Key Economic Reports and Events for the Week Ahead

The main event of the next week will be FOMC meeting which is due on Wednesday. Markets don’t expect changes in the federal funds interest rate or QE, but should be attentive to the way how the Fed will comment on the government's plans to borrow money in the debt market to fund the new stimulus package proposed by Biden’s administration.

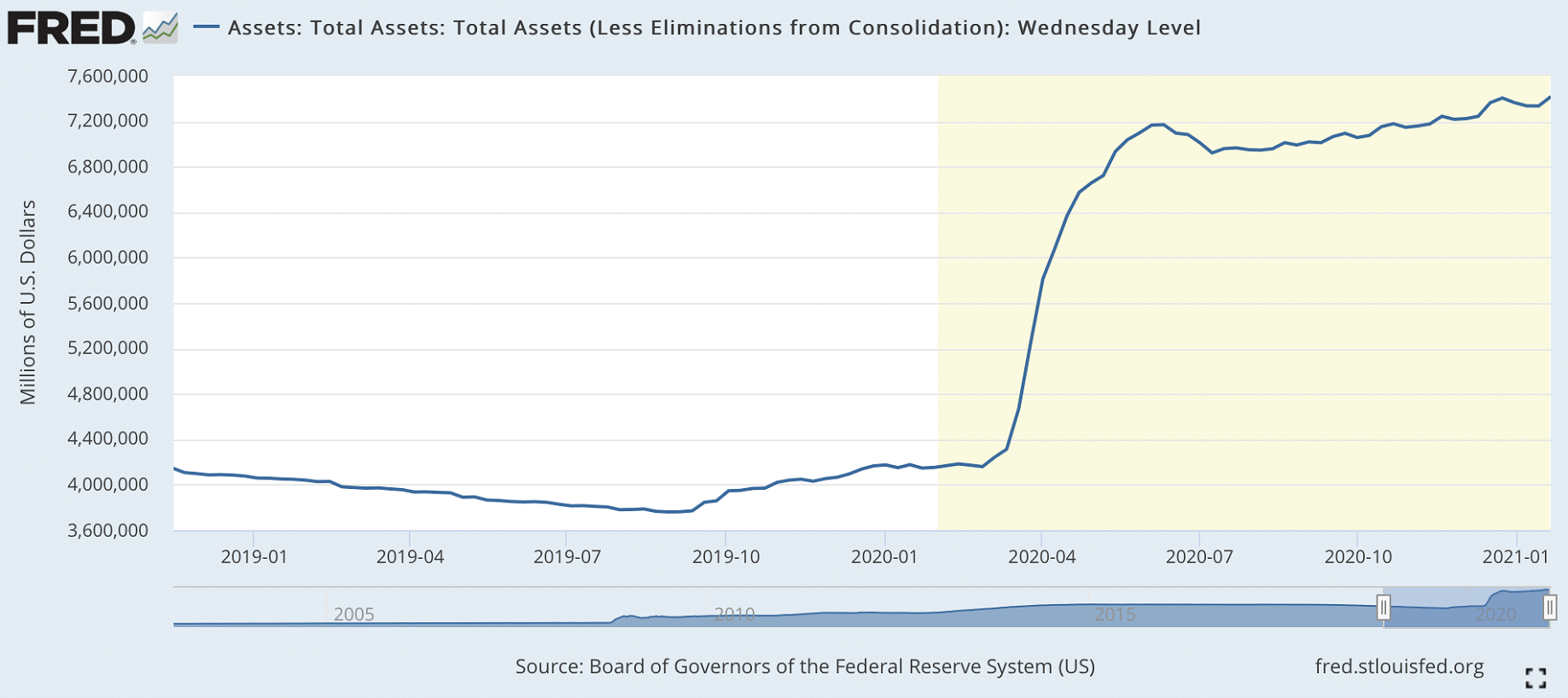

If the Fed does not give a signal that it will help the market absorb a new large portion of bond supply, investors may become frustrated and start exiting the market in anticipation of a decline in prices under pressure from the new supply. Therefore, the Fed should be inclined to signal that it is ready to provide as much support as needed. The dynamics of the Fed's balance sheet shows that the Fed continues to ease monetary policy through QE - the asset balance continues to grow and renews highs:

Accordingly, ahead of the Fed meeting, the FX market may be inclined to dump USD due to expectations that the Fed will again signal about increase in money supply.

On Monday and Tuesday, investors are likely to pay attention to reports such as the IFO German Business Climate Index and the Conference Board US Consumer Confidence Index.

The report on orders for durable goods in the United States, which will be released on Wednesday, will allow assessing the dynamics of consumption of high-value goods and income growth in December. The indicator, following US retail sales, is likely to disappoint expectations, which may have already been factored in asset prices.

Canada's January GDP Growth Report, which is due next Friday, is also likely to cause some volatility in the Canadian dollar. Monthly growth of GDP is expected to slow to 0.3%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.