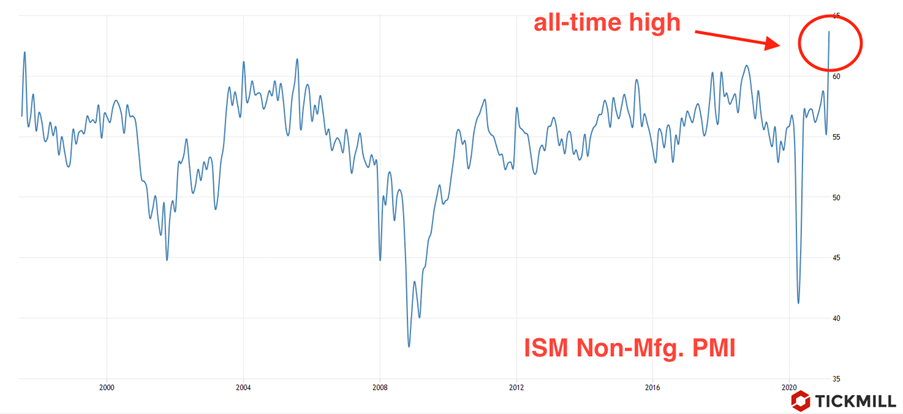

ISM Non-Mfg. Activity Index for March Hits All Time High

Incoming data on the US economy suggests that recovery is quickly gathering pace. The bar to surprise markets after blockbuster March NFP report was quite high, however US activity indices could raise economic optimism to a new level. The ISM released services and manufacturing PMIs for March managed to beat already upbeat forecasts.

The service sector index rose from 55.3 in February to 63.7 points in March, beating the forecast of 59 points. This is an absolute record since 1997:

The service sector is a key part of the US economy as it employs more than 70% of workers. New orders, a leading component in the data, jumped to 67.2 points which indicates a huge monthly increase in orders, unlike anything seen in many years. The jump is clearly explained by easing of social restrictions, which in turn explain the impulse of consumption. The very fact that the ongoing reboot of the economy props up demand for risk assets allows us to witness breakouts of key resistance levels in US stock indexes after a long period of consolidation.

Markit's composite activity index, which combines activity in both manufacturing and services, added a few tenths in March, climbing 59.7 points.

The 50-point level divides the area of contraction and expansion of activity. PMI readings reflect the change in activity compared to the previous month. The actual high readings of the indices indicate that in March there was an impulse in US economic growth, which is due to accelerated vaccination, the lifting of restrictions and, of course, the fiscal impulse. This, as we see it, is stimulating consumer spending at the right time.

ISM data reinforce hopes that April job growth will exceed March growth by 916,000.

S&P 500 futures pull back after rising to 4077 points on Monday. All three major US stock indexes closed more than 1.5% yesterday, reflecting optimism in the data. Oil prices rebounded on the expectation that the economic momentum in the US would also spur growth in other economies. WTI and Brent rose by more than 2% on Tuesday.

The June Fed meeting will certainly require significant revision of economic projections. Now the Fed’s dot plot indicates that the Central Bank plans one rate hike starting in 2024, but taking into account the latest data on the economy, it is difficult to drive away the idea that the normalization of policy in the United States will begin much earlier.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.