Is Correction Overdue in the Oil Market?

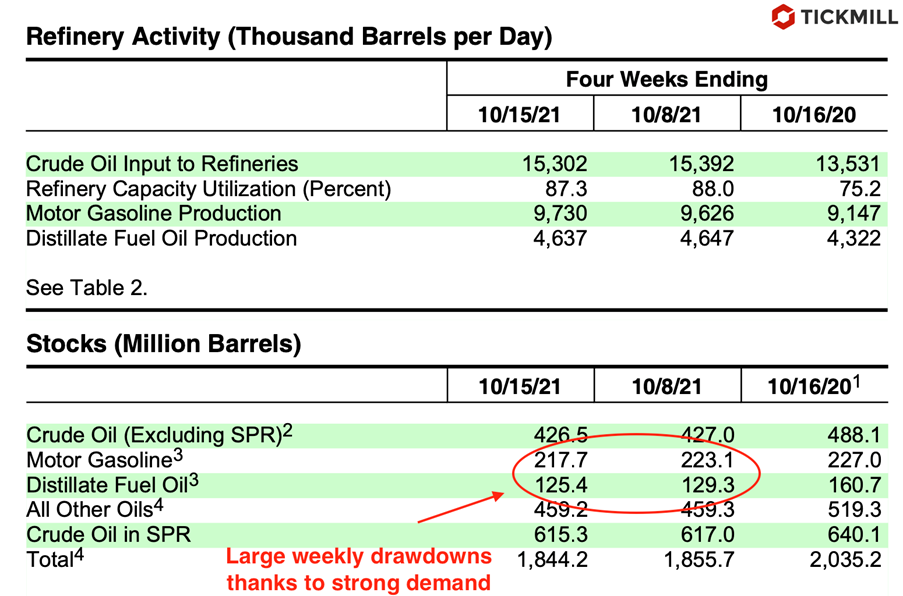

Oil market got a boost of optimism on Wednesday, which helped WTI quotes to test the $84 mark, for the first time since 2014. The catalyst for the move was a positive EIA report. Crude oil inventories fell by 431K barrels in the reporting week, which is a rather modest event, but together with product stocks, inventories fell by almost 10 million barrels. In addition, reserves at Cushing decreased by 2.32 million barrels to 31.23 million, the lowest level in three years. Gasoline and distillate stocks decreased by 5.37 and 3.91 million barrels, while their level is at a minimum in 2 years:

It is clear that strong demand for fuel in the United States has contributed greatly to the reduction in inventories. Demand continues to show positive weekly dynamics, underpinning bullish momentum in the oil market. The rise in prices, in turn, is forcing consumer countries to put pressure on OPEC to increase production. However, OPEC is in no hurry to help the United States, India and Japan, large oil consumers, which have publicly called on OPEC to contain the rise in prices. The cartel fears that market imbalances will again lead to an oversupply next year, as some non-OPEC oil producing countries plan to increase production in 2022. In addition, OPEC is not going to increase production in order to stabilize the gas market, as it doubts that oil will be able to effectively replace gas. OPEC's reluctance to respond to calls to increase production indicates that the market may not be afraid of events on the supply side, so expectations will mainly depend on the incoming data from the demand side.

From a technical point of view, prices are developing a corrective movement within a short-term uptrend. A repeated move towards the lower border of the channel with a breakdown is likely due to corrective momentum, which is not uncommon for oil prices:

On the daily chart, prices have deviated significantly from the moving averages, which usually indicates oversold conditions. A correction to the area of $ 81-80 per barrel in WTI will significantly reduce the tension on the market.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.