year-end are modest, regardless of the prior return profile or the sentiment regime, as long as we do not crash into a recession/crisis.

What we are tracking While we stick to our long-standing bullish stance on global equity markets (see GPS: It’s all about expectations Jan 2023 and GPS: Anatomy of a bull market Jan 2024), euphoric sentiment does warrant a close watch on the data flow. Bond yields and inflation breakevens have been on the rise in recent weeks on a pick-up in growth surprises. Given that a more pronounced move in these variables triggered correction in the summer of 2023, we are all eyes and ears on these how these are panning out

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!